Phase 3 Outcomes

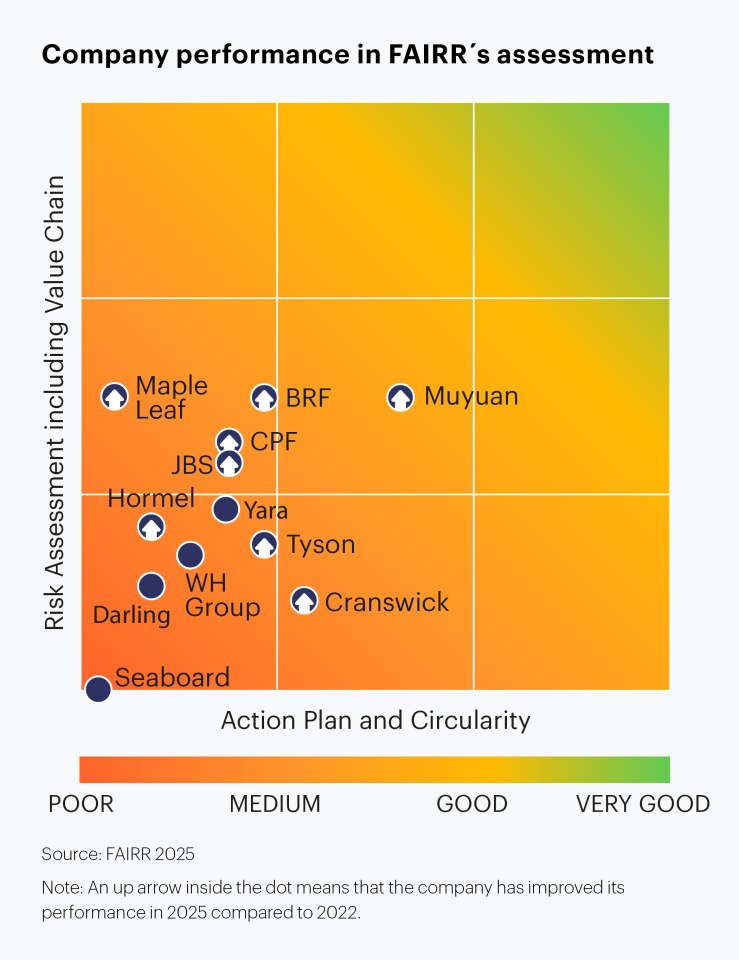

FAIRR’s engagement with 10 pork and poultry producers and two fertiliser producers reveals a growing trend in companies evaluating water quality risks across their operations and livestock supply chains. However, more actions to optimise nutrient use efficiency and circular initiatives must be undertaken in relation to these assessments, or companies will continue to fall short in fully mitigating the substantial environmental risks posed by animal waste and fertiliser pollution.

Below is a summary of the engagement outcomes. More details can be found in the Phase 3 progress report, The Cost of Contamination: Addressing Water Pollution Risks in Intensive Animal Agriculture.

For individual Waste and Pollution engagement company assessments, please visit our Company Universe.

Phase 3 Key Findings

Transparency around water-quality risk assessments is lacking

83% of companies have assessed the water quality risks of their own operations, which shows progress since 2022, yet there remains a lack of transparency about the results.

Only 25% of companies clearly disclose regions where they operate that are considered high risk for water-quality.

This lack of transparency makes it challenging for investors to understand how, or if, companies are using the information from their risk assessments to take meaningful action to reduce waste and pollution in their operations.

83%

companies have assessed the water quality risks of their own operations, which shows progress from 2022, when only 60% did soOnly 30%

of the 10 pork and poultry producers clearly disclose regions where they operate that are considered high risk for water quality.70%

of pork and poultry producers now include livestock supply chains in their risk assessments to some extent, up from only 10% in 202250%

of pork and poultry producers support livestock or crop producers to reduce pollution.Only 20%

of pork and poultry producers are investing in circularity for animal waste.Most risk assessments do not include full livestock supply chains

Only 40% of pork and poultry producers assess their entire supply chain, while 70% include some of their suppliers – representing an improvement versus 2022, when only one company did so.

This, however, means most companies do not have full visibility of their supply chain exposure to water-quality risk, particularly as the level of integration of suppliers varies significantly.

Ensuring water risk assessments cover entire supply chains would support companies to better mitigate potential liabilities and disruptions from suppliers.

This has proven to be increasingly relevant for meat producers, as cases where they are found liable for their suppliers’ pollution are increasing.

The rise in risk assessments is slow to translate into strategies to mitigate pollution risks

Only one company has disclosed targets to mitigate the pollution risks for sites it has identified as high risk.

This would indicate that overall, the rise in risk assessments has not translated into pollution mitigation strategies and targets.

In the past three years, companies in the engagement cohort have expanded the production of biogas across their operations, with 70% capturing biogas for their own operations or for contracted farmers in 2025, compared to 60% in 2022.

However, disclosure of other mitigating actions, such as covering slurry lagoons or having plans in place to distribute manure from sensitive watersheds to other areas, have been less frequent.

Furthermore, the practices disclosed have not been related to an overall strategy for reducing pollution risks in priority areas.

Understanding the nature and water impacts of fertiliser use

FAIRR’s Waste and Pollution Engagement asked the two fertiliser producers to conduct a risk assessment for the on-field use of their fertilisers.

Understanding the impacts of their products when used on farms is essential for these companies to evaluate which fertilisers pose the highest risks to water quality and, thus, to biodiversity and local communities.

Yara International and Darling Ingredients have yet to conduct a downstream risk assessment related to water quality or biodiversity risks from the use of their fertiliser products. Such an assessment would help the companies understand which areas are most sensitive to nutrient pollution and tailor their approach to working with retailers, farmers, local agri-food companies and regulators to support the adoption of appropriate products.

Yara International did conduct a Fertiliser Environmental Footprinting pilot project in 2022 to assess how different organic and mineral fertilisers impact nature-related parameters, such as water consumption and pollution. However, it has not yet translated this into action.

The lack of incentives makes nutrient circularity less attractive

FAIRR assessed the level of ambition and investment in nutrient circularity from all companies and concluded that after three years, the engagement cohort’s exposure to circularity opportunities remains largely untapped and stagnant.

Most companies have not explored or scaled this option. Despite the willingness expressed by governments to enhance nutrient circularity, the lack of financial incentives and support from policymakers may be slowing down the implementation of circular initiatives.

For most pork and poultry producers, circularity remains unattractive unless they can access subsidies that promote the upgrade of the manure treatment to achieve a high-end quality product. The reputational risks associated with being fined as more governments take action against pollution may drive more companies to consider circular models in future.