2024 Protein Producer Index

Key antibiotics and animal health findings

The intersection of antibiotic stewardship and animal welfare is central to promoting health and sustainability in global food production.

Roughly 70% of all antibiotics used globally are in livestock farming, making it a major contributor to the growing threat of Antimicrobial Resistance (AMR).

Overuse in the sector is related to poor husbandry practices and reliance on antibiotics for maintaining animal health and promoting growth, particularly in poultry and pork production.

Addressing AMR involves curbing antibiotic use and improving the welfare conditions of farm animals – and as the latter can often reduce the need for antibiotics, this creates a mutually beneficial relationship between the two concerns.

The findings below explore where companies have progressed on animal welfare and antibiotics policies, practices and commitments, and where more work needs to be done.

70%

of all antibiotics sold worldwide are used for livestock[1].11%

of livestock loss by 2050 will be due to antimicrobial resistance[2].58%

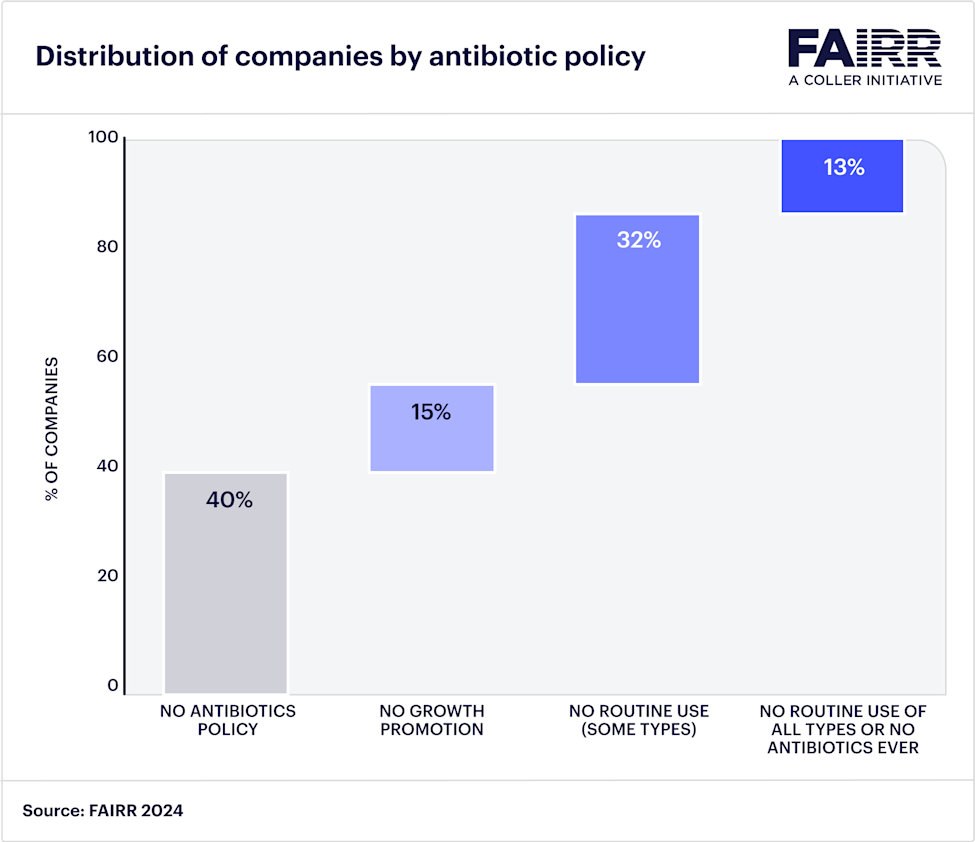

of Index companies are rated high risk on addressing antimicrobial resistance.40%

of companies do not have the most basic antibiotics policy, which limits growth promotion at a minimum.83%

of companies take animal welfare measures as part of their efforts to reduce antibiotics usage.12%

of companies have disclosed a reduction in antibiotics usage, down from 15% in 2023.Antibiotics stewardship and animal welfare continue to present industry challenges

In 2024, 58% and 48% of 60 Index companies respectively were classified as high risk for antibiotics stewardship and animal welfare. At the same time, no new companies moved out of the high-risk categorisation, indicating that these two critical areas remain challenging for poor-performing companies.

In contrast, better-performing companies continue to improve on animal welfare, with one livestock company achieving a best-practice rating for the first time in 2024, and more companies moving from the medium to low-risk category.

Minimum antibiotics policies lacking for most companies

Despite the risks that AMR poses, less than two-thirds of the 60 Index companies meet the minimum requirement of having an antibiotics policy that limits use for animal growth. This remains unchanged from 2023.

A minority are demonstrating best practice, for example by committing to a total antibiotic ban (5%) or by banning the routine use of all antibiotics (20%), meaning antibiotics are only used if animals are diagnosed as ill or exposed to sick animals.

Companies fare better at committing to basic animal welfare principles – 86% of the 51 land-based protein producers in the Index have pledged to uphold the Five Freedoms of animal welfare.3

As the industry makes further progress in setting animal welfare policies, we hope that companies can demonstrate how they are implementing these, and consequently, can show they are ready to take a stronger stance on antibiotics usage.

Better housing and enriched environment measures fail to address underlying animal welfare issues

Biosecurity and sterilisation are the most adopted measures aimed at reducing the use of antibiotics, with 73% of all Index companies implementing them, reflecting their effectiveness in preventing disease outbreaks. Vaccine use follows closely at 63%, indicating a strong focus on preventive health measures.

While 61% of livestock companies have committed to avoiding the practice of close confinement, only 31% have committed to avoiding routine mutilations, one of the harmful practices often associated with poor confinement conditions.

Furthermore, explicitly avoiding mutilation and reducing stocking densities as part of their antibiotic reduction strategies is even less common, with just 14% and 18% of companies doing so respectively.

Nearly 50% of livestock companies state that animals have access to pasture, creating opportunities for natural behaviours to reduce stress, but only 18% say they use high-welfare breeds.

So, while some companies are providing enriched environments, only a fraction are addressing the root cause of animal welfare issues – poor breeding practices.

Transparency lacking in antibiotics use disclosures

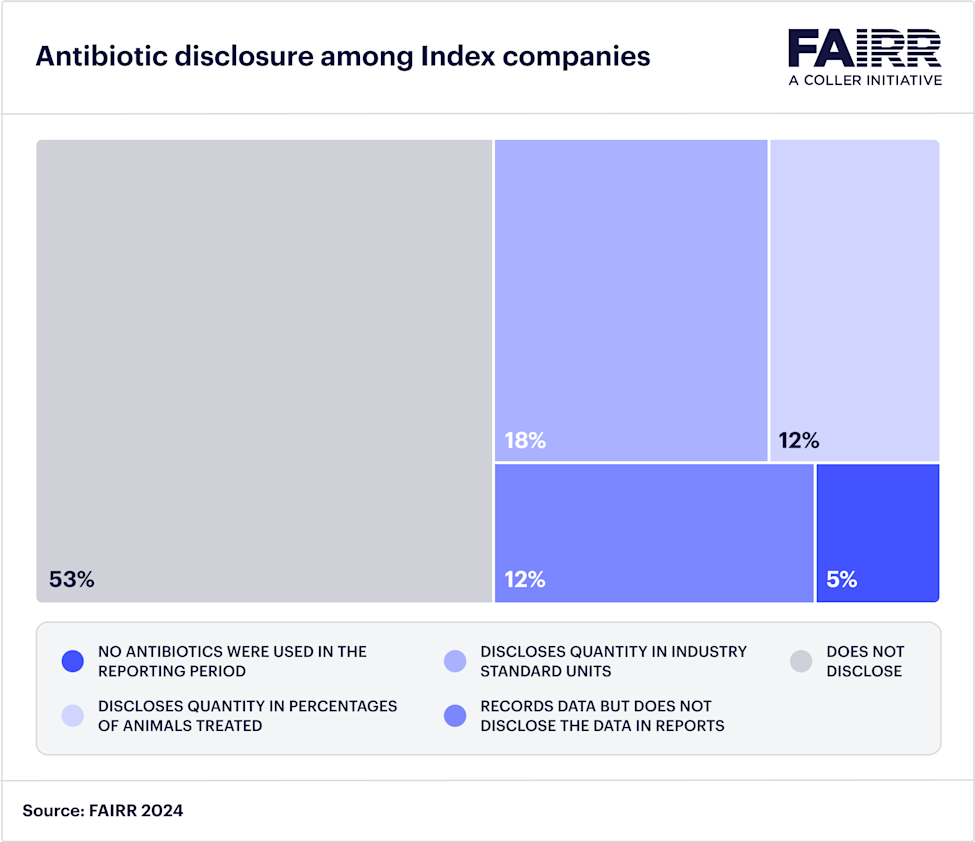

Since 2022, the sector has seen little progress overall in companies disclosing a reduction in antibiotic usage, with only 12% reporting that they do so in 2024.

Alarmingly, 53% of companies do not disclose any information on antibiotic use, indicating a significant lack of transparency and accountability. Indeed, 12% say they collect that information but are not disclosing it publicly, reflecting a transparency gap despite the data being available.

This is particularly prevalent among livestock companies, where 40% do not have antibiotics policies and 10% do not disclose any information on antibiotics use.

Transparency is also lacking when it comes to animal welfare policy violations. While 86% of livestock companies have an animal welfare policy, only 27% disclose when these are breached and what actions are taken if a policy breach is identified.

European and North American livestock companies progressing on animal welfare

European livestock companies score best across all animal welfare factors and continued to improve in 2024, with just one out of seven categorised as high risk.

Overall antibiotics performance declined, however, as one company rating dropped from best practice to low risk. Conversely, the number of companies classified as high risk has also decreased, from three to two out of seven.

North American livestock companies perform relatively better on animal welfare and antibiotics compared to other issues assessed in the Index. Some 43% are rated low risk, compared to 29% in 2023, although two companies out of seven remain high risk.

Asian companies broadly perform particularly poorly on antibiotics, with 86% considered high risk and the remaining 14%, predominantly aquaculture companies, rated medium risk. Similarly, 75% are high risk for animal welfare, with only one company, in dairy, ranking low risk.

Only one-third of Chinese companies have an antibiotics policy that, at a minimum, bans growth promotion. While positive, this highlights a gap between corporate actions and national policy to align antibiotics stewardship with global standards, with China’s 14th Five-Year Plan (2021-2025) aiming to curb antibiotic use in farm animals.4