The Coller FAIRR Protein Producer Index: Progress amidst challenge

The Coller FAIRR Protein Producer Index was established in 2018 to address the knowledge gap in the sustainability risks associated with the food sector. Recognition of its value has increasingly grown, as has its impact in driving engagement with leading protein producers and supporting investors in the sector.

The Index assesses 60 of the largest listed global meat, dairy and aquaculture companies on 10 sustainability factors. These include one opportunity (alternative proteins) and nine risks (greenhouse gas emissions, deforestation and biodiversity, water use and scarcity, waste and pollution, antibiotics, working conditions, animal welfare, food safety and governance).

The nine risk factors are commonly grouped into the following four themes: Climate Change, Biodiversity, Antibiotics and Health and Social Risks.

Company scores improve for majority of risk factors

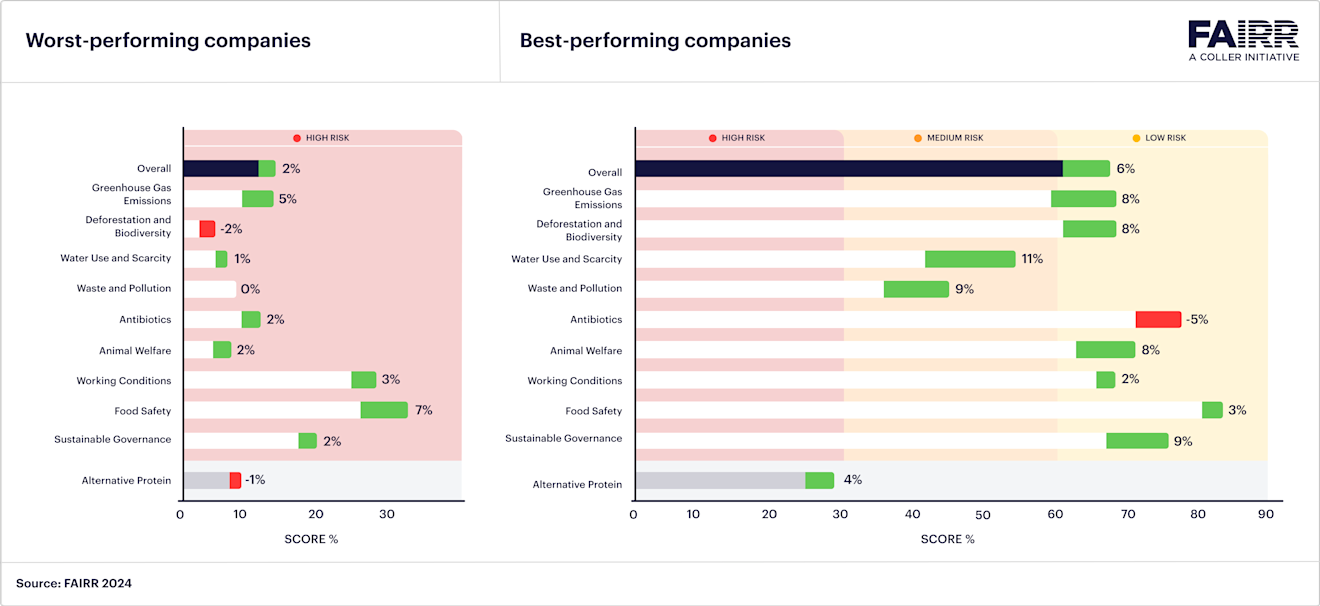

Overall, companies have continued to improve in 2024, with scores increasing for nine out of 10 factors on average. Nearly one-fifth of companies are now considered low-risk, up from 13% in 2023. However, at 45%, the proportion of high-risk companies remains unchanged, while no company has achieved an overall best-practice rating yet.

The 15 worst-performing companies – defined as those in the bottom quartile – made limited progress across all ESG factors apart from deforestation and biodiversity, waste and pollution and alternative proteins.

The 15 best-performing companies – defined as those in the top quartile – improved in all factors except antibiotics. In particular, the average score of this cohort dropping by 5% for antibiotics is concerning.

Food safety and governance risks managed best, progress on alt proteins stalls

Protein producers manage risks associated with food safety the best, followed by governance and working conditions, with overall average scores increasing 4% and 3% respectively. On governance, for example, the proportion of companies that have linked executive remuneration to a sustainability metric has increased, from 38% to 53%.

Overall, companies still score poorly on water risk and waste pollution management, with both risks only seeing a score increase of 4%. Progress on alternative protein opportunities has also been limited, with a 2% decrease in overall average scores compared to last year.

As a lower-impact food source compared to animal protein, alternative proteins are essential for reducing greenhouse gas emissions, land use and water consumption. They also present companies with opportunities to diversify their product portfolios and encourage more diverse and sustainable diets among consumers.

North America and Asia are key regions for global protein production and consumption,1 and the lack of progress among Index companies overall, and in these two regions specifically, is concerning.

Regional imbalance clear as Europe and LATAM lead low-risk ratings

While all regions saw an increase in overall company scores compared to last year, ranging from 1% to 6%, there is still an imbalance in how companies are managing ESG risks and opportunities, as demonstrated by the prevalence, or absence, of companies achieving a low-risk rating.

More than half of companies headquartered in Europe, and one-fifth of those in Latin America, are rated low risk, highlighting their progress in integrating comprehensive sustainability strategies into their operations and adopting robust practices.

Several drivers may have contributed to this progress, ranging from a more stringent regulatory landscape in Europe to the environmental challenges in LATAM, such as deforestation and water scarcity, that have required immediate action.

On the other hand, protein producers in Asia and North America are all rated high or medium risk, with no companies achieving a low-risk rating.

Less stringent regulations and the significant influence of carbon-intensive industries may be delaying the more widespread adoption of comprehensive sustainability strategies in these regions, while companies in fast-growing economies may not yet prioritise ESG disclosures.

This disparity could have significant implications for global investors, as North American and Asian companies may be more exposed to financial and operational risks than their European or Latin American peers. These include potential regulatory penalties, supply chain disruptions and reputational damage linked to poor ESG performance.

Moving beyond commitments to active practice, measurable results

This year’s key findings look at four themes: Climate Change, Biodiversity, Antibiotics and Health and Social Risks.

They show that Index companies are improving in various ways, from setting zero-deforestation targets in alignment with the Science-Based Targets initiative to limiting the use of antibiotics usage, improving human rights due diligence processes and investing in innovations that help develop more sustainable feed sources.

Nonetheless, there is still room for improvement. Crucially, the key findings emphasise that the type and quality of information companies are disclosing matters.

As the sustainability landscape continues to evolve rapidly, FAIRR believes that it is crucial to go beyond simple disclosure.

Over the 2023/2024 assessment cycle, 38 out of 60 companies engaged with FAIRR to develop a better understanding of their performance. FAIRR also established contact with three companies it has not previously had a dialogue with. Companies will be offered one-to-one calls with FAIRR’s Index team to discuss the 2024/2025 results.