Methodology

FAIRR’s evaluation framework evaluates companies in six assessment categories: Materiality, Strategy, Product Expansion, Consumer Engagement, Tracking & Reporting, and Investor Engagement, customised for retailers and manufacturers. The categories are designed to track a company’s approach to mitigating supply chain risks in animal protein commodities. They also measure how the company drives growth and builds climate-aligned portfolios by expanding alternative proteins and plant-based foods through product development and consumer engagement.

2022 Outlook

FAIRR assessed companies on the same six assessment categories as in previous years; however, instead of quantitatively scoring, FAIRR performed a qualitative assessment and assigned a forward-looking outlook for each company. The outlook reflects a company’s progress since Phase 5 and FAIRR’s view on its expected trajectory for the next 12-18 months. It is based on public disclosure, third-party data, and information shared during the collaborative engagement dialogues.

For each company, FAIRR provides individual signals for the six assessment categories, and the overall outlook is formed by aggregating the six signals. The outlook can be neutral, positive or negative.

Definitions of outlook:

Positive - There is evidence that the company has achieved significant progress and will continue with an upwards trajectory. Progress is enough that the baseline score of Phase 5 would significantly increase, as two or more assessment categories have positive signals. To score a positive outlook, a company requires two net positive signals (i.e., it could have one negative (-1) signal and three positive (+3) signals, resulting in two positive signals).

Neutral - The company is on track, with no material change leading to a significant score increase or decrease against the evaluation framework.

Negative - There has been detracting change since Phase 5 or lack of speed of necessary progress to maintain the baseline score. Evidence or lack thereof shows that the company is on a downwards trajectory which would lead to a material score decrease. Negative signals outweigh positive signals.

2021 Score

Companies are scored based on performance against each of the six assessment categories. Five of the categories are weighted at 18% each: Materiality, Strategy, Product Portfolio, Consumer Engagement, and Tracking & Reporting. Investor Engagement has a lower weighting at 10%.

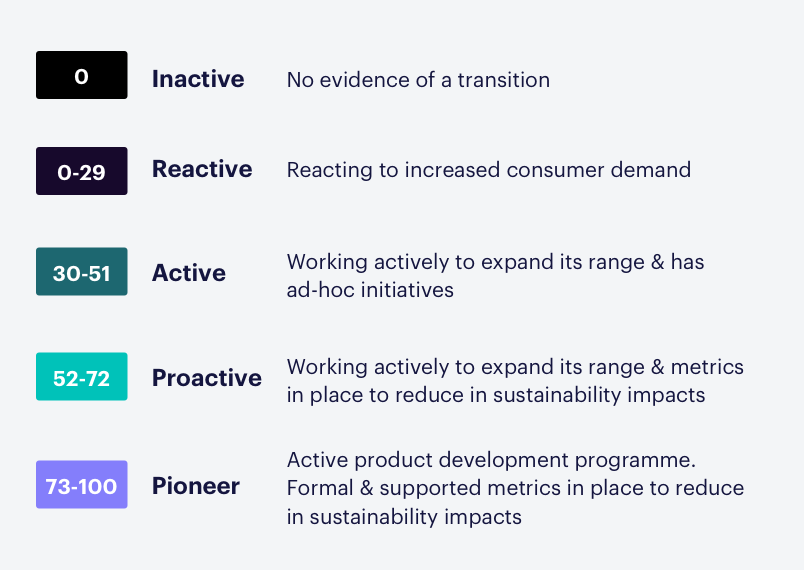

Final company scores are calculated as the total sum of scores up to a maximum of 100 points. Based on their score, companies are categorised across five levels to indicate how prepared they are to undertake a protein diversification strategy: Inactive; Reactive; Active; Proactive; and Pioneer.

During this fifth phase of engagement, all companies received a detailed qualitative assessment of their performance against the evaluation framework and were given the opportunity to provide feedback. FAIRR referred to each company’s annual report, quarterly earnings calls, sustainability reports, websites, CDP responses (if publicly available) and any other publicly available source, including media reports. FAIRR also incorporated information from company responses to the investor letter and notes from company/investor meetings, where available.

Overall, companies are categorised across 5 levels reflecting how prepared they are to undertake a protein diversification strategy.

Level | Score | What this typically means |

|---|---|---|

Inactive | 0 | The company shows no evidence that it is expanding its portfolio to include plant-based and alternative protein sources. Further, the company has not undertaken any supply chain initiatives to mitigate environmental impacts of its animal protein commodities. |

Reactive | 0-29 | The company is reacting to increased consumer demand for alternative and plant-based protein products. It has launched or added some products to meet this demand. The company has some health/nutrition goals to increase the consumption of whole grains and vegetables through its products, and has some sustainable sourcing initiatives. These are, however, mostly focused on animal welfare and/or third-party certification for some key commodities. |

Active | 30-51 | The company acknowledges the environmental and health impacts associated with diets heavy in animal proteins. The company is working actively to expand its plant-based and alternative protein portfolio and has ad-hoc initiatives to engage consumers on the benefits of plant-based diets. On the supply chain side, the company has committed to setting science-based GHG emissions targets, including for its agricultural supply chain. It also has some initiatives in place to address the environmental impacts of its animal protein commodities. |

Proactive | 52-72 | The company explicitly acknowledges the environmental and health impacts associated with diets heavy in animal proteins and accepts the materiality of this issue for its business. It does not, however, demonstrate explicit board-level support to undertake such a transition. The company has conducted some type of risk or scenario analysis to understand how its growth will be impacted by animal protein commodities. The company has an active R&D or product development programme on plant-based and alternative proteins. It demonstrates evidence of using multiple strategies to expand its product portfolio and engage consumers on the benefits of plant-based diets. The company has established internal metrics to track progress but does not share these externally. |

Pioneer | 73-100 | The company has modelled the implications of growing animal protein consumption (in line with anticipated trends) on its business and sustainability strategy. The company demonstrates explicit board-level support to undertake a protein transition. This is supported by a publicly available quantitative target that provides the roadmap for transition to a healthier, more sustainable protein portfolio. The company has a sourcing programme in place to reduce the sustainability impacts of its animal and alternative protein sourcing, including through a science-based target to reduce GHG emissions. The company has an active R&D or product development programme on plant-based and alternative proteins. It demonstrates evidence of using multiple strategies to expand its product portfolio and engage consumers on the benefits of plant-based diets. This is supported by a growing category share of alternative/plant-based foods and protein products across its business. The company establishes formal, standardised metrics to track its protein portfolio transition in line with its protein transition |

Members-only Content

To register as a member of the FAIRR network, please fill out the sign up form or if you need additional information on the FAIRR network, please contact investoroutreach@fairr.org.