A focus on Latin America

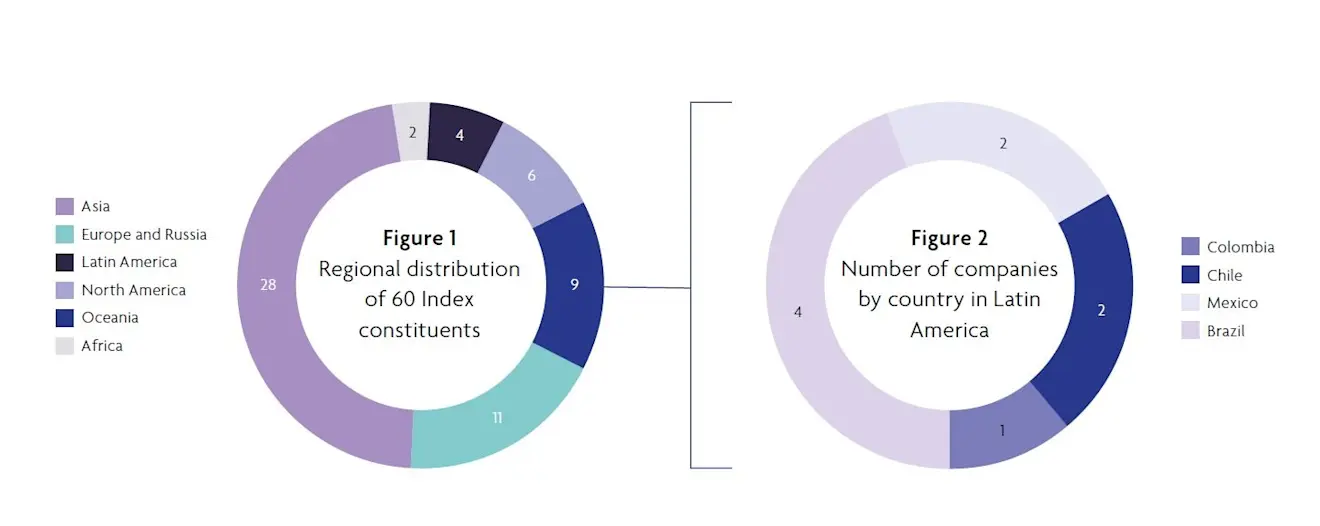

This report is a summary of the Index results for nine companies based in Latin America. They represent 9 (15%) of the 60 Index companies assessed in the Coller FAIRR Protein Producers Index and have a combined market capitalisation of $31 billion.

Intensive Farming

Intensive farming – which prioritises feed efficiency and rapid weight gain –is now standard practice across all farmed species. It has helped to increase global meat, egg and milk production by 140% since 1961, and make farm animals, led by cattle and pigs, the largest mammalian biomass on the planet.

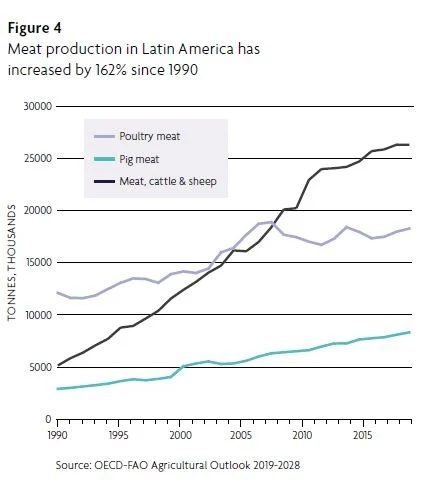

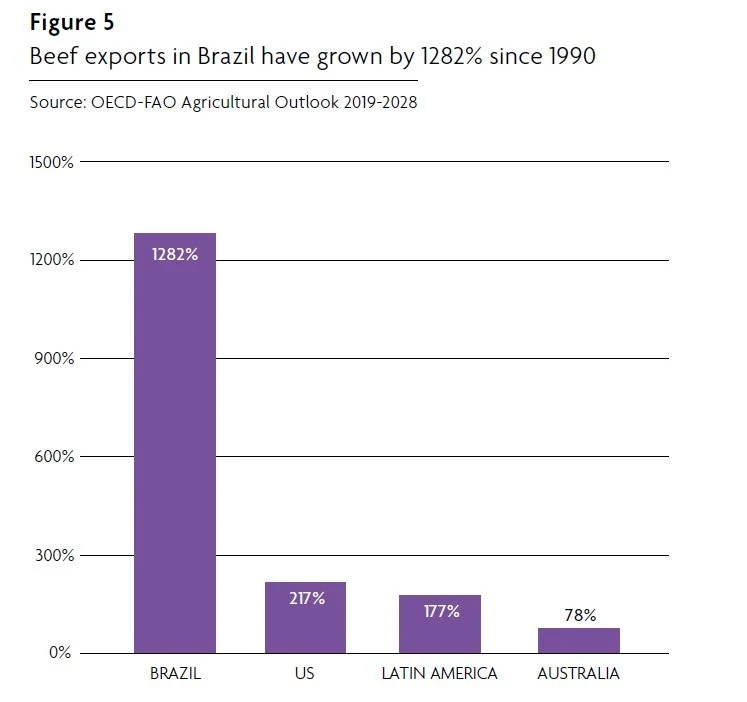

In Latin America, production and consumption of animal products is in line with the global trend. Pork and poultry have experienced remarkable consumption growth since 1990, growing 104% and 230% respectively. Growth in poultry consumption has been particularly strong, often replacing other meats. Unlike in other regions of the world, beef consumption rates have been constant since 2006. Despite low growth in overall beef consumption, cattle production in the Latin American region has risen 58% from 1990 to 2018. Regional growth in beef consumption has increased alongside beef exports: 177% growth since 1990. While this percentage shows the increasing importance of the industry in the region, Brazil has spectacularly exceeded the regional average with a 1282% rise since 1990, making it the largest cattle meat exporter in the world.

The rapid growth of the meat sector in many Latin American countries has transformed the availability and accessibility of cheap protein sources and resulted in economic and social benefits. However, these benefits have come at a steep cost: the sector is one of the primary drivers of the most serious environmental and social risks facing our planet and society. Global multinationals that breed, grow and process livestock and fish are ultimately on the front lines of managing and mitigating these risks. The lack of scrutiny on the sector has meant that these companies have been allowed to scale their operations, markets and production volumes without clear controls. This creates systemic risks: not just for companies, but also their global food customers, investors, consumers and society at large.

The FAIRR Initiative is working to leverage the power of institutional capital to effect change in the livestock and farmed fish sectors. One of our key research initiatives is the Coller FAIRR Protein Producer Index. This ranks 60 of the world’s largest protein producers on their disclosure and management of material environmental and social risks. The Index is the world’s only benchmark dedicated to profiling animal protein producers and showcasing critical gaps and areas of best practice in the sector.

The primary purpose of this Index is to enable and support investor decision-making on the protein sector. We hope investors will integrate the data and analysis on the performance of these global listed assets into their stewardship and investment decisions. The Index is also a benchmark to help animal protein companies assess themselves against their peers in the sector and improve their management and reporting of risks.

This report is a summary of the Index results for the animal protein producer companies headquartered in Latin America.

Beef Production and Deforestation

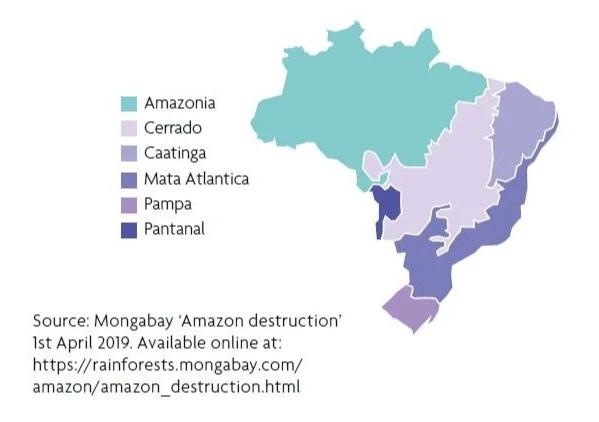

Brazil is the world’s largest exporter of beef, providing close to 20% of total global exports. Nearly 40% of the country’s cattle herd is in the Amazon region, with an estimated 80% of Amazon forest cleared since 2014 occupied by cattle.

Furthermore, Brazil emerged as the leading beef global producer and exporter in the early 2000s for several reasons, which range from government incentives (encouraging the expansion of cattle ranches and soy plantations) to global and domestic market dynamics (which placed Brazil’s beef industry in a favourable position for growth).

Historically, Brazilian governments have driven land reform policies to address inequalities in the distribution of land and wealth. Many of these policies emphasised “productive uses” of “unused” land, such as forested lands. Due to the land reform programme, cattle ranching evolved as one way for both landowners and squatters to secure land tenure in the Amazon. It is estimated that these policies, reinforced by government subsidies, led to the deforestation of 15 million hectares between 1964 and 1997.

The beef industry in Brazil benefited from these government policies but it was the increase in the domestic and international demand in the 1990s that allowed the industry to thrive. Rising demand from Asia – especially China and Hong Kong – has driven overall export growth. In 2018, 38% of Brazilian beef exports went to China and Hong Kong. In October 2019, Brazilian Index company and beef processor Minerva entered into a joint venture with Chinese representatives to explore the opportunities for beef imports and distribution in the Chinese market. Brazil beef and soy industries have further increased their sales to China in the last year as a collateral result of the ongoing trade war between the US and China.

Beef Production and Deforestation

In late August 2019, forest fires in the Amazon attracted significant media and policy attention. The growing demand for beef, both in the domestic and global market, is undeniably adding pressure on the Amazon ecosystem, driving the likelihood of forest fire incidents. Despite no-deforestation commitments and monitoring programmes from Brazilian meatpackers such as JBS Marfrig and Minerva, the highly segmented nature of the cattle industry makes it hard for beef companies to have full visibility into whether their cattle are purchased from deforested areas. In most cases, the cattle are born in ranches where they mature before being sent to fattening ranches, who then sell the fattened cattle to meat-packing plants. It is in this first step of the supply chain where meat-packing companies need to enforce more effective monitoring programmes to ensure that the cattle do not come from deforested areas. One study found that 15% of indirect suppliers to the three major beef companies are associated with illegal deforestation, and JBS is potentially the company most exposed to risks associated with deforestation, with 32 operating plants in the Amazon region. Rather than increasing its efforts to deal with this risk, JBS has reduced the transparency in its supply chain by limiting the publicly available information on the location of its farms.

The recent widespread coverage of Amazon forest fires has resulted in the possibility of regulatory action, especially from European countries. Finland has called on the EU to consider banning Brazilian beef imports, and both Ireland and France have threatened to block the trade deal between the two regions without action from the Brazilian government. If the EU-Mercosur trade deal is not finally ratified, it will impact South American country members, whose overall exports to the EU amounted to 20% of their total trade in goods in 2018.

Investors have also begun responding to the Amazon crisis. Nordea is currently examining its holdings in companies with high exposure to deforestation and has said it has halted the acquisition of Brazilian government bonds. This highlights the attention that global investors are beginning to pay to deforestation risks.

How Latin American meat companies compare on actions to mitigate deforestation risk in soy supply chains

Company | Commitment on soy sourcing | Soy supplier traceability | Innovation to more towards sustainable feed sources |

|---|---|---|---|

Grupo Nutresa | No commitment | No Information | No Information |

Marfrig Global Foods | Commitment for 100% of soy | Traceability to plantations | No Information |

BRF | Commitment limited to the Amazon | Traceability to sub-national region | No Information |

JBS | Commitment limited to the Amazon | Strong traceability, but limited to direct suppliers | No Information |

Minerva | No commitment | No Information | No Information |

Grupo Bafar | No commitment | No Information | No Information |

Industrias Bachoco | No commitment | No Information | No Information |

How Latin American beef companies compare on actions to mitigate deforestation risks linked to cattle supply chains

Company | Commitment on cattle sourcing | Cattle supplier traceability |

|---|---|---|

Grupo Nutresa | Minor target | No disclosure |

Marfrig Global Foods | Commitment limited to the Amazon | Strong traceability, but limited to direct suppliers |

JBS | Commitment limited to the Amazon | Strong traceability, but limited to direct suppliers |

Minerva | Commitment limited to the Amazon | Unclear traceability |

Grupo Bafar | No commitment | No Information |

Industrias Bachoco | No commitment | No Information |

Latin American Company Performance

The 2019 Index demonstrates that most companies have yet to meaningfully address the most fundamental sustainability risks. Three companies (Minerva, Grupo Bafar and Industrias Bachoco), valued at $4 billion and with combined revenues of over $8 billion, are ranked as high risk (worst performers) by the Index. None of the companies are ranked among the top 10 companies in the 2019 assessment.

Best Performers

None of the nine companies are ranked as "Low Risk". Three of the best perfoming companies are ranked as "Medium Risk" in the risk and opportunity ranking.

Company | Assessed Proteins |

|---|---|

Marfrig Global Foods | Beef |

Grupo Nutresa | Multiple |

Salmones Camanchaca | Poultry & Eggs |

Worst Performers

Two of the worst performers in the Index, Grupo Bafar and Industrias Bachoco, received average scores of 10% and 6% respectively, indicating that these companies have very limited management and/or disclosure on any of the nine risk and opportunity factors.

Company | Assessed Proteins |

|---|---|

Minerva | Beef |

Grupo Bafar | Multiple |

Industrias Bachoco | Poultry & Eggs |

Risk & Opportunity Factors

Greenhouse Gas Emissions

The nine Latin American companies scored an average of 18% on managing greenhouse gas emissions compared with 17% attained by the remaining 51 Index companies.

Six companies (67%), valued at $11 billion, are categorised as “high risk”-i.e. they have little to no disclosure on greenhouse gas emissions targets across their operations and supply chains.

A holistic strategy on climate management requires companies to go beyond setting targets: they must complete their emissions inventory to include all significant on-farm sources and demonstrate year-on-year reductions on absolute emissions across all three scopes. Only one company, Marfrig Global Foods, has a complete emissions inventory, meaning that they report on agricultural emissions resulting from animal feed.

Water Use and Scarcity

The seven meat companies that have a critical dependency on freshwater resources scored an average of 23% on managing water use compared with 11% attained by the remaining 37 meat companies in the Index.

Four companies (57%) valued at $10 billion, are categorised as “high risk.

Where companies do address water scarcity, these initiatives are focused on their direct operations, with companies receiving an average score of 7% on water-saving measures in animal feed. In contrast, the rest of meat companies in the Index scored an average of 5%.

Only three meat companies (JBS, Marfrig and Grupo Nutresa) have set specific time-bound water use targets for their facilities. None of the companies seem to have targets that are “risk differentiated,” i.e., based on local context

Water Pollution in Livestock Production

Meat companies in the Index scored an average of 11% on managing water pollution, which is the same score attained by the remaining 37 meat companies in the Index.

The 7 Latin American meat companies, valued at $29 billion, are categorised at “high risk” and do not provide any disclosure on how they manage pollution linked to fertiliser use and manure.

No company meets SASB’s standards for the sector, which requires disclosure of the amount of manure generated.

Deforestation & Biodiversity

The seven meat and dairy companies exposed to deforestation risks in their soy and/or cattle supply chains scored an average of 30% on managing these risks compared with 4% attained by the remaining 37 meat companies in the Index.

Four companies (Minerva, Grupo Nutresa, Grupo Bafar and Industrias Bachoco), valued at $7 billion, are categorised as “high risk”. None of them disclose any management of deforestation risks linked to soy supply chains.

No company discusses or addresses high deforestation risks linked to the Cerrado savannah, which supplies much of China and the European Union with the soy imports needed to feed their respective livestock sectors.

The three major Brazilian beef producers, JBS, Marfrig and Minerva, have a commitment to avoid deforestation in the Amazon, though these companies face challenges in maintaining traceability in indirect supply chains.

The US-China trade war is contributing to increased Chinese imports of Brazilian soy, intensifying deforestation rates in the Amazon.

The two aquaculture companies, Salmones Camanchaca and Empresas Aquachile, are fully certified or working towards full certification by aquaculture certification schemes, demonstrating that certification has become a core business requirement.

Antibiotics

The nine Latin American companies in the Index scored an

average of 22%

on responding to antibiotic risks compared with 20% attained by the remaining 51 Index companies.

Six companies (67%), valued at $28 billion, are categorised as “high risk”. They do not have any policy on antibiotics use and do not disclose the quantities or types of antibiotics used on their farms.

Animal Welfare

The 7 meat companies score an average of 33% on welfare commitments and even lower on a third-party auditing and assurance of welfare (20%). In contrast, the remaining 37 meat companies scored an average of 20% on welfare commitments and 13% on auditing and assurance.

Six companies (67%), including aquaculture producers, valued at $23 billion, are categorised as “high risk”.

Aquaculture producers focus on basic metrics such as stocking density and mortality rates, though Salmones Camanchaca provides a high-level statement on the importance of welfare.

Working Conditions

Six companies (66%), valued at $21 billion, do not discuss human rights due diligence processes to identify, prevent and remedy human rights abuses in their

No company discusses how it is meeting the UN Guiding Principles of Business and Human Rights.

Two companies (22%), Grupo Bafar and Industrias Bachoco, provide

no disclosure of work-related injuries and fatalities.

Food Safety

78% of the companies have food safety management certifications recognised by the Global Food Safety Initiative (GFSI), which shows compliance with international food safety standards.

Only two companies (22%) provide a description of their product recall system.

Sustainable Proteins

Despite Brazil being one of the biggest meat-eating countries in the world, there is a growing consumer appetite for vegetarian and vegan products driven by growing consumer concerns over health, animal welfare and environmental impacts. According to research by the Good Food Institute published in 2018, nearly 30% of Brazilian respondents reported that they were moving towards reducing their consumption of animal products or were already vegetarian. Following this trend, major meat producers and retailers in the country are introducing plant-based meat products to their portfolio. Marfrig Global Foods and Burger King have worked together to launch a new plant-based burger after 69% of consumers surveyed by Burger King stated they would be likely to buy a plant-based option if it was offered.

Four companies display activity in the alternative protein market

In Development | A Few Products |

|---|---|

BRF The company is exploring re-entering the alternative protein market after discontinuing a line of non-meat products in 2010. | Grupo Nutresa The company has introduced two plant-based alternative products in 2018 (Veggie Burger and Veggie Bites) under the brand Pietran. One of the company's brands, Noel, also produces a product made of soy protein (Carve). |

Marfrig Global Foods Marfrig is partnering with Archer Daniels Midland (ADM) to develop and sell plant-based protein products in Brazil. | JBS JBS debuted a plant-based burger in May 2019. |