Methodology Summary

The methodology used in the Coller FAIRR Protein Producer Index is reviewed on an annual basis in cooperation with subject matter experts and investor members. In addition, all 60 companies in the Index are invited to provide feedback throughout the review process.

The Index helps to identify the most material environmental, social and governance (ESG) risks affecting the livestock industry. It seeks to reduce the associated risks to companies and investors while encouraging a transition to a more sustainable food system.

Harmonisation | Sector-Specific | Materiality |

|---|---|---|

Align with existing methodologies to avoid increasing the reporting burden on companies | Ensure that indicators capture sector-specific issues in livestock and fish farming | Assess company disclosures against the most material risks and issues |

To capture best practices and avoid increasing the reporting burden on companies, FAIRR’s methodology aligns with over 54 standards across themes and sub-sectors, including the Sustainability Accounting Standards Board’s materiality matrix for the sector.

If you are interested in learning more about our methodology and how it can support your sustainability goals, we encourage you to reach out and schedule a meeting with the Index team. We are pleased to offer direct meetings with both existing and prospective FAIRR members to discuss the current Protein Producer Index methodology and answer any questions you may have.

Methodology Review

Since its inception in 2018, the methodology has been updated on an annual basis to various degrees. The 2024 methodology is the same as that used in 2023 and is also very close to the 2022 methodology. When changes are made, FAIRR engages with multiple stakeholders so the Index continues to reflect the most material issues and best practice. We have worked with more than 60 companies, investors and subject matter experts since the Index was created.

The Index methodology is designed to assess how livestock and aquaculture companies manage and report on material ESG risks (and opportunities). We acknowledge that disclosure on its own is not entirely reflective of whether companies manage these risks and, if they do, whether their management systems are effective. To provide a more comprehensive view, we integrate limited performance-based indicators where available and relevant: for example, on emissions performance, aquaculture feed conversion ratios and antibiotics usage.

Subject-matter experts

How we calculate the final company risk score

The FAIRR Initiative conducts company assessments using publicly available information. This includes annual and sustainability reports, company websites and (where available) CDP disclosures.

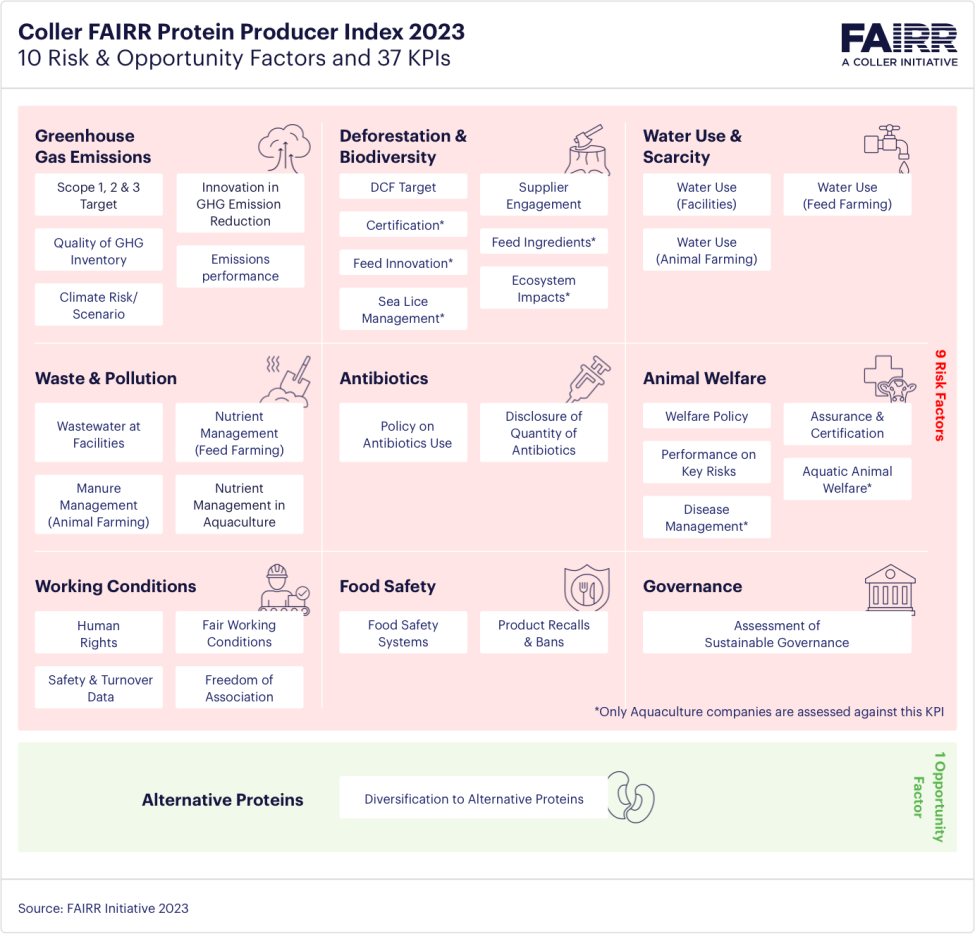

Companies are given a final Risk factor score, which is the average of scores they receive across the nine individual risk factors; GHG Emissions; Deforestation & Biodiversity; Water Use and Scarcity; Water Pollution; Antibiotics; Animal Welfare; Working Conditions; Food Safety and Governance.

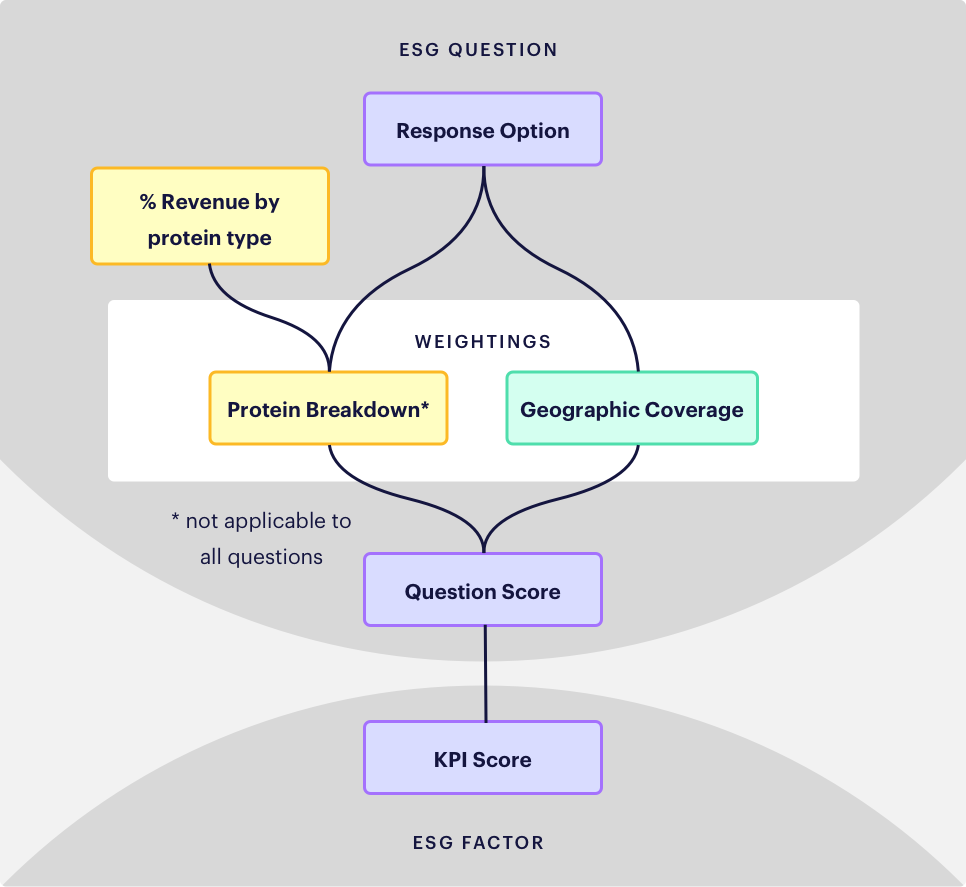

All risk factors and KPIs within an individual risk factor are weighted equally. Each KPI is made of several questions. Where policies and practices only apply to certain geographies or proteins, companies will be awarded partial points through the application of quantitative weighting. The Risk Factor Score is then converted to a percentage (out of 100).

Weightings

The methodology accounts for two types of reporting scopes:

Geographic coverage: to fairly score a company in line with the geographic coverage of its ESG practices and disclosure, points associated with a question’s selected response option are subject to a quantitative weighting.

Protein breakdown: whilst some questions are protein-specific, the methodology also includes general questions where a company may not report on all animal proteins from which it derives revenue. In these cases, a second weighting is applied to reflect the protein breakdown of the company’s financials.

Risk Factor

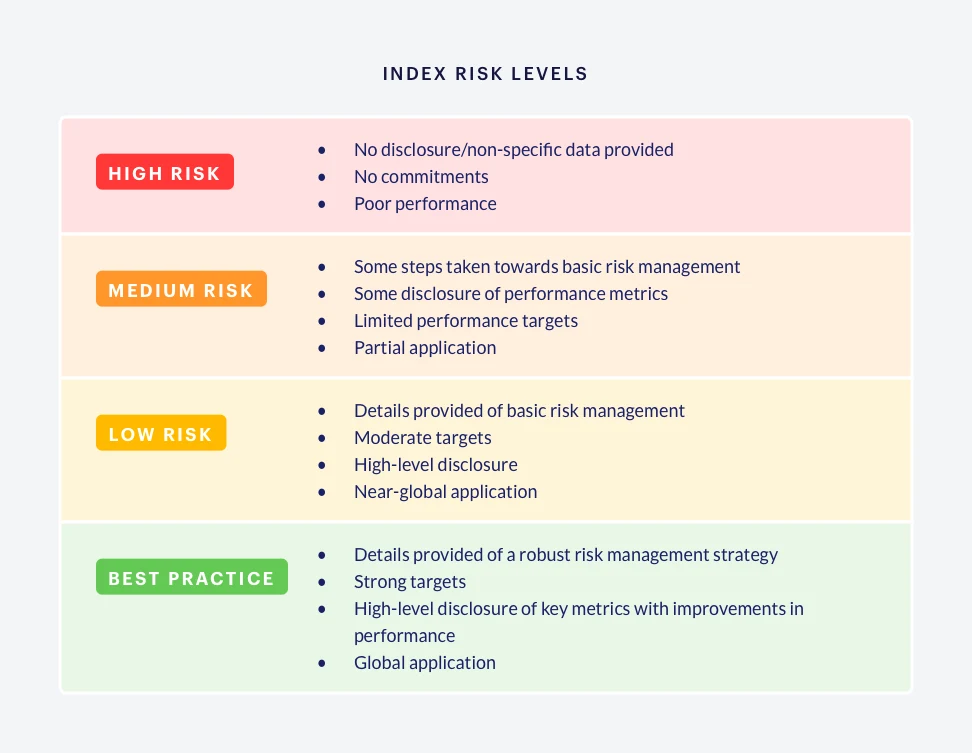

Companies are given a rating per ESG factor, as well as an overall rating, based on their factor and final risk scores, according to the following risk categories:

High Risk

No or limited disclosure and commitments.

Medium Risk

Basic management of the risk with limited detail and some disclosure of performance metrics. Basic performance targets and limited geographical application.

Low Risk

Moderate management of the risk with more detail and moderate levels of disclosure of performance metrics. Moderate performance targets and near global application.

Best Practice

Strong management of the risk with more detail and high levels of disclosure of performance metrics. They have strong performance targets across a global application. They are also improving performance.

Opportunity Factor

This is a separate score and captures a company’s performance on the Alternative Proteins opportunity factor.

Limitations

The 10 factors and 37 indicators reflect the sector’s material impacts. However, these are not an exhaustive list. A key risk for the industry is growing awareness of the causal link between high meat consumption and non-communicable diseases such as cancer, diabetes and obesity. However, the Index does not consider health and nutrition issues as part of its current methodology, beyond an assessment of company exposure to alternative proteins. This is primarily because health and nutrition issues are complex and dependent on local culture and social contexts. There is currently no standardised framework for assessing animal protein consumption in the context of health.

Another key risk for the industry is food waste. According to the FAO, approximately one-third of all food produced in the world is lost or wasted. The impacts and risks associated with food waste have strong relationships with other risk factors included in the Index: GHG Emissions, Water Use & Scarcity, Deforestation & Biodiversity (through land-use change), and Waste & Pollution (through fertiliser and pesticide applications).

Similarly, food packaging and the use of plastics are emerging issues for the industry. These are linked to other risks covered by the Index. However, since these risks are not specific to the animal protein sector, the Index does not currently assess them.

Our aim is to work with stakeholders so that the Index methodology continues to evolve and remains comprehensive and meaningful for investors and sector companies.