FAIRR is launching a new Climate Risk Tool for the meat sector based on TCFD-linked scenario analysis. We invite you to join us for a webinar next week to hear all about it.

The material risks created by a changing climate are severe and the global animal protein industry is increasingly vulnerable. But how do investors quantify the risk and opportunities relevant to their portfolios?

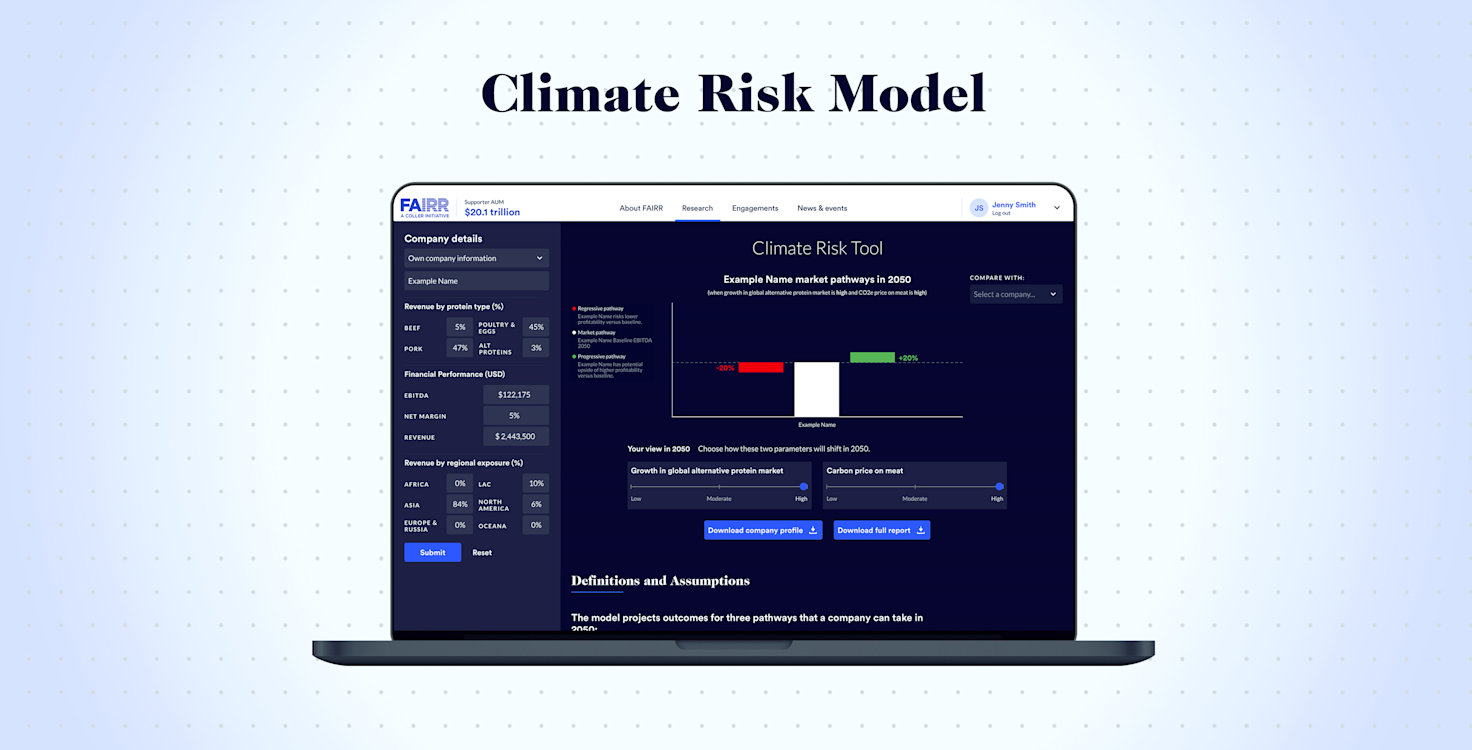

FAIRR has developed a ground-breaking tool to help investors quantify the financial implications of climate change on the meat sector. The tool – the first steps towards developing a forward-looking analysis of the meat industry — is based on seven key risk factors, including higher electricity costs, feed volatility and increased livestock mortality.

We will be running two 60-minute sessions on Thursday, 12th of March and Friday, 13th of March, where we will guide you through the model and give a demo on how to use the tool.

Speakers:

Aarti Ramachandran, Head of Research & Engagements, FAIRR

Bryan Vadheim, Vivid Economics

Ed Smythe, Senior Research & Engagement Manager, FAIRR

Content:

Context and background<br />Physical risks, such as extreme weather events and temperature increases are already impacting the livestock industry. The FAIRR Climate Risk Model is designed as a first step to enhance forward-looking analysis on the meat sector.

Industry risks<br />As a particularly carbon-exposed sector, the protein industry is a top candidate for substantial devaluation. Additionally, chronic and acute risks, such as droughts and floods, will increase costs for the sector. Investors failing to account for these risks will mis-allocate capital and investment.

Assumptions & results<br />We will discuss how the model will impact the profitability of meat companies due to factors such as protein substitution, demand constraints and rising costs linked to climate change.

Live demo of the online tool<br />We will also have a live demonstration of the interactive online tool, which accompanies the model + Q&A.

Key Information

| Date: | 12 March 2020 |

| Time: | 15:00 - 16:00 |

| Location: | Online |