Executive Summary

“Globally, 70% of bacteria have now developed resistance to antibiotics, including to the drugs seen as our last line of defense.” US Food & Drug Administration

Antibiotic misuse in farming: the investment risk

Antibiotic resistance is one of the biggest threats to global health today, according to the World Health Organization (WHO). Resistance is rising to dangerously high levels globally and is indiscriminate in who it affects. As antibiotics become less effective, a growing list of infections, including pneumonia, tuberculosis, blood poisoning and gonorrhoea, are becoming increasingly difficult and sometimes impossible to treat.

This briefing sets out the investment risks associated with farm antibiotic misuse, and key ways in which investors can engage companies to mitigate this risk and drive improvements within the food, farm and pharmaceutical sectors.

Rising levels of antibiotic resistance have provoked alarming statements from medical authorities across the globe. The Chief Medical Officer in the United Kingdom spoke in 2013 of an apocalyptic scenario in the near future, in which people going for simple medical procedures die of routine infections “because we have run out of antibiotics”. The World Health Organisation now warns of a post-antibiotic age, where common infections, minor injuries and routine operations can kill once again.

The overuse of antibiotics in agriculture is widely recognised as a contributing factor to this crisis. The UK Review on Antimicrobial Resistance, led by Lord Jim O’Neill, stated that that the evidence linking farm antibiotic use and resistance in human infections “warrant[s] a significant reduction in farm antibiotic use, both by overall quantity and by antibiotics that are important for human health.”

The implications of farm antibiotic misuse for the investment sector are substantial.

Growing global awareness of the contribution of farm antibiotic use to human resistance is highly likely to lead to substantial shifts in market sentiment, which could have significant financial implications on investment portfolios. This is compounded by rapidly changing consumer beliefs about the future effects of farm antibiotic overuse, and increasing public and regulatory scrutiny on all supply chain actors seen to be enabling the continuation of such practices. In addition, the declining efficacy of antibiotics in veterinary medicine could have significant negative consequences for animal health and livestock rearing.

The global investment community has a key role to play in driving positive change. By engaging with companies on the issue of farm antibiotic use, investors can exert significant positive pressure on these actors, thereby contributing to the long-term health and stability of the food, farm and pharmaceutical markets.

The race against the declining efficacy of our antibiotics will be closely run, and the challenges facing livestock farmers and supply chain actors are not insignificant. But there are also huge benefits to be reaped. Tackling farm antibiotic overuse could see farming businesses benefit from increased resilience, food and pharmaceutical companies from improved company brand value, and investors from the long-term, sustainable returns generated from a robust and well-functioning system. Most crucially, tackling profligate farm antibiotic use will help to safeguard these vital resources for future generations.

The macro economic implications of the antibiotic resistance crisis are hugely significant. Levels of drug-resistant infections by 2050 are predicted to cost the world $100 trillion in lost output between now and 2050, which is more than the current global economy. The WHO estimates that in the EU alone, the issue is costing more than $1.5 billion in healthcare expenses and productivity losses. With antibiotic resistance in farm animals, food and certain human infections increasing in a number of countries worldwide, we must act fast to save our antibiotics.

Intensive livestock farming and the global antibiotic resistance crisis

Worldwide, significantly higher volumes of antibiotics are used in food animals than in human medicine.

In intensive farming systems, the routine preventative mass-medication of animals with antibiotics is common. This practice is particularly prevalent in the pig and poultry sectors, where animals are often kept in crowded conditions, and disease outbreaks are more common and harder to control. In the Netherlands and other European countries where calves are farmed intensively, these animals can also receive high levels of antibiotics.

The growth of intensive livestock farming in the second half of the twentieth century went hand in hand with the availability of antibiotics (in addition to specialized feeds, vaccines, etc). Today, the majority of all antibiotics produced are given to livestock nearly half of all antibiotics in the UK, two-thirds in the EU,6 and 70% in the US.7 Less intensive and organic farming methods have been identified as a way to reduce dependency on antibiotics.

How resistance develops

Antibiotics are substances which kill or prevent the growth of certain bacteria. Some bacteria, however, can be resistant to the effects of an antibiotic. When an antibiotic is used, resistant bacteria can survive and reproduce as sensitive bacteria are killed or prevented from growing. Antibiotic resistance occurs naturally, but is being greatly accelerated by the misuse and overuse of antibiotics. Globally, 70% of bacteria have now developed resistance to antibiotics, including in some cases to the drugs seen as our last line of defense. Increasing awareness of this issue has often led to a focus on improving prescribing practices in human medicine, which is a crucial part of the solution. In recent years, institutions such as the National Institute of Health and Care Excellence (NICE) have joined the debate, publishing their first guideline on this topic in 2015, and encouraging health professionals to curb inappropriate antibiotic prescribing practices. The overuse of antibiotics in farming has not always received the same level of attention.

Why livestock receive antibiotics

Most antibiotics are used not to treat disease (therapeutic use), but are routinely administered to groups of animals to prevent illness or to promote growth (non-therapeutic use). Use of antibiotics as growth promoters was banned in the EU in 2006, and a voluntary ban will be implemented in the US in 2017. However it remains legal in the EU to routinely mass-medicate groups of animals when no disease has been clinically diagnosed in any of the livestock within the group (prophylaxis). Mass-medication accounts for circa 90% of all veterinary antibiotic use in Europe.

The routine administration of non-therapeutic antibiotics underpins current methods of intensive livestock production, where animals, most commonly pigs and poultry, are kept in crowded, often inhumane, conditions. In these systems animals are more prone to disease as their immune systems are compromised, and require regular doses of antibiotics to remain healthy.

While it is necessary to treat animals therapeutically when disease is present, most of the concern surrounds the much more widespread non-therapeutic mass medication of pigs and poultry. This is because mass medication generally occurs at low, subtherapeutic doses for long periods of time, a form of treatment which is more likely to result in antibiotic resistance than short treatments at high doses.

Antibiotic resistance on farm animals can then transfer to humans, see box: ‘Farm antibiotic use and human resistance – the science.’

The UK government recently described prophylactic administration of antibiotics as ‘excessive and inappropriate’, but continues to permit such practices. Data published in October 2016 by the European Medicines Agency revealed that many European countries are failing to put an end to the overuse of antibiotics in farming, with European usage levels averaging at 152 mg of antibiotic per kg of livestock, over three times higher than target of 50 mg/kg recommended by the UK government commission Review on Antimicrobial Resistance (The O’Neill Review). These high levels are attributable to the continued failure by most countries to ban routine preventative mass medication in intensive farming.

Agricultural use is predicted to increase by 67% globally by 2013, with use in the BRICS emerging economies (Brazil, Russia, India, China and South Africa) expected to double by 2030, as compared to 2010 levels. This rise is likely to be driven by the growth in consumer demand for livestock products in middle-income countries and a shift to large-scale, and more intensive farms where antibiotics are used routinely.

Farm antibiotic use and human resistance – the science

Decades of scientific research have established that there is a link between the overuse of antibiotics on farms and antibiotic resistance in human infections. This is acknowledged by bodies like the World Health Organization and the European Food Safety Authority.

The O’Neill Review came to a similar conclusion after a large review of the scientific evidence, and said that in light of the available science there is a need for the world “to start curtailing the quantities of antibiotics used in agriculture now”.

For some infections such as Campylobacter and Salmonella, farm antibiotic use is the main cause of resistance in human infections. Farm antibiotic use contributes significantly to resistance in life-threatening E.coli infections, and the emergence of dangerous variants of MRSA, such as MRSA CC398, is closely linked to the overuse of antibiotics in intensively farmed animals.

Resistance to antibiotics classed as ‘critically important’ for humans (as categorised by the WHO) is a major concern, fueled in part by inappropriate use of these antibiotics in farming.

Investment implications

Excessive use of antibiotics in intensive farming, and the corresponding human health impacts, creates systemic risks across the food, farming and pharmaceutical industries due to the potential for sudden regulatory change and sector-wide reputational damage.

Food producers, retailers and restaurants

It is extremely likely that farmers will see a reduction in the availability of antibiotics for veterinary use, which poses challenges for the most intensive farming systems – particularly in the pig and poultry sectors. In these systems, the continuation of many current farm management practices will no longer be possible without the availability of antibiotics for routine mass medication. For forward-looking livestock farming businesses who are prepared to adapt, and to invest in welfare-oriented antibiotic reduction strategies, there is a very real opportunity to benefit from increased business resilience, healthier animals, and better consumer perception. In contrast, for those who fail to prepare for this change, the operational disruption could be significant. Unprepared farming businesses may experience disease outbreaks and high mortality rates as they will have failed to explore approaches for preventing disease other than routine antibiotic treatments.

Major global food companies will also be affected by the contracting availability of antibiotics for veterinary use. Public awareness around this issue is rising fast, and the potential impact of any disruption on purchasing habits, and on competitors, could be extreme. In a recent interview, Perdue Farms’ Chairman, Jim Perdue, was surprised how quickly sentiment changed in the US after Perdue made moves to reduce their own antibiotic use (see case study overleaf). He said; “I think we were taken aback a little by how big this became…we work with Chick-Fil-A for example. We supplied them…and then McDonald’s announced, and then Subway announced, and it’s like the cage-free thing – it’s like dominoes.”

Media attention is also turning to global food companies, who are increasingly pressured to act on farm antibiotics.

For example, a recent briefing by FAIRR, ‘The restaurant sector and antibiotic risk’, points out the worrying lack of comprehensive policies from the world’s leading food retailers, and highlights the financial risks associated with antibiotic misuse and growing antibiotic resistance.19 This report found that none of the ten largest global restaurant and fast-food companies investigated had a fully comprehensive policy on the issue. Moreover, recent policy announcements from major global food companies – including McDonald’s, Tyson and Walmart, company policies have generally been limited in their scope, applying only to certain species, or to certain geographical regions. With the antibiotic resistance crisis high on the global agenda, such piecemeal policies are unlikely to escape public scrutiny.

Pharmaceutical industry

The increasing scrutiny on farm antibiotic use is highly relevant to the global pharmaceutical industry. Worldwide, significantly higher volumes of antibiotics are used in livestock than in human medicine, with the majority of antibiotics being manufactured for food production. Forthcoming regulatory or trade restrictions around veterinary prescribing are therefore likely to have a huge effect on overall company sales for companies producing farm antibiotics.

Faced with an uncertain market for veterinary antibiotic products, and a dwindling supply of effective drugs, pharmaceutical companies must drive investment in R&D for new antibiotics or for non-antibiotic alternatives. Worryingly, the U.S. Food and Drug Administration has approved only nine antibiotics in the last decade, with pharmaceutical companies prioritising the development of more profitable treatments for chronic illnesses. The pharmaceutical industry is under growing pressure to tackle pollution within its supply chains – most of which is associated with the manufacture of veterinary antibiotics. As scientific research increasingly points to environmental pollution from the production of antibiotics as a contributing factor to resistance, big polluters are receiving further negative media attention.

“If we get closer to 2050 and there are 10m people around the world dying [from drug resistant infections], guess who is going to be blamed?”

Lord Jim O’Neill

Pharmaceutical companies now face market uncertainty, contracting supplies of effective antibiotics, and a public backlash similar to the one experienced by the banks after the financial crisis.

A changing regulatory landscape

Over the last few years, antibiotic use in the global veterinary sector has been subject to considerable regulatory scrutiny. In Europe, current legislative reviews to the Veterinary Medicinal Products and Medicated Feed Regulations are set to substantially limit veterinary prescribing across the EU and to include a likely ban on the routine prophylactic administration of antibiotics to groups of animals. This proposal was overwhelming supported by MEPs in a Plenary vote in the European Parliament in March 2016.

In the US too, the overuse of antibiotics in livestock production is coming under regulatory scrutiny. The use of antibiotics for growth promotion is increasingly restricted, with measures now being introduced to phase out growth promoters over a three year period.

This changing legislative landscape could have material implications on businesses which are unprepared for regulatory restrictions to farm antibiotic use, potentially causing significant operational disruptions and reductions in livestock numbers due to the increased prevalence of disease in densely packed facilities.

It is estimated that a ban on certain antibiotics in the US could cost pig producers US$4.50 per animal in the first year and would cost the industry more than US$700 million over a 10-year period (at 2003 prices). Those facilities dependent on the prophylactic use of antibiotics to compensate for the overcrowded and unhygienic conditions are most at risk – as the introduction of such legislation could require costly restructuring of facilities. Companies that prepare for such a change by making appropriate adjustments to farm management practices, and by investing in strategies to reduce dependency on antibiotics, will help to insulate themselves from future operational shocks.

Forthcoming regulatory limits, and corresponding changes to how veterinary medicines are licensed, will have material implications for the pharmaceutical industry. In particular, these companies are likely to see large falls in sales of antibiotics classed as ‘critically important’ for human health, which are likely to be subject to substantial restrictions in the veterinary sector, due to fears around increasing resistance to these drugs in human bacterial infections. For example, in the Netherlands, farm sales of the ‘critically important’ modern cephalosporin antibiotics fell by 99% from 2011 to 2015, as part of a national effort to significantly reduce farm antibiotic use levels.

At the national level, governments are starting address the issue. The UK Government has committed US$300 million to support microbiology surveillance capacity in developing countries. G7 and G20 leaders have committed to take action and at the World Economic

Forum in Davos more than 80 companies committed to develop sustainable markets for antibiotics and to reinvigorate the basic scientific research and development needed to create the antibiotics pipeline. On 21st September 2016, all 193 countries of the United Nations signed the declaration at the UN General Assembly high-level meeting in New York; committing to ambitious measures to tackle the antibiotic resistance crisis.

“Antibiotic resistance is a global problem that requires global solutions. Bold action from global policy makers is required to correct this market failure.They need to focus corporate minds on much more prudent use of antibiotics in agriculture in a way that does justice to their critical importance to human life.”

Steve Waygood, Chief Responsible Investment Officer, Aviva Investors

The high level scrutiny now directed at this issue is building pressure for more radical action, including increased regulation around how veterinary antibiotics may be used.

Trade restrictions

Regional changes to legislation can also hinder market access as certain imports become prohibited. For example, the introduction of EU legislation banning products where hormones are used as growth agents is estimated to have cost US beef exports US$100m a year.25 Although EU restrictions on antibiotics have remained limited, this is likely to change in the near future, in tandem with forthcoming regulatory restrictions on how veterinary medicines may be used. Trade restrictions are likely to be more widely adopted in coming years; as rising concerns around antibiotic resistance cause more jurisdictions to introduce restrictions on the import of livestock and poultry products from animals given antibiotics prophylactically or for growth promotion.

A recent document co-authored by the World Trade Organization (WTO) on the antibiotic-resistance “epidemic” made clear that WTO agreements allow signatory states to “take measures to protect human health or the environment.” They encourage WTO Members to base any trade restrictive measures on international standards, guidelines or recommendations where applicable, stating that WTO trade law ultimately can support the implementation of international standards for appropriate use of antibiotics. This includes “the area of animal husbandry and/or good manufacturing practice, for example, through the inclusion of environmental standards that prevent spill-over of antibiotics into the environment from factories by wastewater”.

Shifting market sentiment

With scrutiny now turning to the retail, high street, foodservice and restaurant sectors, these actors are under increasing pressure to adopt public policies on antibiotic use within their supply chains. Revelations in September 2016 of E.coli28 and MRSA29 on meat products from seven major UK supermarkets prompted unprecedented commitments from the Food Standards Agency, who pledged to work with retailers to reduce farm antibiotic use. The study also prompted at least one major retailer to strengthen their supply chain policy on antibiotic use; including commitments to phase out both routine prophylaxis and use of the ‘critically important’ drugs.

“We are on the brink of a seismic shift in how we value and use antibiotics. Public scrutiny, policy restrictions, the declining efficacy of our drugs – it’s clear that the era of systematic farm antibiotic overuse is coming to an end. The direction of travel must now be towards better farming systems. Businesses who are quick to adapt and to place good welfare at the heart of their operations will be rewarded by the increased resilience that comes from severing an unhealthy dependency on antibiotics and other inputs.“

Emma Rose, Alliance to Save Our Antibiotics

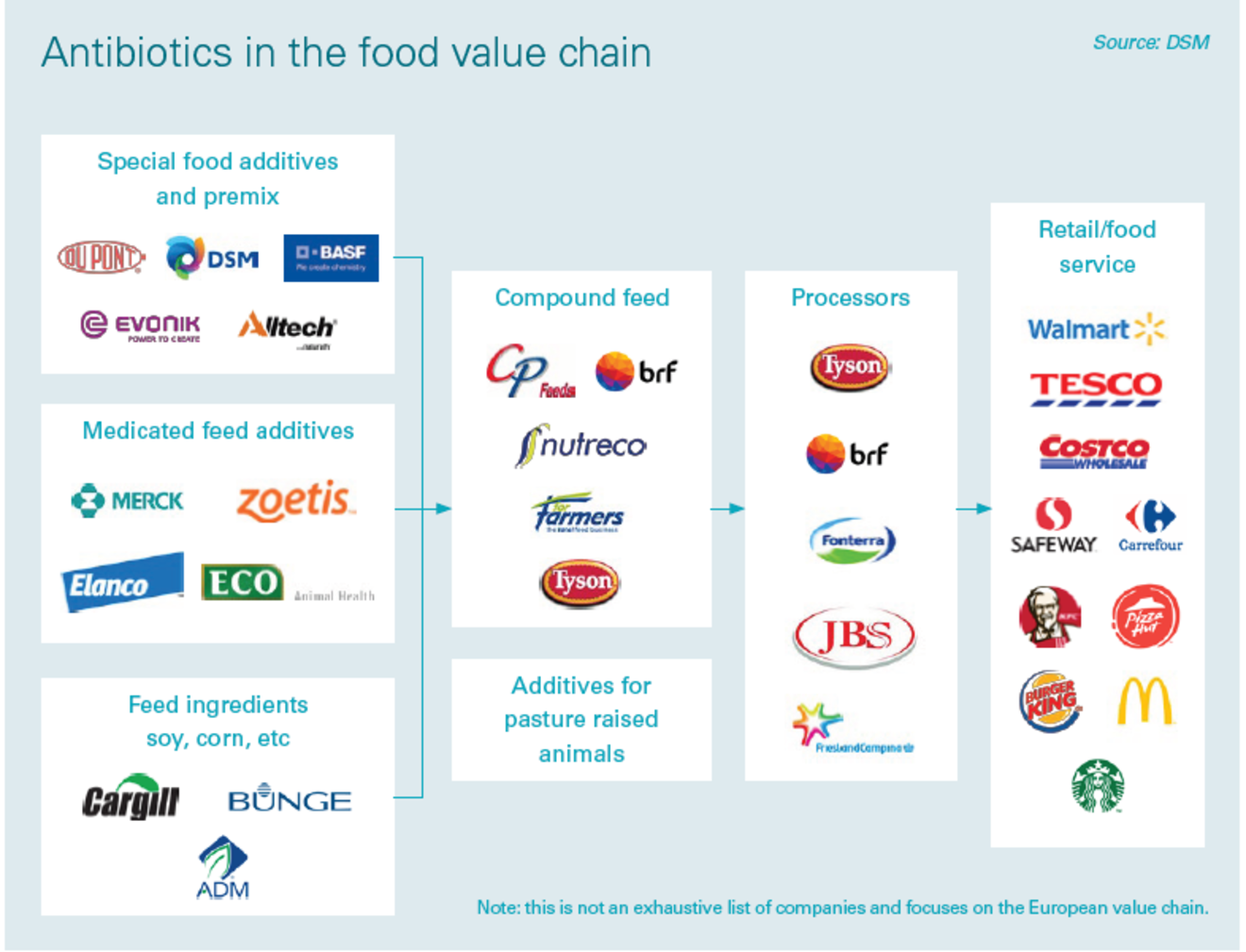

Such corporate commitments from retailers and restaurants, underpinned by new contractual requirements for suppliers, will have significant implications along the food value chain – especially as consumers and NGO groups are pushing for commitments to be global in scope. The introduction of similar blanket supply chain requirements by major food retailers in other European countries has had significant implications for livestock farmers (see case study overleaf).

There is some concern that recent policy announcements from major global food companies including McDonald’s, Tyson and Walmart have been piecemeal; applying only to certain species or to certain geographical regions.32 The lack of clear and comprehensive demand-side policies from leading food retailers and producers risks sending conflicting market signals to livestock producers; failing to provide farmers with the confidence they need to invest in infrastructural improvements aimed at reducing antibiotic use.

Public scrutiny and reputational risk

Alongside regulatory and operational risks, companies, especially those with consumer facing brands, are also encountering reputational risks as consumer preferences shift. Companies believed to have poor policies and practices around farm antibiotic use face increased scrutiny from civil society and the media and may experience negative campaigns. For example, a recent report written by six prominent consumer organisations including Friends of the Earth and the National Resources Defense Council ranked the US’s leading restaurant chains on their policies and transparency around the use of antibiotics in their meat and poultry supply chain. Of the 25 companies reviewed, 20 received a negative grade.

Negative media coverage and civil society campaigning can harm sales and affect consumer loyalty which is a matter of particular concern for companies whose customers can easily shift their spending habits. Responsible investment NGO ShareAction’s recent online action, which called on McDonald’s to put in place a comprehensive antibiotics policy, attracted over 10,000 participants in the first three weeks; a complementary petition on US activism platform SumOfUS, which echoed the same concern, brought the total number of citizens calling for action by McDonald’s on this issue to nearly 140,000.

Pharmaceutical companies are also at risk of reputational damage connected to this issue. Pfizer is currently the target of a civil society campaign, after allegedly using Chinese factories which are depositing untreated antibiotic waste into waterways,43 potentially presenting a perfect breeding ground for antibiotic resistant bacteria.

The investment opportunity

Preserving the efficacy of our antibiotics for the future will require a fundamental shift away from routine reliance on antibiotics in farming, towards a healthoriented system of rearing animals. The sheer scale of this change will require a system-wide approach to tackle antibiotic use; from livestock farmers, producers, food retailers, pharmaceutical companies and policymakers at local, regional, national and global levels.

Investors too, have a crucial role to play. By opening a dialogue with companies on this issue, investors can help to stimulate the wholesale uptake of measures to reduce antibiotic use, and to shift the narrative around what constitutes ‘responsible’ use.

Identifying and addressing the risks associated with the overuse of antibiotics in farming could present commercial opportunities, by improving company brand value and addressing consumer concern. For example, market research has shown that the value of sales of ‘antibiotic-free’ rose in the US in dollar terms by 34% in the US in 2013 and by 25% in 2014 to 11%.

“From the farm to pharma, from livestock to life sciences, complacency in the administration of our invaluable antibiotics has led to dangerously high levels of antimicrobial resistance that risks wiping $100 trillion off potential global output by 2050.”

Abigail Herron, Head of Responsible Investment Engagement, Aviva Investors

By investing in livestock systems and businesses which exhibit low risk, and by engaging with existing portfolio companies on responsible antibiotic use, investors can manage risk. Importantly, by engaging with this issue, investors can help to build a resilient and robust food and farming sector which is better for both human and animal health.

Understand a company’s strategy to manage and mitigate antibiotic risk

Questions to ask when engaging with companies on this issue

Food producers

Operational

How does your supply chain, both upstream and downstream, stand to be affected by antibiotic resistance?

Does antibiotic resistance feature on your corporate risk register?

What measures will the company put in place to improve animal husbandry, health and welfare – in order to reduce the need for antibiotics in the first place?

Strategy

Have any studies been commissioned to quantify this impact?

Are customers aware of this topic and asking you for more information?

What are the company’s policies and practices regarding nontherapeutic use of antibiotics?

Does the company have a clear policy on elimination of routine use of antibiotics in its global supply chain?

Does the company have a clear policy outlining a commitment to limiting farm use of the ‘critically important’ antibiotics, which restricts use of these antibiotics to where sensitivity testing shows that no other antibiotics are likely to work?

Governance

At what level is the issue of antibiotic resistance discussed in your organization? (H&S team, divisional management, senior leadership, Board of Directors?)

Who do you perceive has most responsibility for combatting antibiotic resistance?

How do you view yourself as contributing to the solutions (e.g. responsible practices, new incentives, etc.)?

To what other systemic issues would you compare AMR?

Food retailers and restaurants

Operational

How does your supply chain, both upstream and downstream, stand to be affected by antibiotic resistance?

What contingency measures and scenarios have been discussed around this issue?

What initiatives and incentives have been put in place to mitigate the impact?

What measures will the company put in place to improve animal husbandry, health and welfare – in order to reduce the need for antibiotics in the first place?

Does antibiotic resistance feature on your corporate risk register?

Strategy

Have any studies been commissioned to quantify this impact?

Have you assessed sentiments amongst your customers towards the use of antibiotics in food production?

Does the company have a clear policy on elimination of routine use of antibiotics in its global supply chain?

Does the company have a clear policy outlining a commitment to limiting farm use of the ‘critically important’ antibiotics, which restricts use of these antibiotics to where sensitivity testing shows that no other antibiotics are likely to work?

Governance

At what level is the issue of antibiotic resistance discussed in your organization? (H&S team,Board of Directors?)

Who do you perceive has most responsibility for combatting antibiotic resistance?

How do you view yourself as contributing to the solutions (e.g. responsible practices, new incentives, etc.)?

Pharmaceutical industry

Operational

Which product lines stand to be affected by this trend?

How do you keep abreast of the latest science around antibiotic resistance, and the latest policy developments on this issue?

Does antibiotic resistance feature on your corporate risk register?

Have you assessed the impact of rising drug resistance on demand for non-antibiotic drugs (or devices) which depend upon the availability of effective antibiotic treatments or prophylaxis for their successful use?

Strategy

What is your approach to R&D in this area?

Is your company actively engaged with policy discussions taking place in multilateral forums and with national governments about the national and international response to drug resistance?

Is your company a signatory to the January 2016 Davos Declaration, or September 2016 industry ‘roadmap’ for action on antibiotic resistance? If so, what action is your company taking to implement the commitments contained in these documents?

Governance

At what level is the issue of antibiotic resistance discussed in your organization? (H&S team, divisional management, senior leadership, Board of Directors?)

How have the recommendations of the Review on Antimicrobial Resistance landed internally and what outcomes can you share?

Who do you perceive has most responsibility for combatting antibiotic resistance?

How do you view yourself as contributing to the solutions (e.g. responsible practices, new incentives, etc.)?

Conclusion

The threat of antibiotic resistance is one of the most pressing and critical challenges facing our global health system. With coordinated action between government, industry, investors, civil society and the public at the international, national and local levels, we can still turn the tide against antibiotic resistance.

The 2015 Global Action Plan on Antimicrobial Resistance, drafted by the World Health Organization (WHO) with support from the United Nations Food and Agricultural Organization (FAO) and the World Organisation for Animal Health (OIE), recognizes the need for multi-sectoral cooperation to address resistance.

Investors have a key role to play. We hope that this document has served to highlight why and how investors should engage with companies and broader stakeholders.

Next steps

Ask your research providers and sell side brokers to include this topic in their coverage/notes.

Integrate antibiotic resistance into your engagements and investment processes.

Read more about the public health risks of antibiotic overuse in farming at saveourantibiotics.org

Antibiotic Resistance Benchmark – contribute to the development of this initiative by the Access to Medicine Foundation, which has received a 5-year grant to set up a specific antibiotic benchmark to monitor and track how pharmaceutical companies will participate in the fight against resistance. See more at

Support the establishment of a new ‘Global AMR Innovation Fund’ as recommended by the UK Review on Antimicrobial Resistance to kick-start a new innovation cycle that can help make the development and production of new antibiotics commercially sustainable. Investors should look to multinational organisations such as the World Bank to leverage long term financing commitments to issue bonds in a variety of currencies and capital markets.

Case studies

Perdue Farms

In 2014, eight years after it voluntarily gave up using antibiotic growth promoters, the US poultry producer Perdue Farms decided to stop routinely using antibiotics that are important in human medicine for disease prevention in all of its operations. Most of its birds, however, were still receiving routine doses of certain toxic antibiotics, called ionophores, are only used in farm animals. Also, if any of the chickens did fall sick, Perdue still treated them with human antibiotics.

More recently, in October 2016, Perdue decided to go even further, and to end the routine use of all antibiotics on its farms, including ionophores. Perdue’s Chairman, Jim Perdue, says that eliminating antibiotic use from its hatcheries was the most difficult step, as previously eggs had been routinely injected with a very important human antibiotic called gentamicin. Perdue has begun to use antibacterial babywipes, to keep the eggs clean before hatching. Perdue says that it has also made improvements in animal welfare that go well beyond industry guidelines, and that it is learning from organic production about how to avoid diseases without resorting to antibiotics.

Perdue still treats chickens with antibiotics if they become sick, but this only occurs for about 5% of birds, and treatments are non-routine. This probably explains why a Consumers Report study in 2014 found that even chicken meat from these Perdue birds had lower levels of resistant bacteria than chicken meat from other leading brands like Tyson’s, Pilgrim’s and Sanderson Farms.

Perdue is the leading brand producing fresh chickens in the United States, and publicity like the Consumers Report is putting commercial pressure on its competitors to take action as well. Tyson and Pilgrim’s have also now set goals for reducing their antibiotic use. According to the National chicken Council, about half of the US chicken industry has eliminated the use of human antibiotics, and that percentage is expected to keep growing.

Public pressure prompts supply chain shift in the Netherlands

In December 2015 the Netherlands’ three biggest supermarkets, Jumbo, Albert Heijn and Lidl, announced they would stop selling meat from the fastest growing breeds of chicken (known as plofkip, or ‘exploding chickens’). This move was a result of a public campaign by animal welfare organisation Wakker Dier, which aimed to shine the spotlight on the welfare implications of the huge national consumption of chicken from fast growing breeds. In 2014, the average citizen consumed 18.4 kilograms of chicken annually most of this from fast growing birds. These birds would usually live just 42 days in a closed pen, in which time they reach a slaughter weight of at least two kilograms. The resulting health issues arising from such conditions, such as respiratory illness, lesions and cardiac problems, typically require flocks to be routinely medicated with antibiotics.

Wakker Dier’s campaign resulted in sales of ‘plofkip’ chicken in Dutch supermarkets falling by half. This in turn has enabled farmers to switch to slower growing broilers without fear of overproduction, falling prices, or a surge in imports of chicken from other countries with lower standards.

This market certainty has supported an increased in the share of slower growing broilers in the Netherlands from around 10% in 2015 to around 20% in 2016.

These slower growing birds are less prone to health problems, meaning that reliance on routine antibiotics is reduced. Dutch figures show that 2015 levels of antibiotics used in standard broilers was over five times higher than usage levels in slower growing broilers. The impact of the Dutch retailers’ commitment – and the incentive it provides for other supply chain actors – is likely to have significant positive implications for national veterinary antibiotic use levels.