Alternative Proteins Regulations

Overview

Public Investment into Food Technology

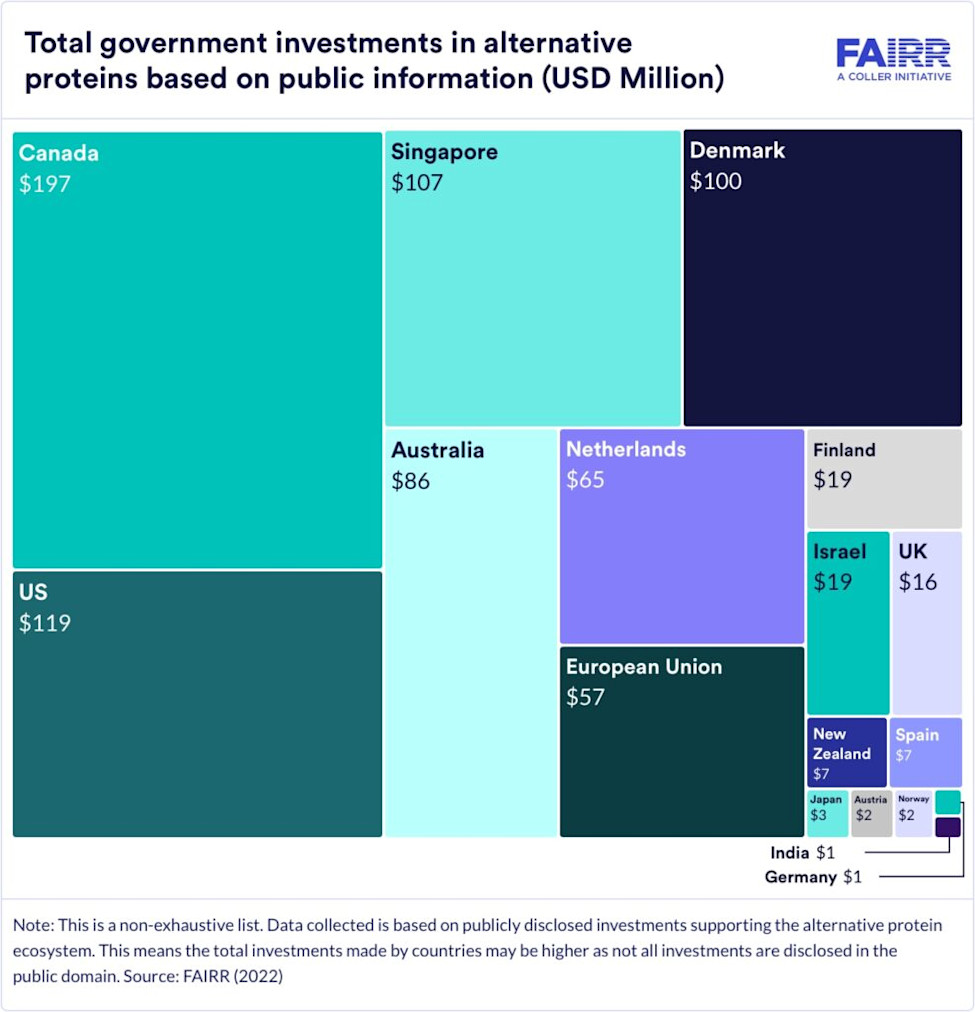

Public investment into alternatives has increased significantly in recent years. Rising consumer demand for alternative proteins helps to mitigate pressing health, environmental, and animal welfare concerns. This has triggered developments in the policy sphere. However, more investment is needed to further accelerate the development of food technology, and government investment will be an essential element to help build investor confidence in the space.

Over the past year, a number of countries have made significant investments in the alternative protein sector. Canada continues to lead the way, with $197 million invested thus far. The US is just behind, with $119 million invested in 2022 alone, mostly for plant-based ingredients in schools.

Investment from governments into alternatives demonstrates a growing interest in dietary mitigation options that tackle both dietary inequalities and the climate impacts of animal protein reliant diets.

Regulation for Cultivated Meat on the Move

Although investment in this area has increased substantially over the past few years, regulatory updates have been much slower to follow, with only Singapore approving cultivated meat for public sale.

In general, cultivated meat regulatory approval falls under the “novel foods” category, which, according to the European Food Safety Authority (EFSA), covers any food that was not consumed “significantly” before 1997.[1] Over the past year, countries have begun to develop clearer regulatory frameworks and application processes for cultivated meat and other alternative proteins, including the US, South Korea and Israel.[2][3][4] Alternative proteins are also increasingly being discussed in the UK, with the UK’s Research Institute (UKRI) releasing an alternative protein roadmap in June 2022, as well as committing to invest £120 million in research across the food system.[5]

Summary of Regulatory Status Update: Cultivated Meat

FAIRR members can view the full data table by downloading the Climate Transition Proteins Report.

Country/Region | Update | Status | Latest regulatory update |

|---|---|---|---|

United States | An executive order in support of biotechnology and biomanufacturing that specifically mentions alternative proteins was signed by President Biden. [6] Both the FDA and USDA have overseen the approval of cultured animal cell foods. Also, there will be a premarket consultation for cultivated foods and naming guidance for plant-based alternatives by the end of 2022.[7] | Open to applications, no approval so far but expected in the medium term. | 2022 |

China | Added to 5-year plan (see Spotlight in Climate Transition Proteins Report). | Open to applications, no approval so far but expected in the medium term. | 2022 |

European Union | The first application for EU authorisation of cultivated meat is expected by the end of 2022, leading to a potential consumer release by winter 2024.[8] The EU already has a Novel Food Regulation framework, through which cultivated meat would need approval. Yet, if the cultivated meat includes genetically modified inputs, then EU GMO legislation also applies.[9] | Open to applications, no approval so far but expected in the medium term. | 2022 |

Germany | A coalition agreement is in place to strengthen sources of alternative proteins, plant-based alternatives and meat replacements.[10] | Early stage. | 2022 |

Japan | Japan has brought together a team of experts to analyse the safety of cultivated meat,[11] a move seen as a precursor to the implementation of a regulatory framework that would allow for the sale of commercial products.[12] | Framework under development. | 2022 |

Netherlands | Private tastings of cultivated meat approved.[13] Cultivated meat and alternative proteins are included in the Dutch National Protein Strategy.[14] | Open to applications, no approval so far but expected in the medium term. | 2022 |

South Korea | The Ministry of Food and Drug Safety (MFDS) aims to establish a regulatory framework for the alternative protein industry by the end of 2022.[15] | Framework under development. | 2022 |

United Kingdom | Cultivated meat has been approved for private tastings since 2013. The UK has committed to developing dedicated guidance materials for approval of new alternative protein products while reviewing existing novel food regulations, so they are transparent for innovators and investors and maintain world-leading consumer safety standards.[16][17] | Framework under development. | 2022 |

Brazil | While steps are being taken to analyse the protein regulatory landscape, no official guidance has been released.[18] | Early stage. | 2021 |

Canada | The process for pre-market approval for novel foods and a public consultation on guidelines for alternative and plant-based proteins was announced.[19][20] The Food and Drug department will be responsible for the approval, and a safety evaluation before the products enter the market will also be required. | Open to applications, no approval so far but expected in the long term. | 2021 |

Qatar | The Qatar Free Zones Authority and the Ministry of Public Health have indicated their intention to grant regulatory approval for cultivated chicken.[21][22][23] | Open to applications, no approval so far but expected in the medium term. | 2021 |

Singapore | The Singapore Food Agency published a robust framework detailing the requirements for the safety assessment of novel foods, with a section dedicated to cultivated meat and seafood.[24][25][26][27] | Open to applications, approval granted to Good Meat. | 2020 |

Australia and New Zealand | The Food Standards Australia New Zealand plans to address cultivated and fermented products within the existing Food Standards Code as a novel food or, if applicable, as a genetically modified food.[28][29] | Open to applications, no approval so far but expected in the long term. | 2018 |

Israel | Israel has a pre-market authorisation process for cultivated and fermented protein and has developed a regulatory framework.[30][31][32] | Open to applications, no approval so far but expected in the medium term. | 2015 |

Labelling Regulations Becoming an Obstacle

The past year has seen alternative proteins rise up the political agenda. Lobbying groups, consumers and policymakers are debating the labelling criteria for alternative proteins, and whether such alternatives can associate themselves with terminology previously reserved for use by conventional animal proteins. Terms like “meaty”, “sausage” and “dairy” are amongst those up for debate, with discussion, criticism and prohibitions across the globe.

Proponents of the backlash against labelling freedoms for plant-based products argue the need to reduce consumer confusion around whether a product is sourced from animals or plants. Government opinion, however, is divided. Studies have questioned whether existing labels are indeed a source of confusion. Six country-specific studies, including US,[33] EU,[34] Netherlands,[35] and Australia, [36] suggest that omitting words traditionally associated with animal products from the names of plant-based products actually causes consumers to be significantly more confused.[37]

Labelling bans are expected to apply to fermented and cultivated products, representing a further obstacle for start-ups and established companies investing in developing and commercialising their product portfolios.

Summary of labelling regulatory updates/bans in affected countries

Non-exhaustive data, the purpose is to showcase some examples of restrictive labelling regulation, correct as of 1 September 2022. To access the full table download the member’s report.

Region | Updated | Status |

|---|---|---|

France | July 2022 | Meat organisations in France tried to push through a ban on ‘meaty’ names; the ban proposal was then adopted by the French government and was initially supposed to come into effect in October 2022. For now, the ban has been suspended by the court.[38] |

Turkey | July 2022 | Vegan cheese producers are facing a government ban on production and sales. This ban goes beyond just the terminology and bans the production and sale of alternative cheese resembling dairy cheese. [39] Alternative cheese products have already been taken off the shelves.[40] |

United States | July 2022 | The sector is awaiting the FDA’s draft guidance on the labelling of plant-based milk, currently being reviewed by the Office of Management and Budget (OMB), on whether restrictions will be applied at the federal level.[41] On the other hand, for meaty terms, many states have attempted to ban these. For example, in Texas, the terms ‘burger’, ‘beef’, ‘chicken’, are banned from use by the plant-based alternatives industry.[42] Some states have overturned a previous ban on plant-based labelling: Louisiana (March 2022)[43] and Mississippi (November 2019).[44] |

South Africa | June 2022 | A recent vote called for ‘sector-specific’ meat terminology to be banned for meat alternatives. Following protests from the plant-based sector, this ban has been placed on hold, and the removal of products from shelves has been postponed until November 2022.[45] Moreover, the egg industry also started an initiative to ban plant-based egg labelling; this egg ban has been successfully implemented and consequently removed products off the shelves.[46] |

Belgium | February 2022 | The country is discussing potential restrictions on meaty terms for labelling alternative products at the government level. The outcome is still pending.[47] |

Australia | January 2022 | No ban in place. Earlier this year, discussions at the policy level were held to potentially ban the use of words like ‘chicken’, ‘meat’, and ‘beef’ from plant-based products. No implementation of this suggestion has yet taken place.[48] |

Spain | November 2021 | Notably, the government rejected proposals to ban labels for vegan and vegetarian products, which were put forward by the far-right party.[49] |

India | October 2021 | The government attempted to ban the use of all dairy terms for plant-based dairy products of products on and offline. An industry-led court order stopped products from being delisted.[50][51] |

EU & UK | June 2017 September 2022 | The court law banned terms like ‘milk’, ‘yoghurt’ and ‘cheese’ for plant-based dairy alternatives (The Tofu Town decision) in 2018.[52] In 2020 and 2021, the European Commission averted two further restrictions on meaty (Amendment 165) and dairy (Amendment 171) terms. The Commission currently has no plans to regulate terms.[53] Nevertheless, a revision of the EU Food information to consumers (FIC) regulation is expected, which could reignite the debate on a potential labelling ban for novel foods.[54] |

Dietary Guidelines and the Paris Agreement

Currently, no country-specific Food Based Dietary Guidelines (FBDGs) provide environmentally sustainable and healthy guidance or are aligned with the Paris Agreement.[55] Research suggests the most efficient approach to reducing the environmental impacts of diets is to reduce the consumption of animal-derived foods, particularly red meat and dairy.[56]

Policymakers around the world need to improve FBDGs to address environmental and health risks related to current diets and to align them to their Nationally Determined Contributions (NDCs) and their legal commitment to the Paris Agreement. [57]

Alternative Protein Frontrunners: Country Analysis

Based on public data collected and assessed, this section outlines the countries that have been identified as best placed to support the national development of the alternative protein sector and are more open to becoming alternative protein hubs. The country analysis is based on the following factors, further detailed in this section.

The Netherlands

To date, the Netherlands has invested $65 million into research and into the cultivated meat sector. It has further supported the development and promotion of cultivated meat and alternative proteins by including them in the Dutch National Protein Strategy,[58] as well as approving cultivated meat for private tastings.[59] In September 2022, in an effort to reduce livestock consumption and GHG emissions, the Dutch city of Haarlem announced it will ban meat advertisements from public spaces from 2024.[60] The Dutch government has also committed to reducing livestock numbers by allocating €25 billion to pay farmers to leave the industry.[61] This suggests a radical shift away from animal agriculture from one of Europe’s largest food exporters.

Denmark

Denmark’s National Dietary Guidance, updated in 2021, recommends a substantial (30%) reduction in the consumption of meat and poultry.[62] In 2022, the country invested $100 million into a new Plant Fund to promote the development of plant-based foods and businesses.[63]

Singapore

In 2020, Singapore was the first country to approve the sale of cultivated meat to consumers, approving Eat Just (Good Meat) chicken bites. The Government has set a target to produce 30% of its own food by 2030, due to worries about national food security. Hence, it invested $107 million in research to enhance food security, including R&D for cultivated and fermented proteins.[64]

Other frontrunners

Canada

Thus far, Canada has invested the most in alternative proteins ($197 million). These investments are dedicated to a range of projects, including setting up a national plant-based protein hub,[65] a pea and canola protein production plant in Winnipeg, [66] and an insect-based protein facility.[67] Canada has also established a pre-market approval process for novel foods. In 2022, the Government announced a public consultation on guidelines for alternative and plant-based proteins. Its 2019 dietary guidelines also recommend a reduction in meat consumption, yet this was not quantified. Despite considerable progress towards alternative proteins, the current ecological footprint of food consumed in Canada—if replicated on a global scale—would require 4.5 Earths (Figure 11).[68]

Israel

In 2022, Israel invested $19 million to create a cultivated meat consortium.[69] It has also provided supportive regulation through a regulatory framework for novel foods and has a pre-market authorisation process for cultivated and fermented protein.[70]

US

The US has invested significantly in plant-based foods, including a $118 million investment by the state of California in 2022.[71] The FDA indicates that by the end of 2022, there will be a pre-market consultation for cultivated foods, as well as naming guidance for plant-based alternatives.[72] Approval for the sale of cultivated meat to the public is also expected in the next couple of years, although this has not been announced officially. However, US dietary guidelines do not support a reduction in meat consumption—if these guidelines were replicated globally, the ecological footprint of US food consumption would require 3.5 Earths.[73] The US has also been the most active county in restricting labelling for plant-based proteins.

References

[1] European Food Safety Authority (2022) Novel food.

[2] The Good Food Institute (2022) The regulatory status of cultivated meat.

[3] Ettinger, D. Li, J. (2022) South Korea promotes alternative proteins in its national plan.

[5] UK Research and Innovation (2022) Alternative proteins: Identifying UK priorities.

[7]US Food and Drug Administration (2022) Foods program guidance under development.

[8] Morrison, O. (2022) EU urged to be at forefront of cultivated meat research and innovation.

[10] Vegconomist (2021) New German coalition government commits to promoting alt-protein products.

[11] Buxton, A. (2022) Japan makes move to assess the safety of cultivated meat.

[12] Shimbun, Y. (2022) Health ministry to check safety of cultured meat.

[13] De Lorenzo, D. (2022) Dutch parliament approves cultured meat tasting in the Netherlands.

[14] Vakblad Voedingsindustrie (2021) The national protein strategy.

[15] Ettinger, D. Li, J. (2022) South Korea promotes alternative proteins in its national plan.

[17] UK Government (2022) Government food strategy.

[18] The Good Food Institute Asia Pacific (2022) Novel food regulations around the world.

[19] CISION (2018) Protein industries Canada supercluster kicks into high gear.

[20] Derbes, E. (2021) Cultivated meat is gaining momentum – and pathways for regulatory approval.

[21] de Leon, R. (2021) Plant-based food company Eat Just nabs $200 million investment.

[23] EfeedLink (2021) Possibility of Qatar becoming next country to allow sale of cell-based meat.

[24] Agency for Science, Technology and Research (2021) Agritech and aquaculture.

[26] Singapore Food Agency (2020) Requirements for the safety assessment of novel foods.

[27] Vegconomist (2020) Singapore emerges as the ‘food tech ecosystem’ of Asia.

[28] Food Standards Australia New Zealand (2021) Cell based meat.

[29] Derbes, E. (2021) Cultivated meat is gaining momentum – and pathways for regulatory approval.

[30] Oren, A. (2021) Israel is forging a path for alt protein innovation and growth. Here’s how.

[31] The Regulatory Institute (2020) Cultured meat: how to regulate alternatives to farmed meat.

[32] Nutraceutical Business Review (2020) Israel Prime Minister endorses cultivated meat.

[37] Gleckel, J. (2020) Are consumers really confused by plant-based food labels? An empirical study. [38] Coyne, A (2022) France ban on meaty names for plant-based food suspended by court.

[39] Vegconomist (2022) Plant-based cheese production and sales facing unprecedented ban in Turkey.

[47] Rixon, P. Berthold, R. Armour, S. (2022) Belgium: don’t ban veggie chicken pieces!

[53] Wojciechowski, J. (2022) Answer given by Mr Wojciechowski.

[54] European Commission (2022) Food information to consumers – legislation.

[56] Ibid.

[57] Klerk, E. (2021) The global food system: identifying sustainable solutions.

[58] Vakblad Voedingsindustrie (2021) The national protein strategy.

[59] De Lorenzo, D. (2022) Dutch parliament approves cultured meat tasting in the Netherlands.

[64] Agency for Science, Technology and Research (2021) Agritech and aquaculture.

[65] Cision (2018) Protein industries canada supercluster kicks into high gear.

[67] Kerwin, N. (2022) Canadian government invests $8.5 million in insect production.

[68] Klerk, E. (2021) The global food system: identifying sustainable solutions.

[70] The Regulatory Institute (2020) Cultured meat: how to regulate alternatives to farmed meat.

[72] U.S. Food and Drug Administration (2022) Foods program guidance under development.

[73] Klerk, E. (2021) The global food system: identifying sustainable solutions.