A focus on Asia

This report is a summary of the Index results for the 28 companies based in Asia. They represent 47% of the companies assessed in the Coller FAIRR Protein Producer Index with a combined market capitalisation of $189.75 billion.

Introduction

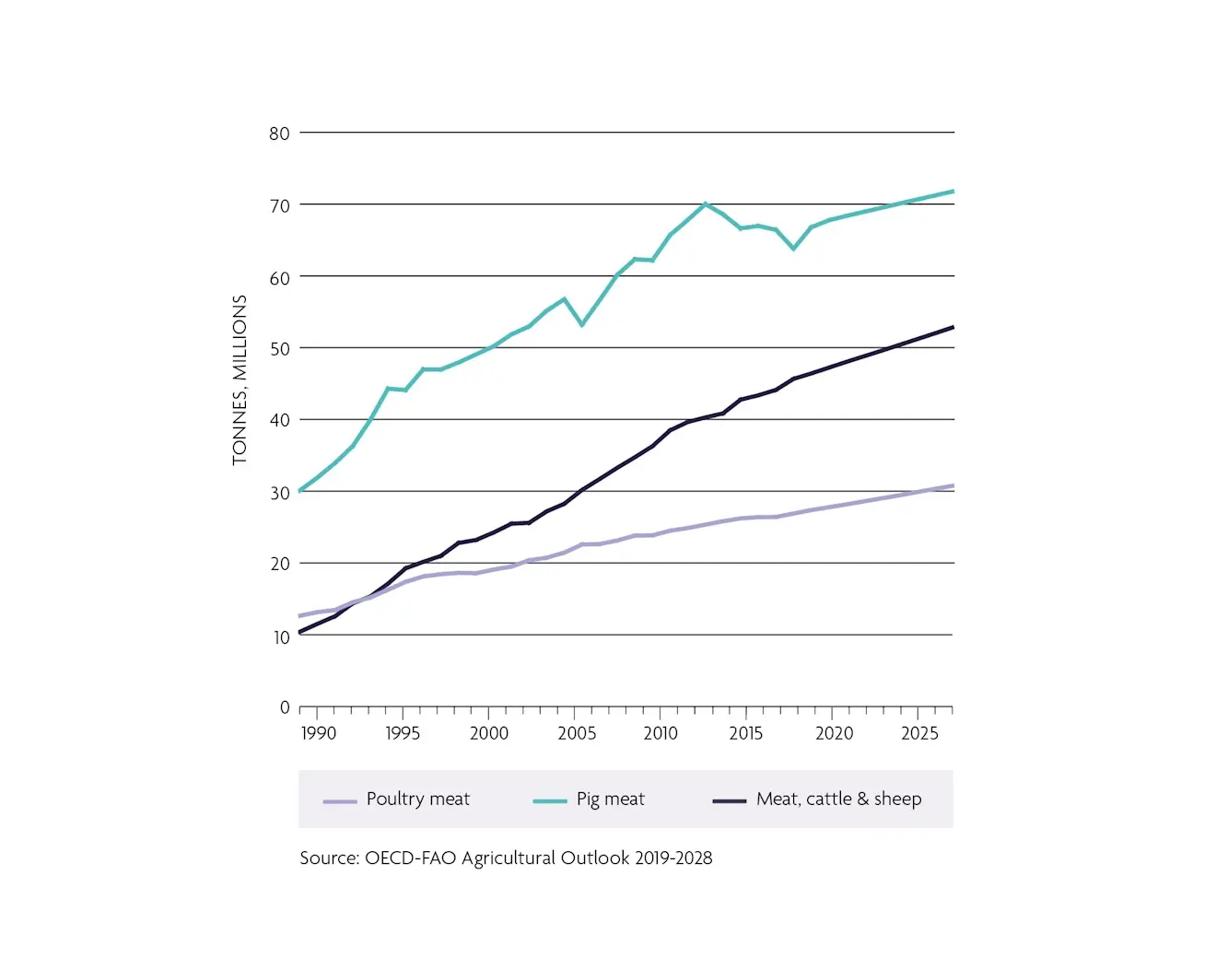

Intensive farming – which prioritises feed efficiency and rapid weight gain – is now standard practice across all farmed species. It has helped to increase global meat, egg and milk production by 140% since 1961, and make farm animals, led by cattle and pigs, the largest mammalian biomass on the planet. In Asia, production and consumption of animal products has followed the same trend, though the absolute level of animal protein consumption varies across the region. Malaysia, Vietnam and China have seen the highest growth in meat consumption per capita since 1990, at 90%, 197% and 335% respectively. In contrast, meat consumption in India has grown less, up 18% from 1990.

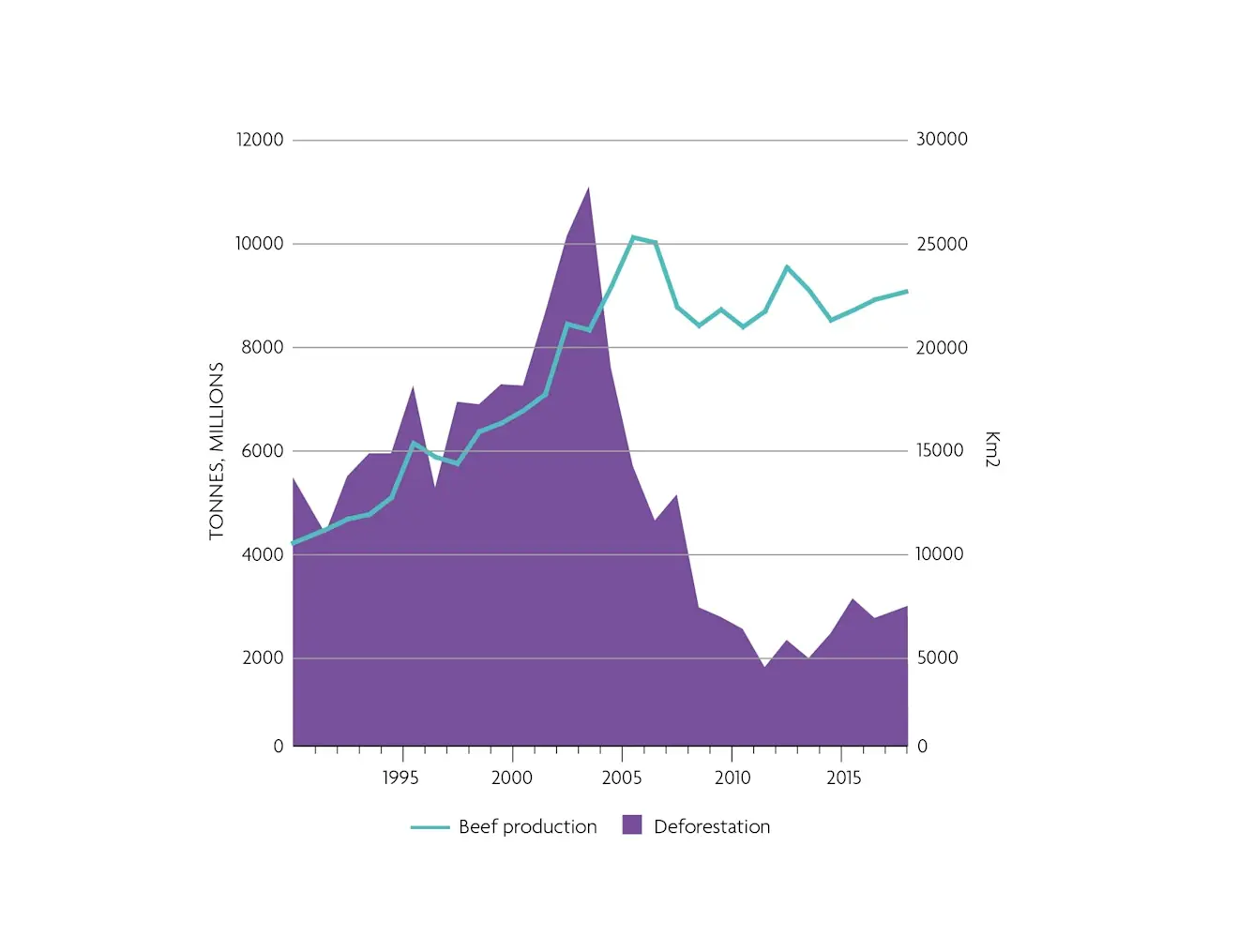

As home to the world’s largest national population (1.4 billion as of 2019), China remains the world’s largest single market for meat. Socioeconomic changes including a growing middle class and urbanisation continue to drive growth in per capita meat consumption; given the scale of China’s demand, this growing appetite has global implications. This is most visible in countries like Brazil, where 74% of soy exports (for animal feed) and 44% of beef exports go to China and Hong Kong. Meat demand in China has exacerbated Brazil’s growing deforestation problem, especially in ecologically sensitive areas such as the Amazon biome and Cerrado savannah.

Meat production in Asiahas increased by 157% since 1990

The rapid growth of the meat sector in many Asian countries has transformed the availability and accessibility of cheap protein sources and resulted in economic and social benefits. However, these benefits have come at a steep cost: the sector is one of the primary drivers of the most serious environmental and social risks facing our planet and society. Global multinationals that breed, grow and process livestock and fish are ultimately on the front lines of managing and mitigating these risks. The lack of scrutiny on the sector has meant that these companies have been allowed to scale their operations, markets and production volumes without clear controls. This creates systemic risks: not just for companies, but also their global food customers, investors, consumers and society at large.

The FAIRR Initiative is working to leverage the power of institutional capital to effect change in the livestock and farmed fish sectors. One of our key research initiatives is the Coller FAIRR Protein Producer Index. This ranks 60 of the world’s largest protein producers on their disclosure and management of material environmental and social risks. The Index is the world’s only benchmark dedicated to profiling animal protein producers and showcasing critical gaps and areas of best practice in the sector.

The primary purpose of this Index is to enable and support investor decision-making on the protein sector. We hope investors will integrate the data and analysis on the performance of these global listed assets into their stewardship and investment decisions. The Index is also a benchmark to help animal protein companies assess themselves against their peers in the sector and improve their management and reporting of risks.

This report is a summary of the Index results for the animal protein producer companies headquartered in Asia.

Chinese Sustainable Meat Declaration

In May 2017, 64 Chinese companies (including six companies featured in the Index) signed the Chinese Sustainable Meat Declaration, launched by the China Meat Association and the World Wildlife Fund (WWF).

Signatories of the declaration made eight commitments, including to avoid deforestation and to reduce GHG emissions and pollution. A progress report was published in September 2019, highlighting progress on implementation for four large meat companies.

Investors should build on this momentum by engaging with signatories to drive implementation. The investment community should also engage meat producers who have yet to join the initiative in order to widen its potential impact.

About the Index

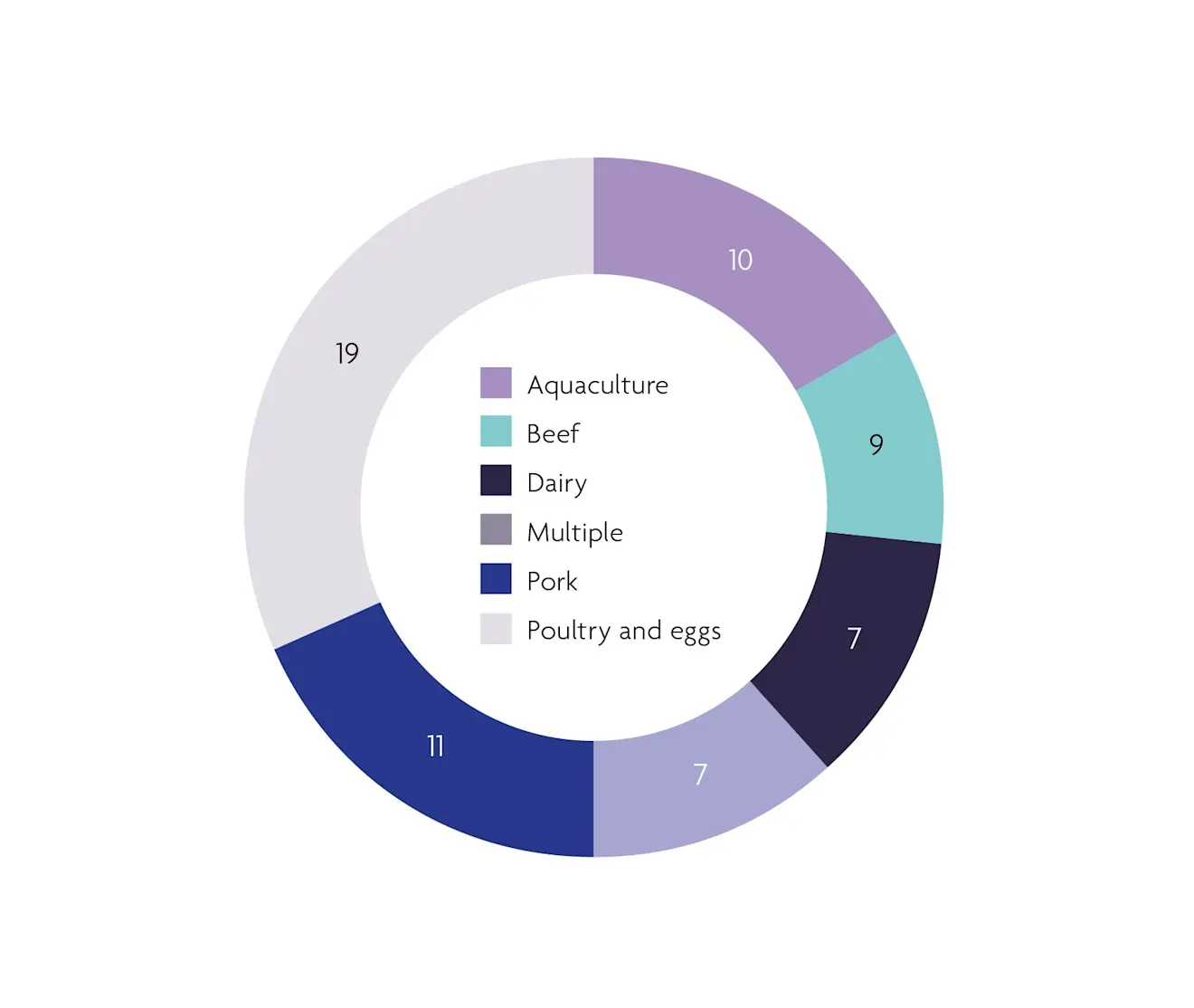

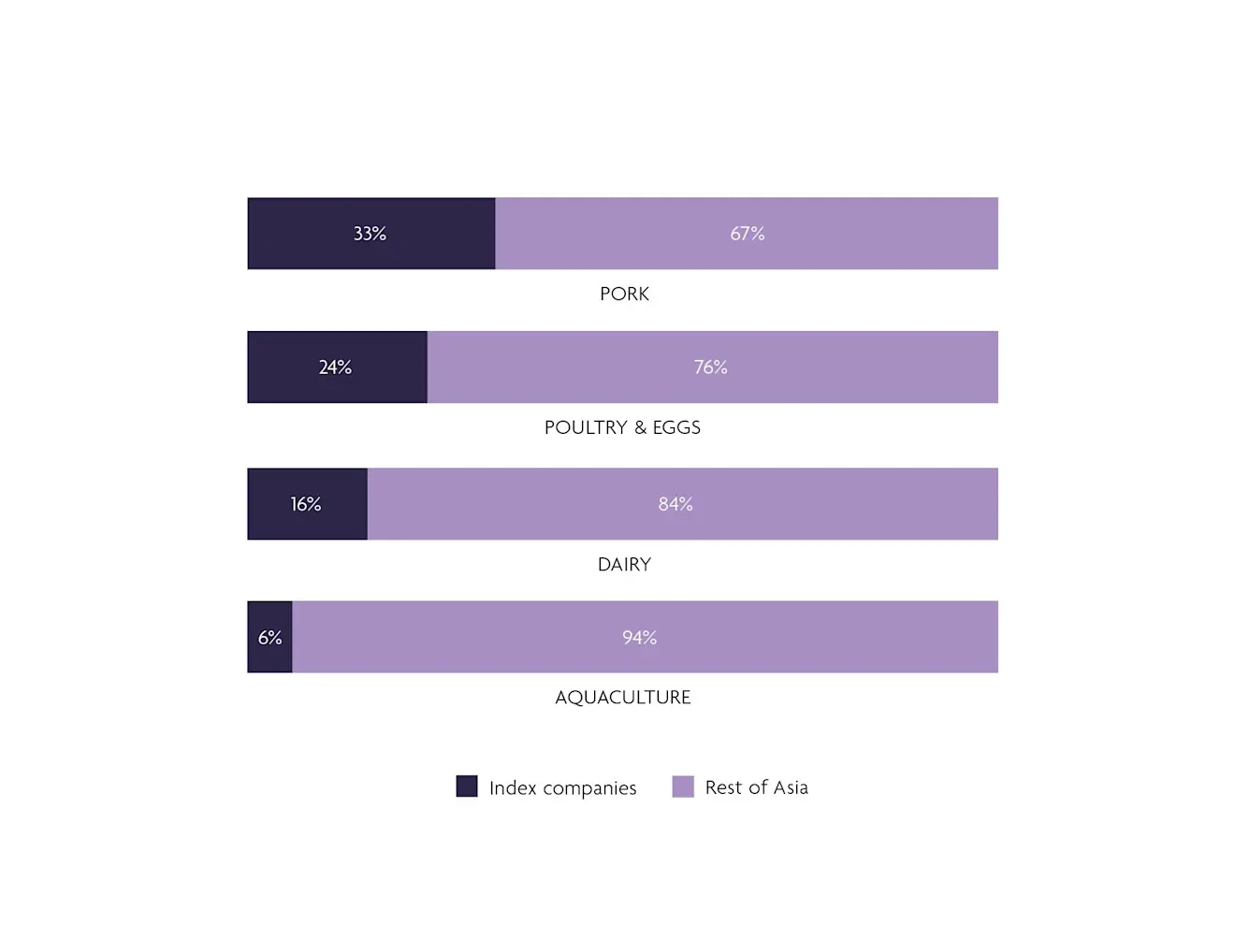

This Index focuses on listed companies primarily involved in breeding, processing, distributing and selling meat, dairy or aquaculture products. The 28 Asian Index constituents have a combined market capitalisation of $189.75 billion.

Protein Distribution of 28 Asian Index constituents by main protein category

Asian Index Companies contribute to 19% of the Asian protein market

Impacts of soy and cattle production

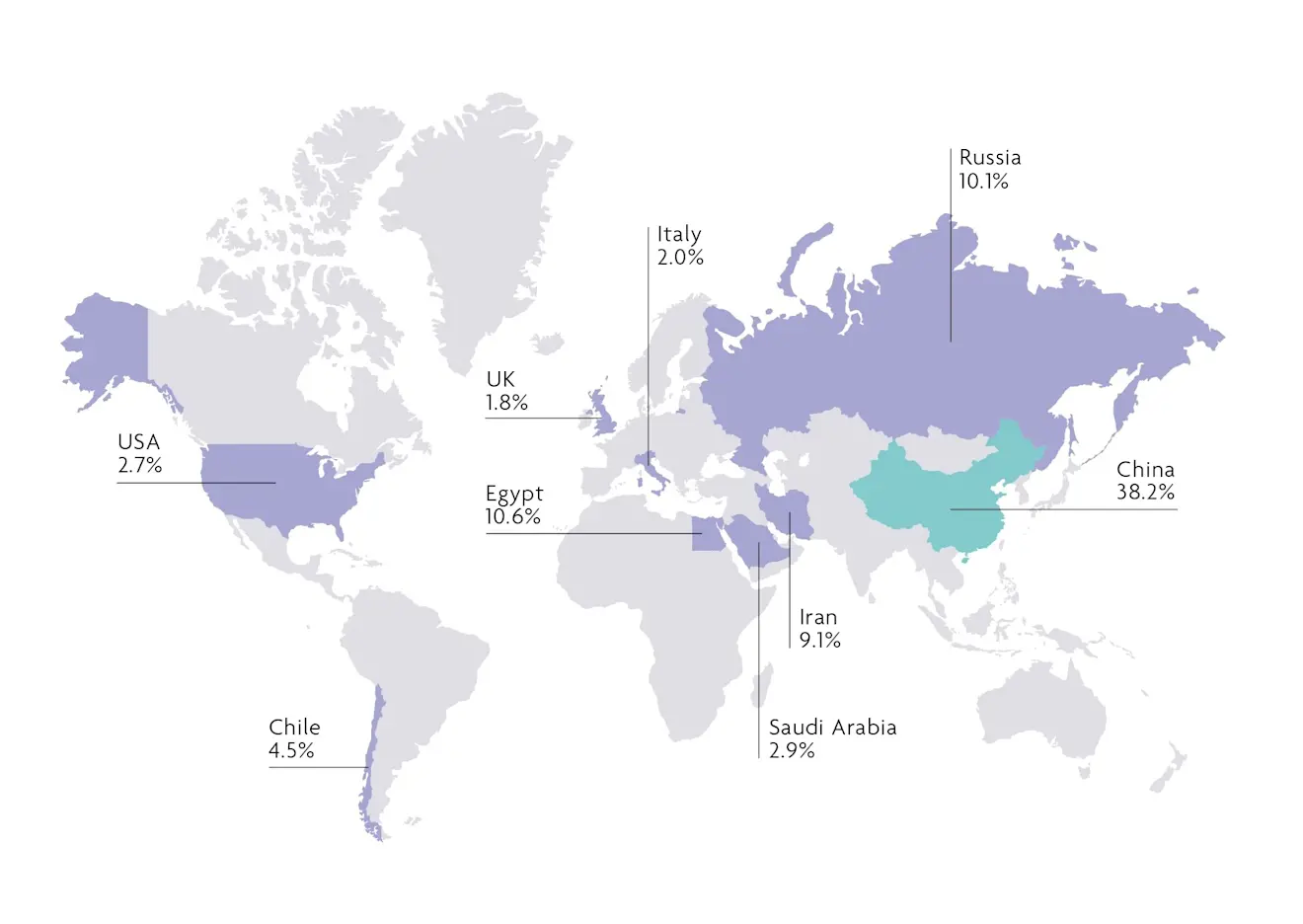

Brazil is the world’s largest exporter of beef, providing close to 20% of the total global exports. The single largest destination for Brazilian beef is China and Hong Kong, accounting for 38% of the country’s beef exports in 2017.

80% of the Amazon forests cleared since 2014 have been occupied by cattle. Nearly 40% of the country’s cattle herd is in the Amazon region.

Brazil is also one of Asia’s largest soy exporters, most of which goes towards feeding pigs and other livestock. Soy-related deforestation has been significant in southern Brazil, where the Cerrado savannah is located. The escalation of the US-China trade war has exacerbated the negative impacts of deforestation. China’s retaliatory tariffs slapped on US exports have reduced Chinese soy imports from the US. US exports of soy to China dropped by 50% in 2018. To fill the gap, China has increased imports of Brazilian soybean and beef.

Deforestation rates in the Amazon increased by 102% from 1990 to 2004

38% of Brazillian beef and live cattle exports go to China

Despite this risk, there is a lack of disclosure on how Asian companies in the Index are managing deforestation risks in beef and soy supply chains.

23 companies (82%) do not disclose information on how they manage deforestation risks linked to soy.

Only two Asian companies (Japanese pork producer NH Foods and Charoen Pokphand Foods) disclose deforestation information to CDP.

Charoen Pokphand Foods is the only company that has a commitment that 100% of soy will have zero net deforestation and forest degradation by 2020.

10 out of 13 companies (77%) that source cattle provide no disclosure on how deforestation risks are managed. For companies that do disclose, only high-level information is provided, and no commitments have been made.

How ASF is impacting production and profits

African Swine Fever (ASF) has been described as the “largest-ever animal disease outbreak”. Cases were first reported in August 2018 and the disease has continued to spread rapidly in Asia, with the most recent cases confirmed in South Korea and the Philippines. There are fears that ASF will reach the UK within a year and there are calls for the Department for Environment, Food & Rural Affairs to actively work with the UK border force to prevent this.

To date, almost five million pigs in Asia have died either directly from the disease or because they have been culled to halt the spread of the disease. However, some projections estimate that the number will be much higher at 150-200 million to be culled or to die from the disease.

Although ASF does not affect humans, it has the potential to spread very rapidly and has devastating socio-economic and public health impacts. The outbreak has resulted in significant financial impacts on Chinese pork producers. The world’s largest pork producer, WH Group, saw a 31.6% drop in operating profit in its fresh pork division for the six months to 30 June 2019 as a result of ASF outbreaks.

Financial impacts for ASF for pork producers

Cause | Financial Impact Driver |

|---|---|

Reduction in stockpilefrom pig culling | Lower volume of stock to sell |

Restriction in the transportation of live hogs | Greater bureaucratic challenges and costs |

Consumers switching demand to other proteins due to rising pork prices from limited supply | Greater competition from substitutes e.g. other animal proteins, plant-based alternatives |

Re-stocking challenges | Stockpile takes long time to rebuild (6 months to raise a pig for slaughter) |

The ASF outbreak has shown how a dependency on one commodity or protein type can result in significant volatility for protein producers. It also highlights the wide range of sustainability risks associated with the intensification of farming. Animal protein companies should be managing such risks and exploring opportunities to build more resilient business models, for example by diversifying into more sustainable proteins.

Company performance

The 2019 Index demonstrates that the vast majority of companies in Asia have yet to meaningfully address even the most basic sustainability risks. 28 companies, valued at $189.75 billion and with combined revenues of over $133 billion, are ranked as high risk (worst performers) by the Index.

Best Performers

Thai producer Charoen Pokphand Foods was ranked amongst the top 10 companies overall.

Company | Assessed Protein |

|---|---|

Multiple | |

Dairy | |

Pork | |

Aquaculture | |

Poultry & Eggs |

Worst Performers

The bottom five Asian companies have an average score of only 7%, indicating limited management and/or disclosure across nine risk and opportunity factors.

Company | Assessed Protein |

|---|---|

Poultry & Eggs | |

Pork | |

Poultry & Eggs | |

Pork | |

Fucheng | Poultry & Eggs |

Risk & Opportunity Factors

Greenhouse Gas Emissions

28 Asian companies scored an average of 12% on managing greenhouse gas emissions, as compared with 17% attained by all 60 Index companies.

24 companies (86%), valued at $162 billion and with revenues of $78 billion, are categorised as high risk i.e. there is little to no disclosure on greenhouse gas emissions targets across their operations and supply chain.

None of the companies have a science-based target for emissions reduction.

Working Conditions

Almost 90% of Asian Index companies – valued at $178 billion – do not discuss human rights due diligence processes to identify, prevent and remedy human rights abuses in their operations.

No company discusses how it is meeting the UN Guiding Principles of Business and Human Rights, though Thai-based aquaculture producer Thai Union has a dedicated human rights policy stating its commitment to respecting human rights in its value chain.

13 companies (46%) do not disclose data on work-related injuries and fatalities.

Asian Index companies score an average of 23% on working conditions overall, compared to 39% attained by all other non-Asian Index companies.

Water Use and Scarcity

25 companies (96%), valued at $177 billion and with revenues of $105 billion, are categorised as ‘high risk’ including eight producers who provide no disclosure of how they manage water use.

26 meat and dairy companies based in Asia are critically dependent on fresh water sources, yet they scored an average of 2% on managing water scarcity risks in feed supply chains. This is lower than the average of 5% attained by all 50 meat and dairy companies in the Index.

Five meat and dairy companies have set specific time-bound water use targets for their facilities, but the targets aren’t ‘risk differentiated’ i.e. more ambitious in more water-stressed areas.

Water Pollution in Livestock Production

24 companies (92%), valued at $171 billion and with revenues of $99 billion, are categorised as high risk, including seven producers which provide no disclosure on how they manage fertilizer use and manure.

Meat and dairy companies in the Index scored an average of 14% on managing water pollution, in line with the average of 13% attained by all 50 meat and dairy companies in the Index.

4 companies (54%) demonstrate little to no awareness of the need to manage manure sustainably.

Antibiotics

27 companies (96%), valued at $189 billion and with revenues of $132 billion, are categorised as ‘high risk’, including 15 companies (54%) who do not disclose any information on its policy or its commitment to limiting antibiotics use.

24 companies (86%) do not disclose the quantity of antibiotics used.

Asian Index companies scored an average of 8% on their management of antibiotics compared with an average of 50% amongst Index companies headquartered in Europe and Russia.

GFPT is the only Asian company ranked ‘low risk’ after having committed to not using antibiotics in its poultry business.

Animal Welfare

26 companies (93%), valued at $188 billion and with revenues of $131 billion, are categorised as ‘high risk’.

Only one company (GFPT) has its operations by a monitored and audited by a third-party farm assurance programme.

Asian Index companies scored an average of 7% on animal welfare compared to 30% attained by all 60 Index companies.

Five out of seven companies with aquaculture businesses (71%) do not discuss the importance of aquatic animal welfare to the company.

Food Safety

16 companies (57%) have at least some facilities certified by programmes recognised by the Global Food Safety Initiative (GFSI), which indicates compliance with international food safety standards.

Asian Index companies scored an average of 44% on food safety compared to 48% attained by all other non-Asian Index companies.

WH Group is the only company that disclosed recall events in the reporting period and included details of each recall, impact on the consumer, the volume of product, the location and any corrective actions taken.

Protein diversification

Enthusiasm around sustainable proteins is growing, both globally and in Asia specifically. The Good Food Institute (GFI) estimates that sales of plant-based meat in China reached $910 million in 2018, reflecting a year-on-year increase of 14.2%.

There are several drivers behind the growth in the sustainable proteins market in the region, which mirror those in other regions. These dietary shifts are partly due to changes in consumer preferences from greater awareness around animal welfare, environmental impacts and, more importantly, health concerns. The leading cause of death in China is obesity and cardiovascular disease, which have been linked to higher levels of meat consumption.

These market opportunities haven’t gone unnoticed by international players: JUST, a plant-based egg company valued at $1 billion, plans to open a manufacturing facility in Asia. Impossible Foods has stated that China is its top priority for future international expansion, to target the greatest number of meat eating consumers. However, global brands will face some competition: the domestic market for plant-based food already has some established names. Though in the past they have targeted religious establishments such as temples and monasteries, they are repositioning their products and marketing to a wider omnivorous audience.

Company | HQ Location | Description |

|---|---|---|

Right Treat | Hong Kong | Flagship product Omnipork is a plant-based pork product, made from mushroom, pea and rice. It has been widely distributed from hawker stalls to Michelin star restaurants. |

Avant Meats | Hong Kong | Uses cell-based technology to replicate fish and seafood products. |

Good Dot | India | Flagship product is vegan mutton, using soy, wheat and pea protein. Examples of other products include mock chicken, fish and eggs. |

Phuture Foods | Malaysia | Plant-based pork company mimicking the taste and texture of pork using shiitake mushrooms, mung beans and others. |

Qishan Food (Whole Perfect Foods) | China | One of China's largest plant-based meat producers. Partnered with Walmart to create plant-based products for Chinese market. |

Shiok Meats | Singapore | Cell-based meat company growing shrimp in labs using stem cells. Showcased their first cell-based Shiok Shrimp dumpling at The Distribution in Food and Sustainability Summit in Singapore. |

Starfield | China | Venture created from a partnership with Planet Green and Hong Chang Biotechnology to create alternative meat products. Launched plant-based mooncakes, burgers, and hot dogs this year. |

Suzhou Hongchang Foods (Hong Chang Biotchnology) | China | Biotechnology company focused on developing a variety of vegetarian frozen and non-frozen food products. |

Some Asian Index meat and dairy companies show evidence of diversification, signalling awareness of the opportunities present in the alternative protein market.

Five companies (18%) – Charoen Pokphand Foods, China Mengniu Dairy, Inner Mongolia Yili Industrial Group, Vietnam Dairy Products, WH group are present in the alternative protein market.

Chinese dairy company China Mengniu has a plant-based protein beverage business under the brand ZhiPuMoFang, which supplies products to Starbucks. This business line accounts for 1.1% of Mengniu’s total revenue (RMB 356.4 million).

These dietary shifts, coupled with the sheer potential market size in Asia, present a huge opportunity to companies and investors. Companies that diversify their product offering early will have first-mover advantage in this growing market.