Market value in billions of dollars of American agriculture commodities in 2012, at the Smithsonian National Museum of American History (March/24)

In the vast landscape of American agriculture, few crops wield as much influence as corn. From fuel to food, its versatility has made it a cornerstone of various sectors, shaping economic strategies and investment decisions alike. However, as climate change accelerates and demand for this commodity surges, understanding the intricacies of its role becomes paramount for investors across the risk/return spectrum, from commodity traders to long-term investors.

Corn, the most valuable commodity in American agriculture (as my picture at the National Museum of American History shows), infiltrates various sectors of the US economy with unique environmental, social, and economic trade-offs. Consider the following figures across its four key usages:

Animal Feed: Over 95% of animal feed in the US comes from corn, which makes up roughly 40% of all corn used domestically.

Fuel: The ethanol industry heavily relies on corn as a primary feedstock, driving demand and influencing market dynamics. 97% of US gasoline contains ethanol, and most ethanol is made from corn starch. Around 45% of all corn is used to produce ethanol.

Exports: The US is a major exporter of corn, selling between 10-20% of total production volume abroad, mainly to Mexico, China, Japan, and Colombia.

Food: Corn is processed to make consumer staples in the US, underscoring its importance for food and beverage products in the American diet. For instance, it is a main ingredient for sweeteners (high fructose corn syrup), flour & cereals, or alcoholic beverages like vodka, bourbon, whiskey, and beer.

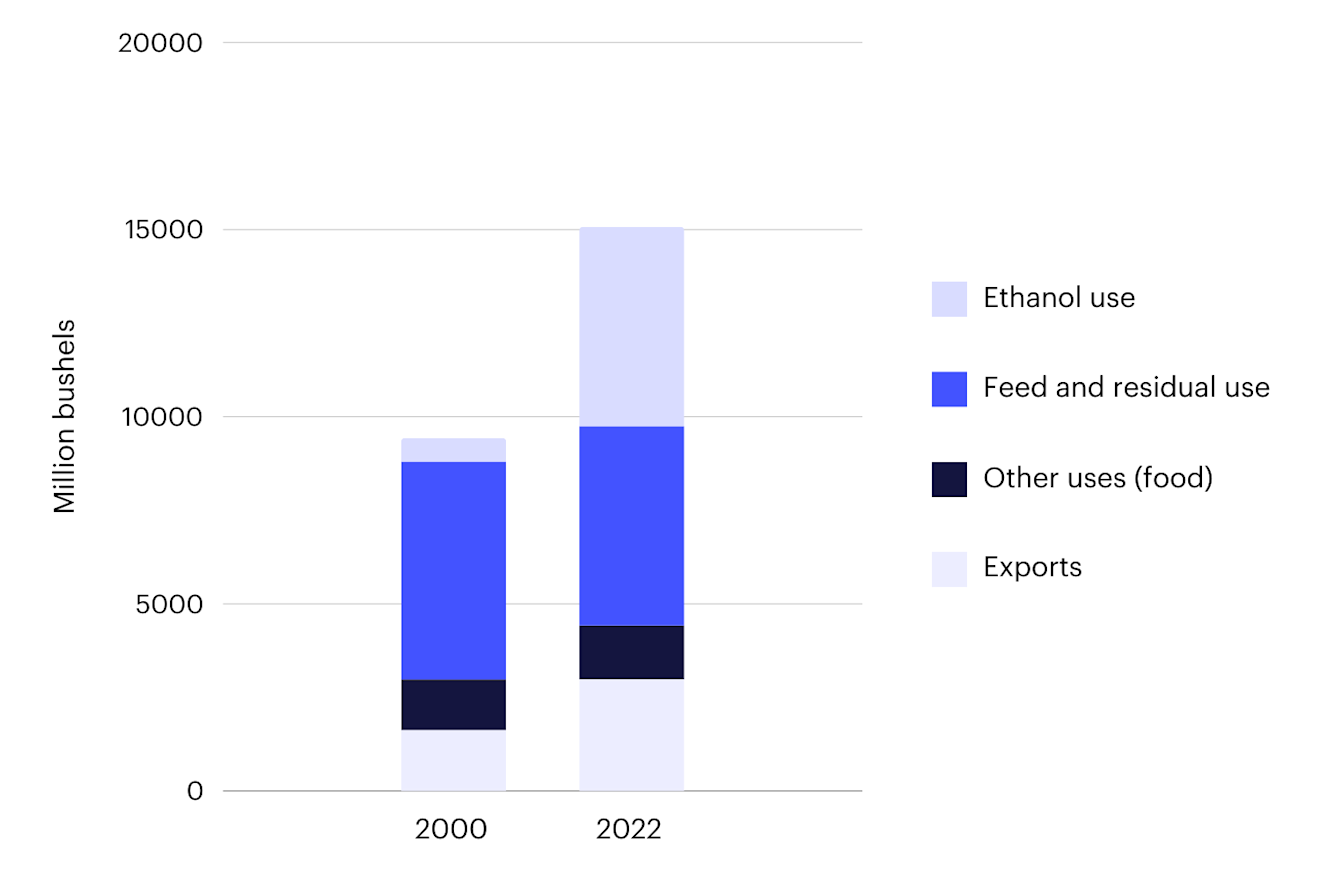

Figure 1: Allocation of corn uses in the US in 2000 and 2022

Source: United States Department of Agriculture, Economic Research Service, Feed Grains Yearbook (ers.usda.gov/data-products/feed-grains-database/feed-grains-yearbook-tables)

Understanding how climate change affects corn and its value chains

In its Net Zero Roadmap, the International Energy Agency (IEA) predicts that the share of biofuels will more than double by 2030, rising from 5% in 2022 to 11%. Over the past few decades, the US has used increased corn production for ethanol. Figure 1 shows that this accounted for 7% of corn usage in 2000, rising to 35% by 2022.

Simultaneously, unsustainable growth has depleted natural resources, with the agriculture sector exerting pressure on planetary boundaries, particularly on four of the six already crossed1. Large-scale corn production relies on agrochemicals and land-use change for monoculture while negatively impacting water tables, biodiversity, and the biosphere systems. Hence, expecting a continued rapid increase in corn supply might be unrealistic.

Let's delve into why the expansion of biofuels could pose challenges and trade-offs for the corn-reliant animal agriculture sector.

Animal protein producers are hooked on corn’s low-costs

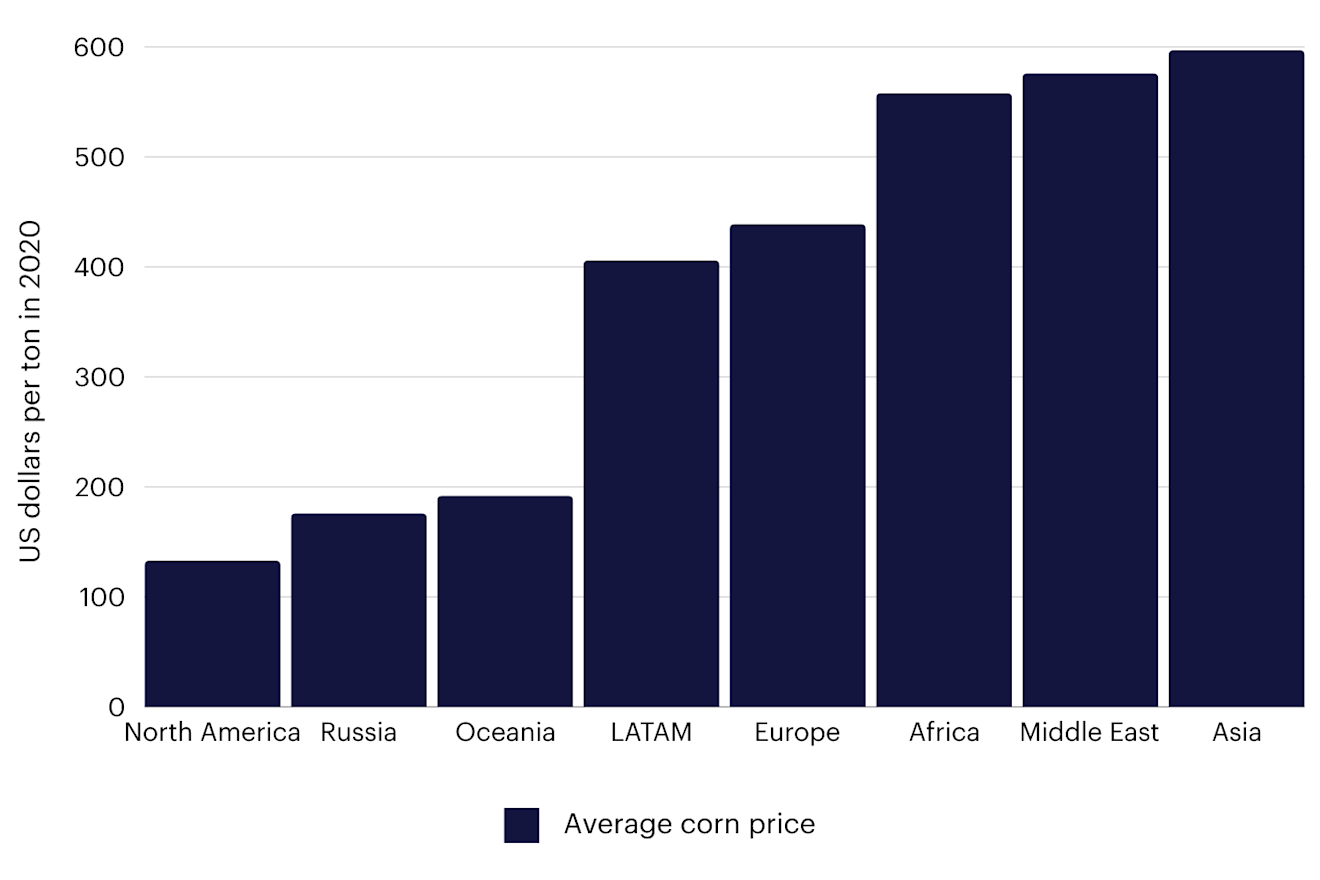

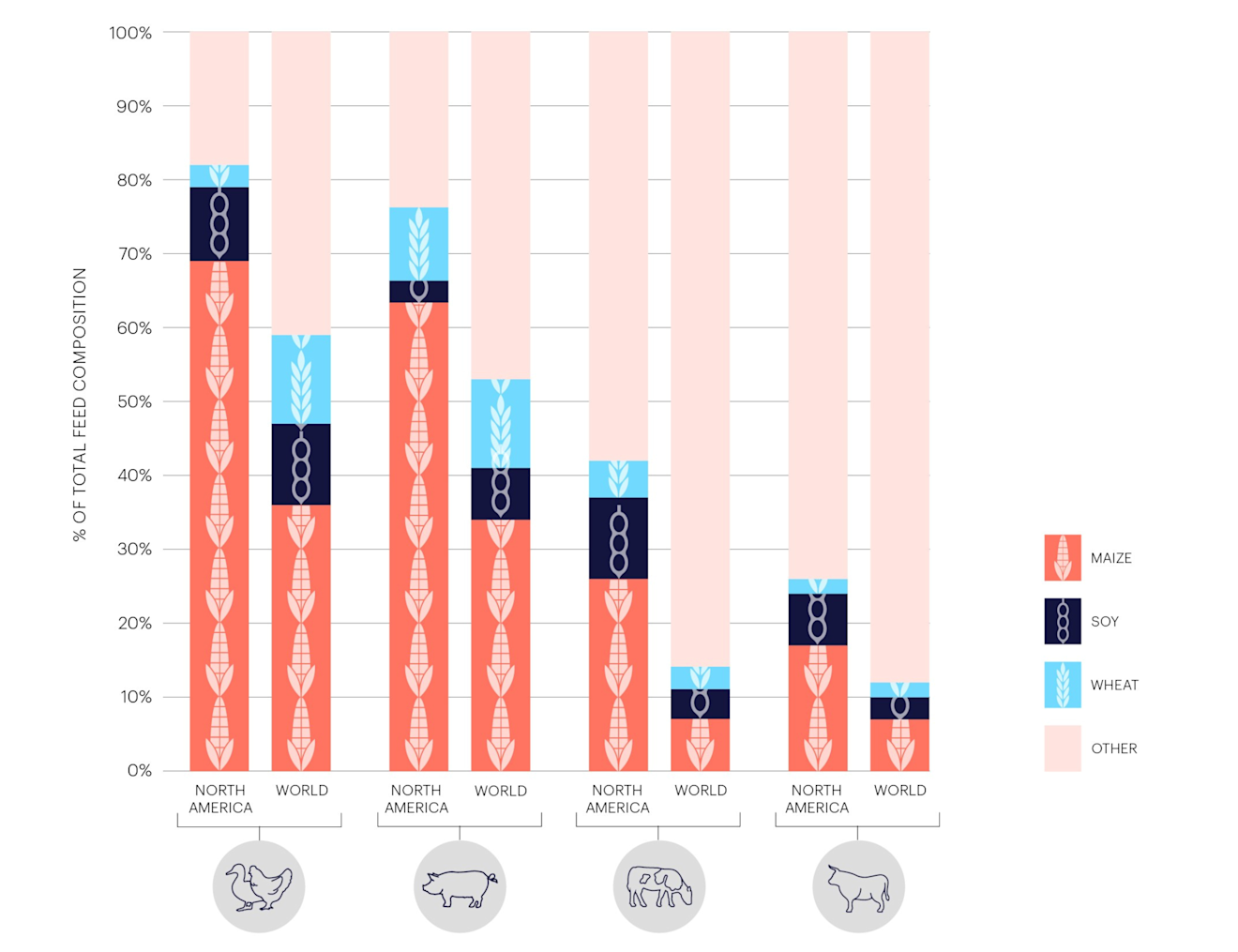

Animal diets depend on the availability of feed and nutritional requirements, which can vary by region. Corn's prevalence in the US has made it crucial for the protein supply chain, as many intensive animal farms rely on it to feed their livestock. Feed constitutes between 60-70% of expenses on average for meat producers, and the price of corn in the US is relatively lower than in other regions of the world (Figure 2), making it an inexpensive cost that boosts the profits of American protein producers. Furthermore, all major livestock species in the US are fed a higher proportion of corn than the global average. The overdependence on corn makes the entire protein supply chain vulnerable, and FAIRR’s estimates suggest that this reliance on corn for feed will persist for the next couple of decades (Figure 3).

Therefore, potentially shifting corn usage from feed to fuel presents significant challenges, prompting a brief discussion of the environmental impacts—climate change, water risk, land availability, and chemical pollution—that limit the increase of corn production and its yields.

Figure 2: Average price of corn by region

Source: Coller FAIRR Climate Risk Tool Model Data, published April 2023, available to FAIRR members here

Figure 3: North American crop dependencies compared with world averages by 2050 in a “high climate impact” scenario

Source: Coller FAIRR Climate Risk Tool Report, published April 2023, available to FAIRR members here

Barriers to increasing corn production and improving yields

Despite its prominence as a feed and fuel source, corn faces significant climate-related headwinds. The Climate Risk Tool finds climate change will result in supply and demand-side shifts, leading to climate-related declines in crop yields in the US and subsequent impacts on price. For example, average feed costs for producers of pork and poultry in North America could rise between 2% and 32% by 2030 and up to 47% by 2050 under a “High Climate Impact” scenario 2.

Water risks make it harder to maintain and expand corn supply in the US. The so-called Corn Belt, referring to the Midwest states, is the primary region for large-scale corn production. The agriculture sector in this area is currently grappling with issues related to water quantity and quality, according to the WRI Water Risk Atlas. Lingering droughts and water scarcity already limit crop yields and could hinder efforts to increase production, imposing a cap on overall output.

Land availability is another barrier to expanding the supply of this commodity. Farmers primarily rely on monocultures to cultivate large-scale crops with significant land use change and biodiversity loss implications. Research found that 75% of all agricultural land used for crops and pasture is allocated to animal production. Additionally, climate change is harming soil health and land quality, leading farmers to search for new land for production. This challenging task also competes with other land use priorities such as urbanisation and nature restoration and conservation efforts (i.e. New EU Nature Restoration Law).

To cultivate monocultures, farmers require substantial agrochemical inputs, such as pesticides and fertilisers, which are significant contributors to climate change and susceptible to supply chain risks. According to the USDA, fertilisers alone account for 36% of a farmer's operating costs for corn. Growers who are heavily dependent on chemical-intensive conventional agriculture have already suffered financial impacts. For instance, Russia, one of the largest producers and exporters of agricultural fertilisers, has experienced geopolitical conflicts that significantly contributed to price increases in fertilisers over the past two years, affecting their affordability and availability. Moreover, using fertilisers poses environmental risks, including eutrophication, soil quality degradation, and greenhouse gas emissions from their production.

Finally, ensuring global food security is of paramount importance, particularly as the impacts of nature and climate change become more pronounced. A climate adaptation strategy involves reallocating the mix of crop production and uses more strategically, with a focus on cultivating human-edible crops rather than animal feed, thereby making more efficient use of natural resources while assuring food security.

Navigating food and agriculture solutions for the “corn-undrum”

Amidst the risks lie opportunities. The current mix in corn usage and its trade-offs can serve as a solution for investors to capitalise on the changing landscape. Here's a non-exhaustive list of opportunities related to corn and animal feed to consider:

Plant-powered protein: if one of the main uses of corn is animal feed to produce protein, why not consider diversifying to other protein sources with a more efficient conversion ratio? Such as alternative protein sources (e.g., tofu, legumes, pulses, meat substitutes, novel proteins). For more information, refer to FAIRR's latest publication on protein diversification.

Animal feed diversification: replacing corn with alternative sources like crop residues, by-products, and surplus human food. Every year in the US, approximately 30-40% of food goes to waste, presenting a circularity opportunity by turning waste into feed. For instance, FAIRR found feed alternatives have the potential to reduce costs and mitigate environmental impacts in the salmon farming industry.

Regenerative production: involves shifting agricultural practices away from conventional methods towards more nature-aligned approaches, with improved water usage, lower carbon footprint, and reduced agrochemical inputs. Explore FAIRR’s report and database on the metrics, best practices, and gaps of this emerging solution.

Better nutrient management: Nutrient circularity (e.g., use of organic wastes as fertiliser) and precision nutrient application can reduce overall agrochemical inputs needed to grow corn. This is especially relevant for animal producers due to the high levels of nitrogen and phosphorus found in manure, as well as the significant amount of manure produced by intensive animal farms. See FAIRR’s engagement approach to address biodiversity risk driven by nutrient pollution in the livestock sector.

Feed optimisation: through animal feed additives that can mitigate carbon emissions of intensive animal farming. Some of these are relatively inexpensive and have achieved progress in terms of readiness and scalability. Despite these additives not necessarily displacing the use of corn in the feed mix, they can optimise feed inputs. See FARR’s report on climate and nature solutions for the livestock sector.

In conclusion, there are numerous opportunities for venture capital and private equity firms, as many startups focus on addressing gaps and finding solutions to reduce reliance on corn and animal protein. For large institutional investors betting on the energy transition through corn-based biofuels while also having exposure to the animal agriculture sector, it is important to thoroughly understand risks and trade-offs to capitalise on the opportunities. Furthermore, publicly traded companies leading the transition to a more sustainable food and agriculture system offer an opportunity for diversified portfolios aiming to preserve long-term value. This transition entails investments in research and development, capital expenditure commitments, and adjustments to business models to remain competitive.

Corn's central role in the US economy and food supply chain emphasises the need to comprehend its dependencies across multiple sectors, vulnerabilities to climate change, and associated investment opportunities. Embracing a holistic approach that prioritises innovation, diversification, and sustainability allows investors to navigate the complexities of the corn market while preserving and enhancing the value of diversified portfolios.

Footnotes

1 The concept of planetary boundaries outlines nine limits that humanity should stay within to ensure sustainable development and prosperity for future generations, as defined by the Stockholm Resilience Centre. Crossing these boundaries increases the risk of causing significant and possibly irreversible environmental changes on a large scale. In 2009, when the first assessment of seven boundaries was conducted, three had already been crossed. By 2015, four boundaries had been exceeded. In the latest revision in 2023, all nine boundaries were assessed, revealing that six had been transgressed. Notably, four of these breaches were driven by the agriculture sector, impacting biosphere integrity, biogeochemical flows, land-system change, and freshwater use.

2 In this climate scenario, the world surpasses 2.0ºC by 2100. The scenario was developed using an integrated assessment model and is consistent with the climate narrative outlined in the Shared Socioeconomic Pathways of SSP5 Fossil-fueled development, as well as the "Too little too late" scenarios proposed by the Network for Greening the Financial System. For more information see Coller FAIRR Climate Risk Tool

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.

Written by

Sofía De La Parra

Senior Investor Outreach Manager

Sofia de la Parra joined FAIRR in March 2021. As Senior Manager, she leads investor outreach across North America and Latin America, with a focus on strengthening collaboration with investor members and growing the network.