Tools Overview

How Tools Work

A core part of FAIRR’s work is communicating our research in impactful ways. To do this, we leverage in-house sectoral expertise and our extensive network of experts/stakeholders to compile interactive research suites, known as Tools. Tools provide insights, not just data, and help drive investment decisions for our members.

Tools range from a market benchmark of the world’s largest public protein producers, to detailed scenario analysis models of how unfolding climate risks will impact financials. Content is updated regularly to ensure the information is always relevant and impactful.

How members use FAIRR’s tools:

For their company assessments and data integration processes

For sectoral and thematic analysis

To inform direct company engagements

To understand macro level trends in the industry

To inform portfolio construction

Latest Activity

Latest release: Coller FAIRR Protein Producer Index 2024/25

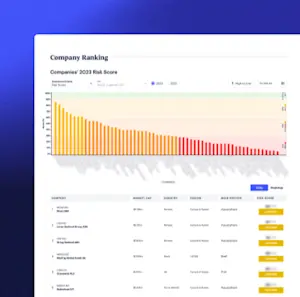

The Coller FAIRR Protein Producer Index is the world’s only comprehensive assessment of the biggest producers of animal protein. The most material ESG risks facing investors of 60 companies are identified across nine risks and one opportunity factor.

Launch of the Coller FAIRR Protein Producer Index 2023/24: Webinar recording is now available

This webinar explored the performance of 60 of the world’s largest animal protein producers on key ESG risk and opportunity factors. In addition, two guest speakers shared their experiences managing risks related to deforestation in supply chains.

Latest Release: Coller FAIRR Protein Producer Index 2023/24

The Coller FAIRR Protein Producer Index, FAIRR’s foundational piece of research, helps to identify the most material ESG risks currently affecting the animal agriculture industry. The Index assesses 60 of the largest global meat, dairy and aquaculture companies on 9 ESG risk factors and one opportunity factor.

New Asia Trends Report Coller FAIRR Protein Producer Index 2022/23

The Index assesses 60 of the largest listed global meat, dairy and aquaculture companies on 10 ESG factors. Asia is home to 27 of these companies, including 12 in the People’s Republic of China. This report demonstrates how some Asian companies have progressed considerably in addressing the ESG risks associated with food production. Compared to 2021, there has been improvement almost across the board – most notably with regard to food safety, antibiotics and alternative proteins.

NEW & improved Coller FAIRR Climate Risk Tool has now launched

Introducing the Coller FAIRR Climate Risk Tool - the only climate risk analysis tool that quantifies the materiality of risks and opportunities of the largest livestock producers. Working with three distinct climate scenarios based on IPCC and NGFS - High Climate Impact, Business as Usual, and Net Zero Aligned – the Tool illustrates how each scenario could impact the cost and profitability of each of the 40 meat and dairy companies. The underlying model focuses on three material climate-related costs - carbon tax, feed costs and heat stress – and provides investors with a critical lens to assess how these costs may affect them in future. By leveraging the tool, investors can make informed decisions to better identify climate-related risks and opportunities in their investment portfolios.

Alternative Proteins Framework has launched

The FAIRR Initiative, in collaboration with the Good Food Institute (GFI), has recently launched two ESG reporting frameworks for alternative proteins. These frameworks were developed in response to the growing interest in alternative proteins, as well as investors’ desire to measure and analyse the ESG characteristics of alternative protein companies and production lines.

Our Tools

Coller FAIRR Protein Producer Index

The Coller FAIRR Protein Producer Index is an assessment of the largest animal protein producers on critical environmental and ESG issues.

Follow

Coller FAIRR Climate Risk Tool

The only climate risk analysis tool that quantifies the materiality of risks and opportunities of 40 of the largest livestock producers.

Follow

Alternative Proteins Framework

The ESG frameworks address this gap by serving as industry-specific tools public and private companies may use to report on the performance of their alternative protein businesses.