This Insight piece considers changes in voting patterns and themes in 2023 and what to expect in the 2024 proxy season. Despite the noticeable recent decline in ESG-related voting patterns, partly attributable to the political landscape in the US, proxy season is a key indicator of market trends. Data for this insight was collected from the PRI Collaboration Platform and ICCR Database.

What Is Proxy Season and Why Is It Important?

With the first flowers of spring, thoughts turn to the 2024 Proxy Season as major corporates convene their Annual General Meetings (AGM). Proxy voting has emerged as a highly transparent aspect of stewardship and engagement as shareholders are increasingly focusing on shedding light on ESG-related corporate practices. Shareholders voting rights enable them to put forward proposals at a company’s AGM, and as responsible investing has become more mainstream, proposals that aim to improve company performances on various environmental, social and governance issues have increased. Proxy season provides the opportunity to identify asset managers’/shareholder alignment with companies’ declared sustainability objectives.

What Can Be Expected for the 2024 Proxy Season?

The 2024 proxy season is already underway with Tyson Foods AGM occurring in February. The E&S resolution proposals focused on climate lobbying, deforestation, circular economy, and child labour, however, all failed to gain majority support. These results were expected due to Tyson’s share structure and raises the issue of minority shareholders’ influence, particularly in light of JBS’s proposed public listing of dual class shares in the US, a move that could further diminish minority shareholders' power in one of the largest meat producers in the world. Further, the recent ExxonMobil lawsuit to block Follow This’s, a Dutch activist investor, resolution on improving emission targets and reductions, raises the issue of escalating corporate behaviour towards shareholder proposals. This form of lawsuit may well constitute strategic litigation against public participation (SLAPP) and could influence other companies to act against their shareholders, severely undermining stewardship activities and fiduciary duties.

While corporate structures and potential litigation against shareholders could become a concern this proxy season, UK asset owners are becoming increasingly frustrated with the inconsistency in stewardship activities of their asset managers. One stewardship figure at a UK asset owner analysed its passive mandates and found that it had defeated itself as managers voted in opposite directions. UK asset owners are trying to tackle the issue of misalignment in stewardship policies and some are pulling back voting in house. This has also become a trend among global asset managers as confidence in proxy advisors decreases due to the failure to fully factor systemic risks into voting recommendations, such as the risk of antimicrobial resistance.

Moreover, pre-disclosure of voting intentions is becoming a conventional stewardship tool to provide more transparency on sustainability objectives and policy. Norges Bank Investment Management began pre-disclosing its voting intentions in 2021 and other institutional investors are following. Pre-disclosure can be a strategic escalation technique and an effective signal to the wider market. PGGM has announced that it will be pre-disclosing its voting intentions, while other asset managers, including LGIM, are undertaking it as a form of selective engagement escalation.

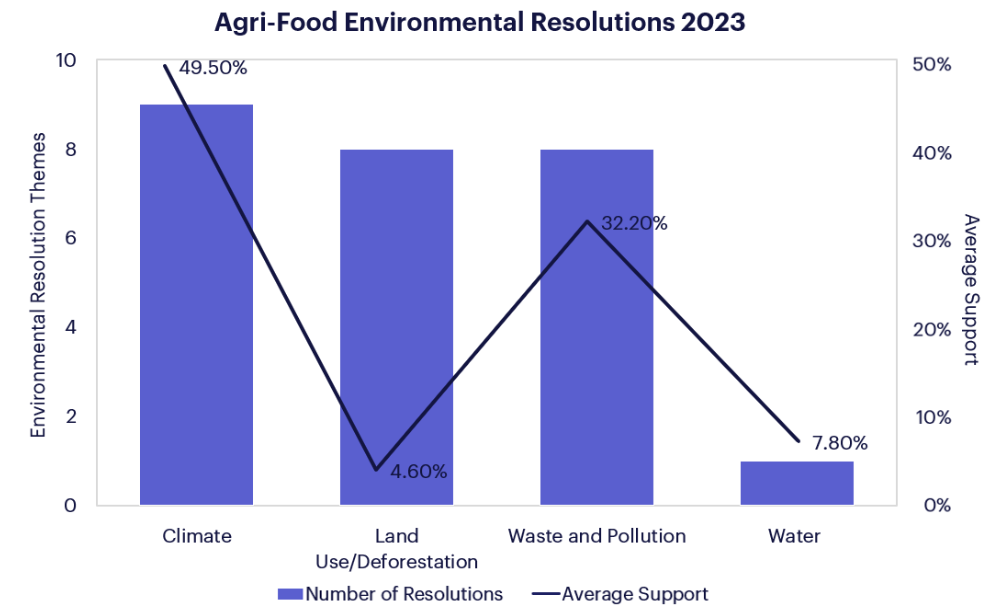

Climate strategies and emission target resolutions have been the most prevalent environmental proposals, while only 38 biodiversity-related proposals have been submitted in the last decade. However, with growing awareness of biodiversity risks and the recent launch of TNFD, it is expected that more resolutions will focus on the impact on nature and biodiversity. Green Century Capital Management has already filed resolutions at agri-food companies to start reporting in line with TNFD recommendations. Water-related proposals are also expected to rise this year with increasing recognition of water risks in Europe and the US. Due to the disproportionate impact on nature and biodiversity from the agri-food sector, and the growing profile of nature-related risks within the investment industry, it can be expected that agri-food companies will see a rise in these types of resolutions.

While the lead up to the 2024 proxy season has already hinted at some of the trends to be seen this year, the 2023 proxy season saw a decline in support of E&S proposals which could continue into this year as well.

2023 Proxy Season Trends: Proposals, Themes and Voting Patterns

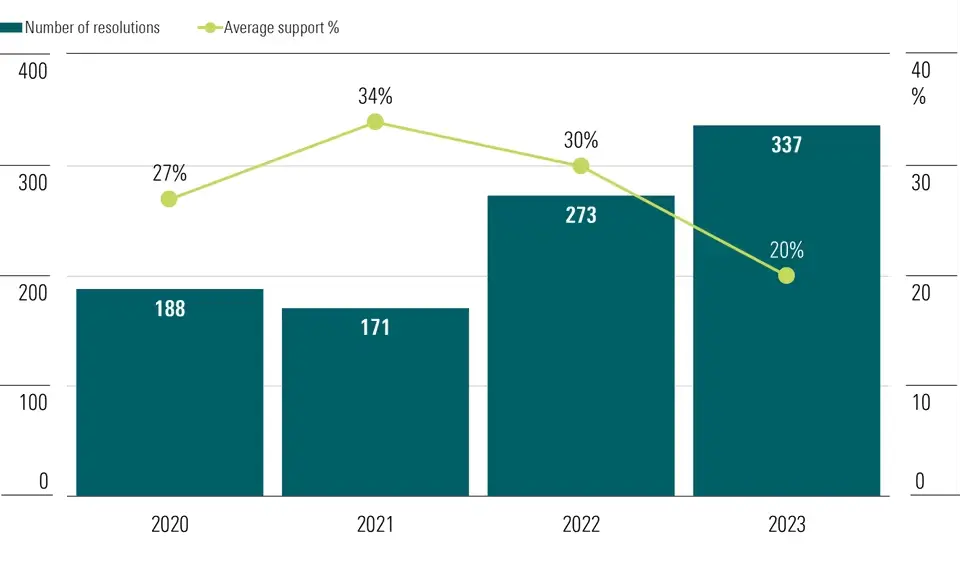

The number of shareholder resolutions proposed at companies has been on the rise over the last three years, and in 2023 there was a global 2% increase in resolutions submitted, the highest since 2016. Within the US, there was a more significant 18% increase in shareholder resolutions. The 2022 proxy season was the first year that over half of resolutions addressed environmental and social (E&S) issues rather than traditional governance themes, and this trend continued in 2023. While there was an overall increase in E&S proposals in 2023, the key themes of such resolutions stayed consistent, with a focus on climate change and diversity-related proposals.

Despite the continued increase in E&S resolutions submitted, the average support for these resolutions in the 2023 proxy season dropped by 10%. When this decrease is analysed, support for resolutions aimed at environmental issues dropped on average from 33% in 2022 to 21% in 2023. Social resolutions experienced a 5% drop year-on-year. Overall, only 3% of all proposals submitted in the 2023 proxy season received majority support, in comparison to 9% in 2022. The resolutions that received most support were requests for reporting and disclosure on climate risk management and lobbying activities, particularly for companies that had not responded to previous engagement.

Source: Morningstar proxy-voting database

Making Sense of These Trends

No action requests are a mechanism which companies use to inform the US Securities and Exchange Commission (SEC) of their intention to omit a shareholder resolution at an AGM. In 2022, the SEC proposed amendments to rule 14a-8 which would limit a company’s ability to exclude a shareholder resolution on the grounds of duplication, resubmission and substantial implementation, thus impacting the success rate of no action requests filed by companies on these grounds. During the 2023 proxy season, the number of no-action requests submitted to the SEC decreased by 28% from the year prior, in part due to the decrease of successful no action requests in 2022. This decrease in submissions can also be attributed to the significant increase in shareholder resolutions proposed at US companies.

Within the US, voting patterns for E&S resolutions dropped markedly among asset managers. On average, only a quarter of sustainability proposals received support from US shareholders, while some of the largest asset managers supported as little as 2% of E&S resolutions. It was reported that the reason behind low support is that many of the resolutions put forward during the 2023 proxy season were too prescriptive, or were redundant as companies had demonstrated appropriate action through disclosure of practices. The decline in support for E&S resolutions could also be attributed to proxy advisors’ recommendations, for example ISS support for E&S resolutions dropped to 52% in 2023.

While voting patterns in the US declined, investors in Europe backed on average 88% of E&S resolutions proposed in 2023. This high percentage of support has increased since 2020, and is attributed to, amongst other factors, legislative requirements in Europe following the recent EU Shareholders Rights Directive II (SRD II). This legislation requires institutional investors and asset owners to annually disclose their engagement policy and how this is being implemented, including their voting behavior, on a ‘comply or explain’ basis. Despite the continued increase from Europe, global support for E&S shareholder resolutions fell due to the difference in the size of assets under management of the United States relative to Europe. Nonetheless, it demonstrates how a strong regulatory environment can impact voting patterns and performances.

Agri-Food Shareholder Resolutions

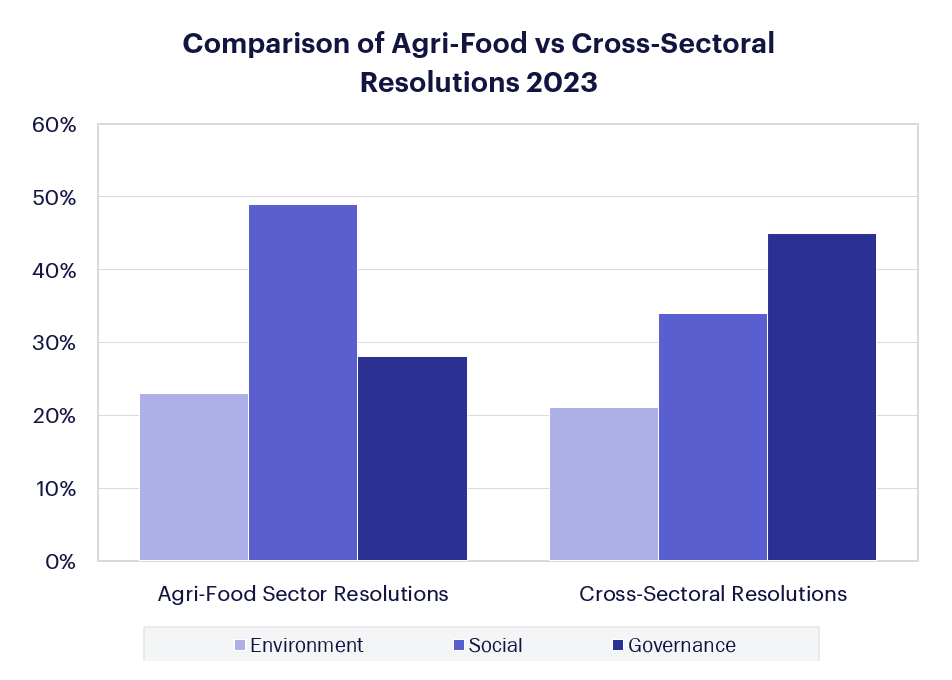

Data from the PRI collaboration platform and ICCR database shows 118 resolutions were submitted at agri-food companies across the supply chain during the 2023 proxy season. E&S resolutions made up 72% of proposals, which is higher than the global, cross-sectoral number of 55% for E&S resolutions. The agri-food sector has disproportional impacts on climate, nature and social goals which is represented through the increased number of E&S resolutions.

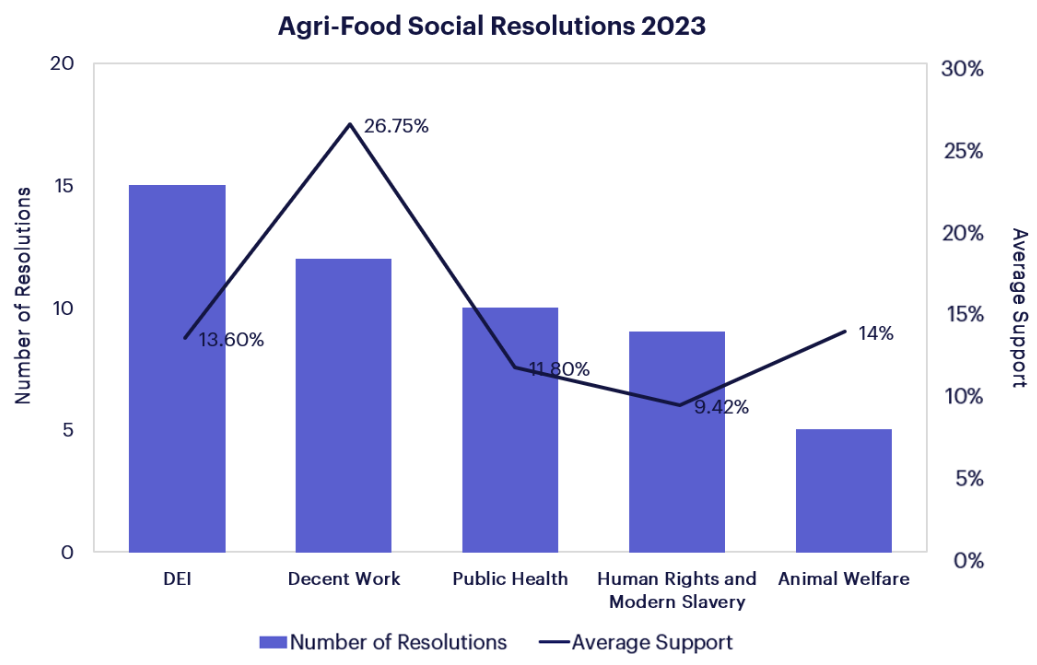

Agri-food E&S resolution themes were similar to other global trends.1 DEI remained the top social theme however themes associated with the food sector, such as public health and animal welfare, were also represented. Social agri-food resolutions received 16.7% of support, consistent with the global trend of 17%. One of the most high-profile resolutions during 2023 was the freedom of association audit proposal at Starbucks which received majority support and could influence social resolution asks and voting performance in 2024.

Environmental resolutions put forward at agri-food companies received higher support than the global average by 10%, which highlights shareholders’ acknowledgement of the food sector’s impact on environment and nature. Of the land use/deforestation proposals, all but one was withdrawn accounting for the low average support, while waste and pollution proposals focused on plastic packaging.

FAIRR Company Universe – Shareholder Resolutions 2023

FAIRR Universe Company | Resolution Ask | Voting Outcome | FAIRR Theme |

|---|---|---|---|

Texas Roadhouse | Report on GHG emission targets | 40.42% | Climate |

Restaurant Brands International Inc. | Report on reduction of plastics | 36.85% | Biodiversity |

YUM! Brands, Inc. | Paid sick leave policy | 20.5% | Social |

Mondolez International, Inc | End child labour in cocoa production | 19.89% | Social |

McDonald’s Corporation | Advisory vote on adoption of antibiotic policy | 16.6% | Antibiotics and Health |

Starbucks Corporation | Report on plant-based milk pricing | 5.3% | Alternative Proteins |

Tyson Foods, Inc. | Comply with expert guidelines on antimicrobial use | 4.59% | Antibiotics and Health |

Hormel Foods Corporation | Report on supply chain deforestation impacts | Withdrawn | Biodiversity |

Source: PRI Collaboration Platform

References:

1The top global themes for E&S resolutions for 2023 were climate change, political lobbying, human rights, DEI and health and safety.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.

Written by

Isobel Rosen

Senior Investor Outreach Analyst

Isobel is a Senior Investor Outreach Analyst at the FAIRR Initiative. She is responsible for strengthening and supporting FAIRR’s global investor network.