Introduction

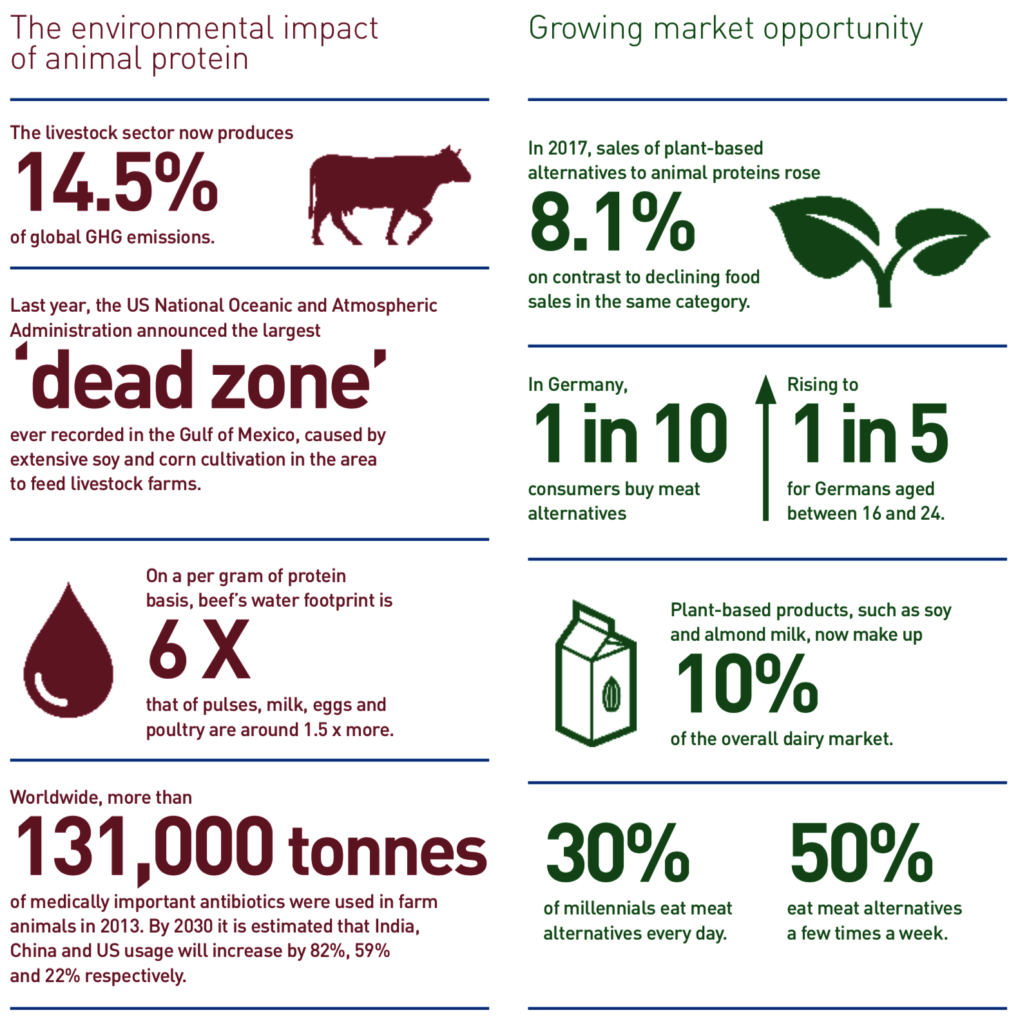

One of the greatest challenges facing the world today is to ensure that the growing population has access to adequate, sustainable and nutritious food. The global food system is under increasing pressure in trying to meet this challenge. This pressure is particularly evident in livestock production, given the sector’s substantial external impacts, its interaction with sustainability megatrends, and a growing global middle class that is demanding more meat.

Conventional (i.e. industrial) livestock production systems have enjoyed uninterrupted growth over the last few decades. While this trend is expected to continue in the short term, resource constraints may dampen expansion in the long term. Furthermore, the sector is increasingly ripe for disruption. The issue of protein diversification is therefore key to managing the risks of climate-affected supply chains and for seizing opportunities for market growth.

We see four key drivers that will shift the food system from its dependence on animal proteins towards alternative protein sources:

growing market opportunity to meet demand for plant-based foods;

accelerated innovation in food technology; increasing awareness of ESG impacts linked to intensive livestock production; and

advocacy and regulation to moderate growth in the animal protein sector.

What are sustainable proteins?

We define sustainable proteins as protein-rich food sources that are:

consistent with nutritional dietary requirements

produced to high environmental and ethical standards

diversified in their sourcing

The most sustainable form of proteins do not involve large- scale livestock or fish production, primarily because of the difficulties of producing animal protein sources that are carbon-neutral, high-welfare, environmentally responsible and efficiently produced. For this reason, our report and investor engagement has a specific focus on alternative proteins, which include plant-based foods and protein sources, fermented proteins and cultured meat. We believe these sources provide the most promising solutions for feeding the world sustainably and nutritiously.

“The development of the protein supply chain is an issue with the potential to radically reshape the supermarket shelf of the future. We very much welcome the support of those investors who want to act today to stay ahead of the curve in the economy of tomorrow.” Duncan Pollard AVP, Stakeholders Engagement in Sustainability, Nestlé

Risks and Opportunities in Protein Production Are Driving a Fundamental Shift Towards Alternative Proteins

The environmental impact of animal protein

“Three of the strongest demand drivers for alternative protein products are essentially those that are ‘pushing’ consumers away from regular animal protein consumption, namely concerns around health, animal welfare and sustainability. That said, there is also a number of ‘pull’ drivers, such as curiosity to try new products, convenience and personal nutrition.” Justin Sherrard Global Strategist – Animal Protein at Rabobank

Innovation in Food Technology Is Driving a New Protein Revolution

We are already seeing innovative new plant-based and alternative protein products and companies appearing across categories. However, we may be on the cusp of a food technology revolution that could accelerate this trend exponentially.

Many companies across the alternative protein spectrum are early stage and yet to commercialise, or are still at low-level production. Yet the speed of their technological development, scale up and cost reduction indicates that mass production and mainstream adoption may be on the horizon in the short to medium term.

Alternative protein technologies

Advanced plant-based

Derived from plant sources and optimised for taste, texture and nutrition through use of either novel plant sources (e.g. mung bean, lupin, algae) or through novel processing methods (e.g. shear-cell technology)

Fermentation

Creation of animal proteins such as casein and whey through a brewing process whereby yeast organisms are programmed to produce the proteins

Cell culture

Growing meat cells (muscle and fat) in a nutrient-rich culture medium to create whole pieces of tissue

Investors Are Seeking to Capitalise on Plant-Based Profits

Protein diversification is increasingly recognised by institutional investors as a relevant ESG theme. It is directly linked to multiple social and environmental issues, and helps investors improve their portfolio performance against the Sustainable Development Goals (SDGs).

Most importantly, it is a way of increasing company competitiveness and financial and operational resilience. In many cases, investors are assessing both the risks associated with the intensive production and consumption of animal proteins, and the opportunities associated with the shift towards alternative sources of protein.

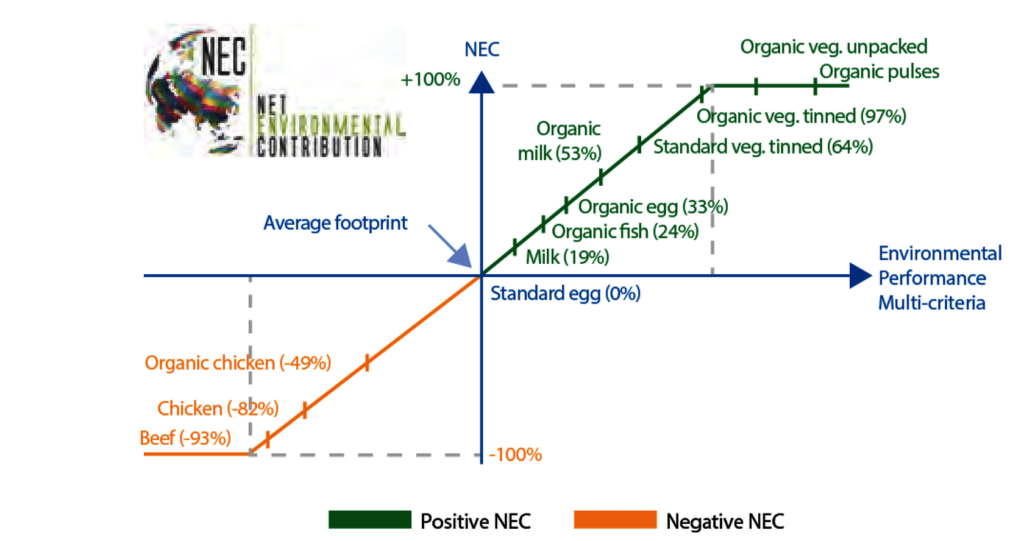

Quantifying ESG risks and opportunities in protein: BNP Paribas and Sycomore AM

In June 2017, BNP Paribas Securities Services partnered with Sycomore Asset Management to accelerate the deployment of the NEC, a new metric for assessing the environmental impact of the economic activities of a company, a portfolio or an index. Developed since 2015 by Sycomore AM, a specialist in responsible investment, and in association with I Care & Consult and Quantis’s experts, the NEC indicator assesses the contribution of a company’s overall activities towards energy and ecological transition, and measures the degree to which a business model is aligned with climate change goals.

The NEC uses a scale ranging from -100%, for activities which are the most harmful to natural capital, to +100%, for the most environmentally-friendly solutions. In the case of the food industry, the NEC indicator classifies different types of food according to their respective environmental impact (climate, water, biodiversity) and the associated nutritional content (proteins, lipids, carbohydrates).

The consolidated result of the three criteria is shown below for common food categories

Position of traditional food products based on their environmental performance (Quantis 2017 and Sycomore AM calculations, sources: FODGES database from ADEME, Global Footprint Network, FAOSTAT database).

Companies are broadening their alternative protein portfolios using three key strategies

Acquisitions

Large food companies have been acquiring plant-based and alternative protein companies to expand their offering of non-meat proteins, as part of a trend towards greater consolidation within the food industry.

Recent acquisitions include:

Danone’s$12.5billion acquisition of White Wave, a global manufacturer of branded plant-based foods and beverages;

Campbell’s Soup’s deal to buy Pacific Foods, maker of shelf-stable, plant-based milk products, for $700 million in 2017;

Pinnacle’s purchase of Gardein for $158 million in late 2014 (after which net sales grew double digits in 2016, even with constrained capacity);

major Canadian meat processor Maple Leaf’s recent acquisition of two plant-based brands: Light life, manufacturer of refrigerated plant-based foods; and Field Roast, a brand of grain-based ‘meat’ and vegan cheese products.

Venture investments

Established players have launched venture capital units to buy into, learn from, and eventually help scale up potentially disruptive start-ups offering innovative alternative protein products.

High-profile venture investments include:

Tyson Ventures’ 5% stake in Beyond Meat, manufacturer of plant-based meat substitutes;

Cargill and Tyson investments in cultured meat startup Memphis Meat;

Kellogg’s$100million investment fund, which led a fundraising round by plant-based smoothies maker Bright Greens and has invested in Kuli Kuli, makers of plant protein products;

General Mills’ establishment of incubator 301 Inc and investment in Beyond Meat and Kite Hill, a plant-based dairy company.

Product development and R&D

Across the food value chain, companies are looking to generate growth through innovation and product development in alternative proteins, both within their legacy brands and by creating new product offerings.

Alternative protein product developments include:

ingredient makers such as ADM developing their range of plant-based ingredients and protein ranges that can be readily used by manufacturers;

Unilever’s collaboration with Givaudan, Ingredion and the University of Wageningen to develop a plant-based steak using innovative ‘shearcell’ technology, which transforms vegetable proteins into a layered, fibrous structure matching the appearance and texture of steak;

retailers, including Kroger, Ralphs, Target, Trader Joe’s, Wegmans and Whole Foods, developing multiple meat replacement products within their own-brand ranges, one of the fastest-growing categories for retailers.

Company Engagement

Investors are engaging with companies either through joining collaborative engagements, like the one being facilitated by FAIRR, or by incorporating the issue into individual company engagement. The purpose is to understand how companies are mitigating and/or capitalising on risks and opportunities linked to protein diversification to ensure long-term value creation for shareholders.

Investor resource – key questions for engagement

How would you rank yourself against your peers and competitors in terms of your company’s ability to meet the increasing demand for plant-based diets?

What percentage of your current own-brand portfolio (by stock keeping units or any other meaningful measure) is reliant (i.e. listed as an ingredient) on animal proteins (poultry, livestock, fish, dairy, eggs)? Have you undertaken a risk/impact assessment on this protein mix? How will this change over the next five years?

Across the company, what percentage of your annual revenues will come from products that align with plant-based diets (including produce and proteins)? How will this change over the next five years?

What percentage of your product development (including R&D) budget across your brands focuses on product concepts that meet plant-based diets?

What are the greatest barriers you face when it comes to developing a global, comprehensive protein diversification strategy?

What external resources will be most useful to help you accelerate the development of a global, comprehensive protein diversification strategy?

Is increasing sustainable protein offerings a priority for your company over the next five years? If so, are efforts driven by consumer demand, competitive pressures, market opportunities, adherence to environmental goals, or another factor?

Using investor influence to encourage companies to diversify protein sources

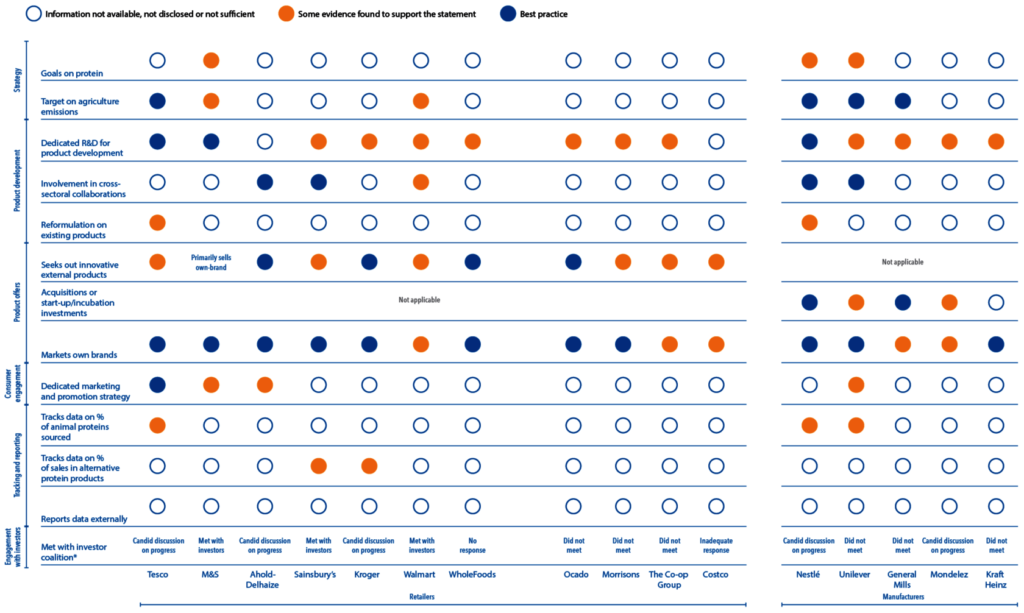

In 2016, FAIRR launched a first of-its-kind collaborative investor engagement to encourage large food manufacturers and retailers to diversify their protein sources. FAIRR’s engagement team identified 16 global food companies – both manufacturers and retailers – based on their exposure to animal protein supply chains and their sensitivity to consumer trends.

The coalition had meetings with 50% of the companies in the engagement. Of the 16 companies, only Whole Foods did not respond to the investor request. Costco and Morrisons acknowledged investor concerns but did not provide an update.

Key findings and implications for investors

Despite agriculture accounting for the majority of value-chain emissions, most companies do not have any meaningful programmes to track, report and reduce supply-chain emissions related to agriculture.

Only six companies – M&S, Tesco, Walmart, General Mills, Nestlé and Unilever – have targets to reduce supply-chain emissions from agriculture. Other companies are heavily exposed to meat and dairy products, but do not discuss the impacts associated with their supply chains.

Companies acknowledge the materiality of protein diversification for their business, but primarily to meet changing consumer demand, rather than as a way to decouple growth from sustainability impacts.

Only Tesco, M&S, Nestlé and Unilever clearly articulate the case for alternative proteins and meat/dairy reduction as being necessary for addressing their impacts as a business.

All companies now offer own-brand products that substitute meat and/or dairy, responding to growing consumer demand for these products.

Several companies referenced dedicated internal resources (R&D), product development, procurement) that focus on developing and/or acquiring plant-based products and ingredients. This is a consequence of growing consumer demand for these products. We believe that companies can scale up research and product development if they also approach diversification from a risk-based perspective.

Companies are struggling to develop coherent messaging and marketing to promote and encourage consumption of alternative protein products.

Retailers in the engagement expressed reluctance to ‘lead’ or ‘create’ consumer demand for shifting diets, rather than simply respond to existing demand.

There is a lack of consensus about the right choice architecture interventions to nudge consumers to buy meat and dairy substitutes.

Very few companies have developed the right metrics to capture and track progress on increasing exposure to alternative protein sources.

Nestlé and Unilever track an enterprise-wide metric on the percentage of their proteins that are derived from animal and plant-based ingredients.

Best Practice: Why Tesco Leads in the Retailer Space

Strong programme to tackle livestock emissions:

Tesco has a comprehensive programme to reduce emissions associated with its livestock supply chains. It has also set a target to reduce agricultural emissions by 15% by 2030.

Acknowledges risk related to protein consumption:

In its letter to investors, Tesco recognises that in addition to sustainability improvements to livestock, plant-based diets will be necessary to meet its supply-chain targets.

Leading consumer demand through innovative product development and marketing:

Tesco presents a best-practice case study for how a retailer can lead consumer demand for alternative proteins and plant-based foods. In January 2018, it introduced 20 ready meals with plant-based options under its Wicked Kitchen brand, developed by its director of plant-based innovation who is a well-known celebrity chef. The marketing of the brand has attracted extensive media coverage, and its labelling is designed to appeal to a wide range of consumers, not just vegans.

Strong engagement with investors:

Tesco representatives met with investors for a candid discussion of its plans and progress on alternative proteins. They responded to all investor questions with detailed answers.

Corporate Actions Supporting Protein Diversification