Introduction

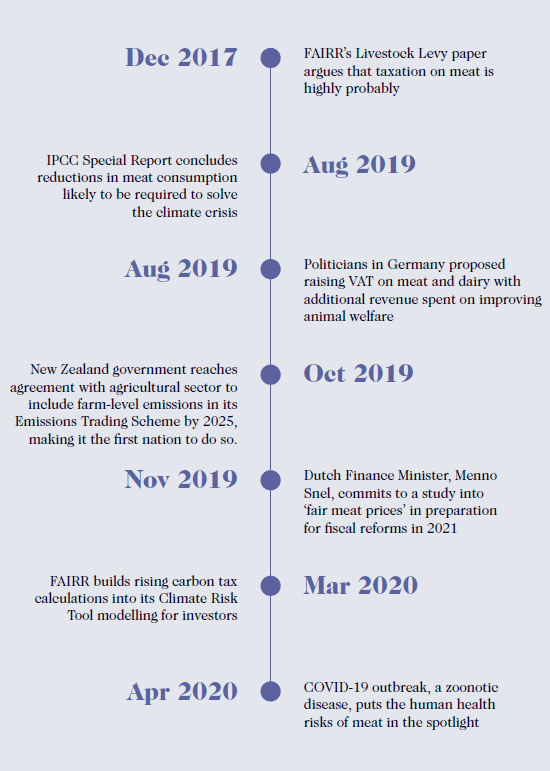

This Progress Report is a follow-up to the December 2017 ‘Livestock Levy’ White Paper and should be read in conjunction with that paper.

Chapter one restates analysis of whether the environmental and social issues associated with the animal protein industry place it on a pathway to behavioural taxation. It does this by offering an overview of how three other commodities - tobacco, carbon and sugar - all came to face similar regulatory tariffs.

Chapter two explores developments in the last few years that have fostered a growing international consensus on the negative environmental and social issues associated with the animal protein industry, with a focus on significant from the UN’s Intergovernmental Panel on Climate Change and University of Oxford.

Chapter three examines how some countries and organisations have discussed the introduction of a tax on meat and considers practical questions and implementation issues.

Chapter four looks at potential next steps for investors and recommends questions that investors could consider on this topic in their active ownership.

Scope of the White Paper

The scope of this paper is to explore the extent to which meat or animal protein might be subject to a ‘behavioural tax’, similar to those placed on tobacco, carbon and sugar.

This paper does not attempt to define what a practical system of meat taxation might look like. Any such discussion of a ‘meat tax’ will include several variables, including, but not limited to:

The types of meat products that might be taxed including beef, pork, chicken, fish, dairy or any combination of those products.

The method of livestock production or management used to produce the meat product. For example, whether products from a cow raised on an ‘organic’ farm should be subject to different taxes to one raised in an intensive ‘factory farm’.

The form of taxation that might best be applied, such as a flat tax, sales tax or another mechanism.

Whether the tax applies on outputs (such as the emissions or the product itself), or on inputs (such as the amount of energy used or on feedstock materials).

The specific social or environmental harm a ‘meat tax’ aims to alleviate, and how the impact of the tax is calculated.

This paper recognises that the methodologies for a meat tax system are likely to be complex and contentious. It does not attempt to define what a successful system might be; rather, it focuses on detailing current proposals being considered to tax animal products.

This paper also recognises that behavioural taxes do not occur in a bubble. They tend to exist as part of a basket of other fiscal incentives and disincentives designed to affect the social behaviour being targeted. In the case of meat, for example, there is a wide range of agricultural subsidies that support the production of animal feedstuffs, such as maize. Research in 2013 found that specific livestock subsidies across all 34 OECD countries amounted to around £35 billion. This paper is aware that the debate on meat taxation exists within this context but does not seek to extend its scope to incorporate this.

Pathways to Taxation

Every government in the world faces challenges when it comes to balancing their budgets, and an increasingly attractive target for revenue creation is a ‘behavioural’ tax, levied on goods deemed unhealthy or damaging to the environment, or both. Over 180 countries impose a tax on tobacco, at least 40 governments worldwide have adopted some kind of price on carbon, and over 40 countries also currently impose taxes on sugar-sweetened beverages.

What is a behavioural tax?

The term ‘behavioural tax’ in this paper is used to define a particular form of state-levied excise tax (i.e. a tariff levied against a specific product rather than a general sales tax for all products). It is a tax that imposes an extra cost on those products or services deemed to have unaccounted costs to wider society in terms of their environmental or social impacts. They are also known as ‘sin taxes’ or in economic terms ‘pigovian taxes’.

Unlike other taxes, the aim of behavioural taxes is not solely to generate revenue for governments. Rather, their prime purpose is to reduce consumption of the commodity in question (by making it more expensive) or to lessen its impact. For example, behavioural taxes on tobacco in Britain make up more than 75% of the total cost to the consumer.

In our original ‘Livestock Levy’ White Paper, we undertook an analysis of the history, pricing, impacts and criticism of the behavioural taxes that have emerged for three different goods: tobacco, carbon and sugar. We found that there was a common series of steps that led to behaviour taxes being imposed on a product, which we call the ‘pathway to taxation’.

The common three-step path that led to a behavioural tax being introduced in the case of these three commodities was:

Step 1 – Consensus: Scientific evidence of negative societal impacts culminating in international consensus, backed by a UN body.

Step 2 – Quantification: A compelling financial public benefit case to justify the imposition of a tax. This usually justifies cost incurred now (tax), to avoid the risks of more severe consequences in the future.

Step 3 – Positive impacts: The emergence of evidence and/or political support that a tax can help lessen the societal/environmental harm being caused.

A snapshot of how these three steps unfolded in the case of tobacco, sugar and carbon, and how similar steps are unfolding in the case of animal protein is shown in the table below:

Steps | Tobacco | Carbon | Sugar | Animal Protein |

|---|---|---|---|---|

Step 1: International consensus on social or environmental impacts | WHO Framework Convention on Tobacco Control (1995) | Establishment of IPCC (1988) | WHO Fiscal Policies for Diet and Prevention of Non-Communicable Diseases (2016) | WHO’s International Agency for Research on Cancer ranks processed meats as Group 1 carcinogens and identified red meat as a probable cause of cancer (2015) IPCC Special Report on Climate Change and Land concludes that reductions in meat consumption and deforestation are likely to be required to solve the climate crisis |

Step 2: Financial public benefit case | US National Cancer Institute/WHO study shows smoking costs global economy more than $1tn annually (2017) | Stern Review suggests investing 1% of GDP to avoid a reduction in global economic output of 5-20% (2006) | WHO Global Burden of Disease report (2012) establishes non-communicable diseases (NCDs) like diabetes as the leading cause of sickness… NCDs calculated to cost $30 tn over 20 years by WEF/Harvard report | Research by Oxford University concludes that a health tax on red and processed meat could save over $40 bn in global healthcare costs (2018) |

Step 3: Emerging evidence of the positive impacts of taxation | WHO data suggests a 10% increase in tobacco prices decreases consumption by 4-5% | The case for whether carbon taxes reduce greenhouse gas emissions is still inconclusive | Harvard research and emerging practical evidence from Mexico both suggest tax reduces consumption and incidences of obesity and diabetes | The case for whether a ‘meat tax’ would result in the desired environmental and health outcomes is unknown |

Step 4: Current state of taxation levels | In 2020, nearly all countries tax tobacco on the grounds of health reasons, and 38 countries have taxes that make up more than 75% of the retail price of a pack of cigarettes | In 2020, a total of 57 carbon pricing initiatives have either been implemented or scheduled for implementation, 11 of those in the last two years. Of the 185 parties that have submitted their Nationally Determined Contributions to the 2015 Paris Agreement, 96 have stated that they plan to use carbon pricing as a tool to meet their commitments | In 2020, at least 40 countries have some form of sugar tax in place, including the UK and Mexico | Proposals for some form of ‘meat tax’ have been discussed in Sweden, Denmark, Germany, New Zealand and the Netherlands |