Final Outcomes

Portfolio diversification targets and metrics on the rise

The number of companies setting targets continues to increase. In 2022, 35% of the engagement companies have committed to increasing the volume or sales of meat and/or dairy alternatives in their portfolios. This figure is up from 28% in 2021 and 0% in 2019.

Companies are increasingly investing in building internal capabilities and systems to track data, more of them are disclosing metrics. In 2022, 39% of engagement companies reported at least one metric showcasing how their product portfolio is shifting. This number is up from 32% in 2021 and 0% in 2019. However, comparability between companies remains an issue; hence the need to align with industry-wide guidance on metrics.

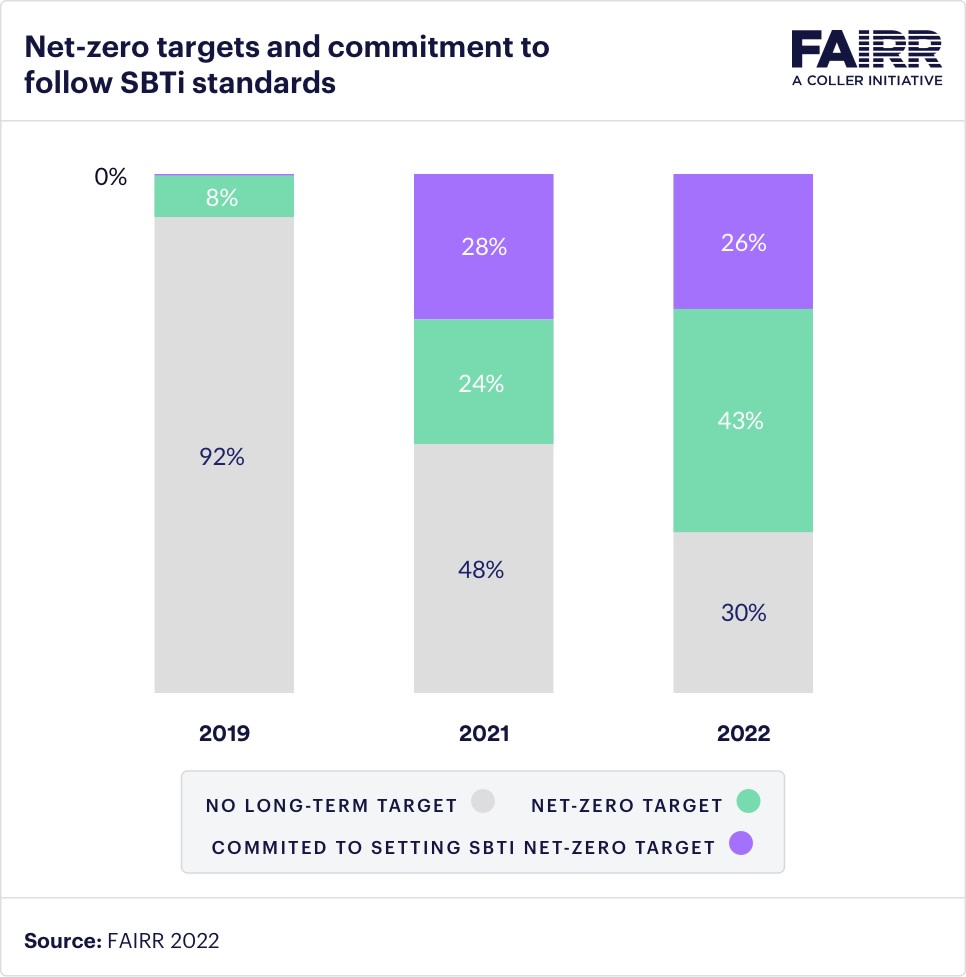

Companies are setting long-term climate ambition alongside interim commitments

70% of companies have publicly disclosed net-zero targets, up from 51% in 2021. Of these, nearly ⅔ are following the SBTi’s net-zero standards, an increase on 28% in the previous year. However, only 50% of net-zero targets cover supply chain emissions despite this accounting for the majority of companies’ emissions.

2/3 of companies now have an SBTi-approved Scope 3 goal, with a target year of at least 2030 and an average target reduction of 27%.

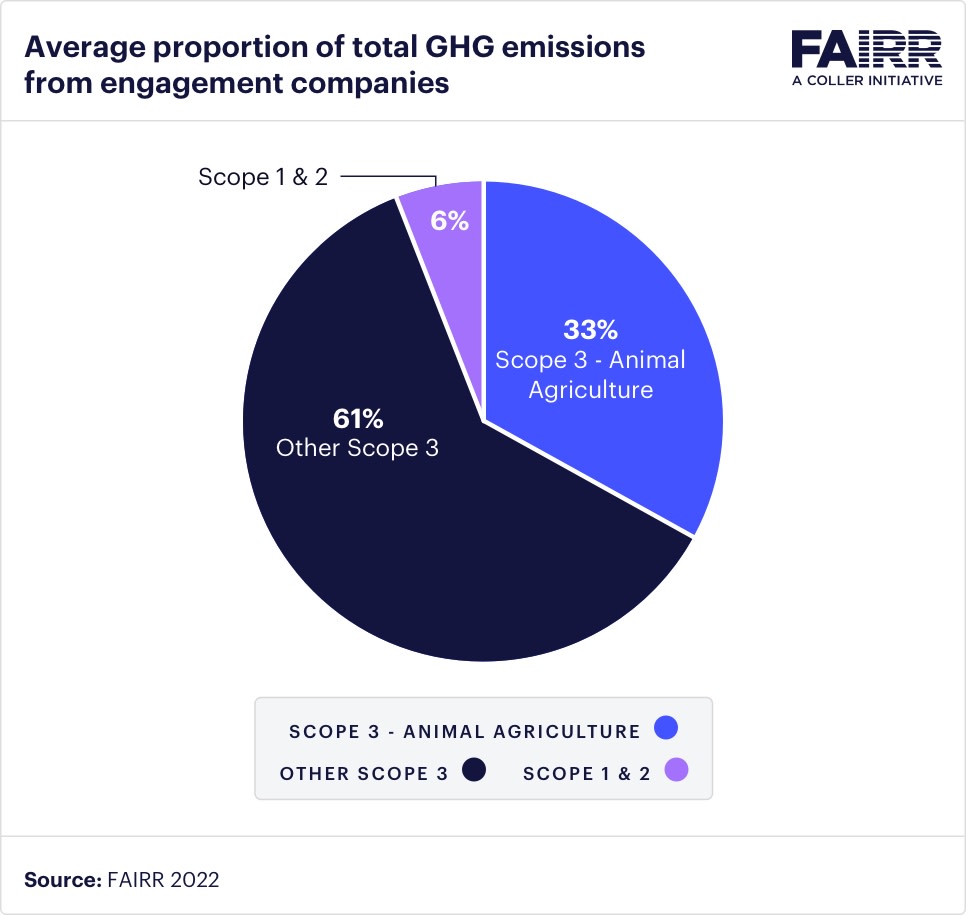

Some corporate net-zero pathways ignore sustainable proteins as an effective climate mitigation tool

Only 5 out of the 16 companies that have net-zero targets, cover Scope 3 emissions and have set a portfolio diversification target. This is an issue as on average, animal agriculture accounts for around 33% of total GHG emissions for engagement companies. Companies will need to rely on multiple levers to reduce their emissions and meet their climate commitments. Currently, most companies are missing the mitigation potential of protein diversification. This will be the focus of FAIRR’s engagement in 2023.

The pace of change is inadequate

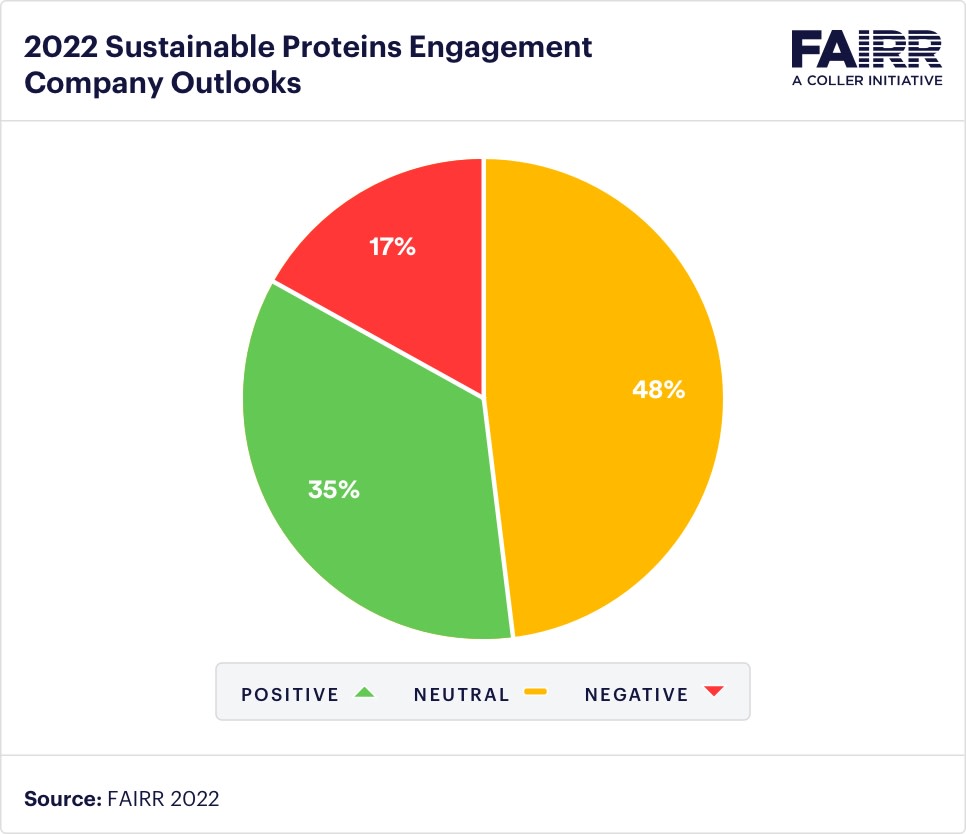

Positively, a third of engagement companies had a positive outlook; this means FAIRR expects their scores to increase significantly in the next 12-18 months.

However, FAIRR found that the remaining companies had either a neutral or negative outlook in 2022. Almost half of the companies are maintaining, rather than accelerating, their pace of improvement on protein diversification. 17% of engagement companies are on a downwards trajectory, leading to a material score decrease. This is insufficient to achieve the systemic change required to limit warming in line with the Paris Agreement.

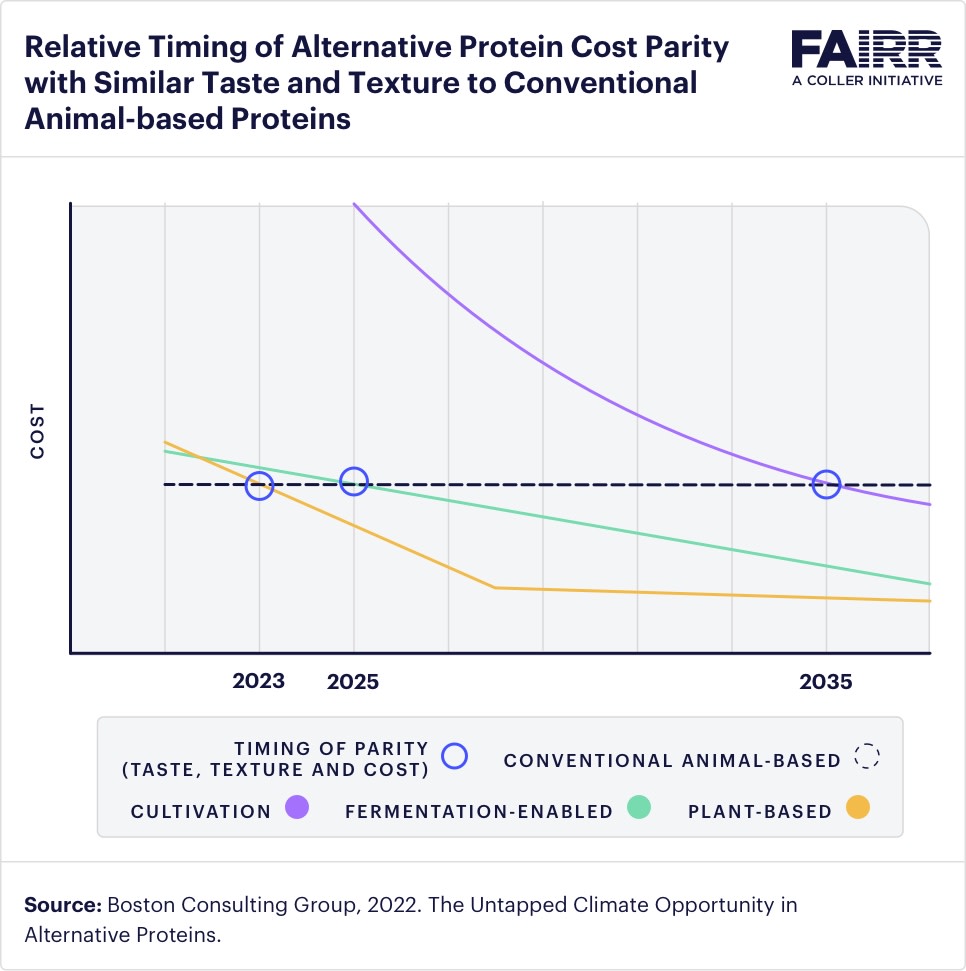

Customer-focused initiatives increasing accessibility and affordability.

Consumer engagement continues to be the lowest performing area for companies in this engagement, given the lack of an overarching strategy to accelerate consumer uptake. Nevertheless, once seen as a premium-priced indulgence, engagement companies are now making concerted efforts to increase alternative proteins’ accessibility and affordability.