Coller FAIRR Climate Risk Tool

Overview

The gap we are filling

Investors have a crucial role to play in the transition towards a more sustainable future. While there has been a significant focus on assessing climate risks and opportunities within the energy sector, a knowledge gap exists when it comes to the agriculture sector. This blind spot could pose material impacts to investors exposed to this sector.

Our approach to filling the gap

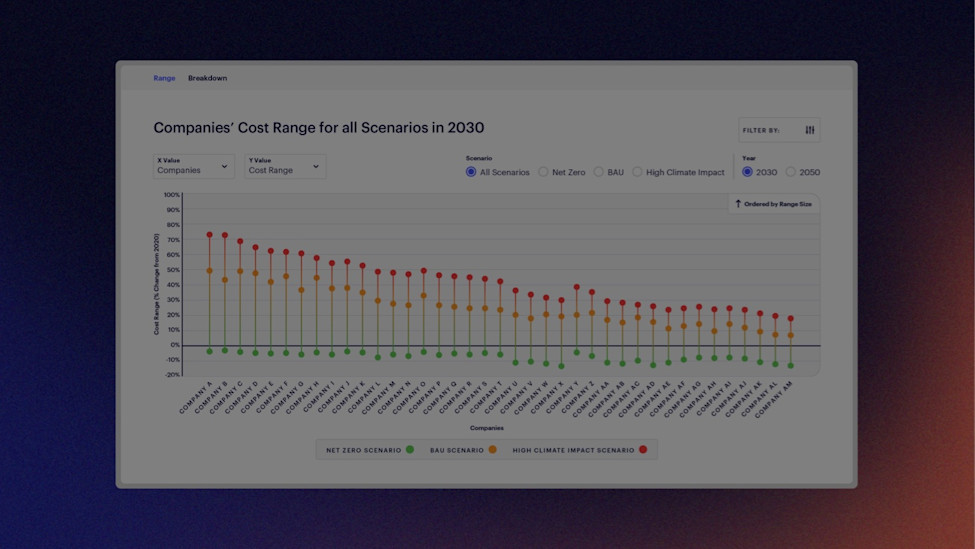

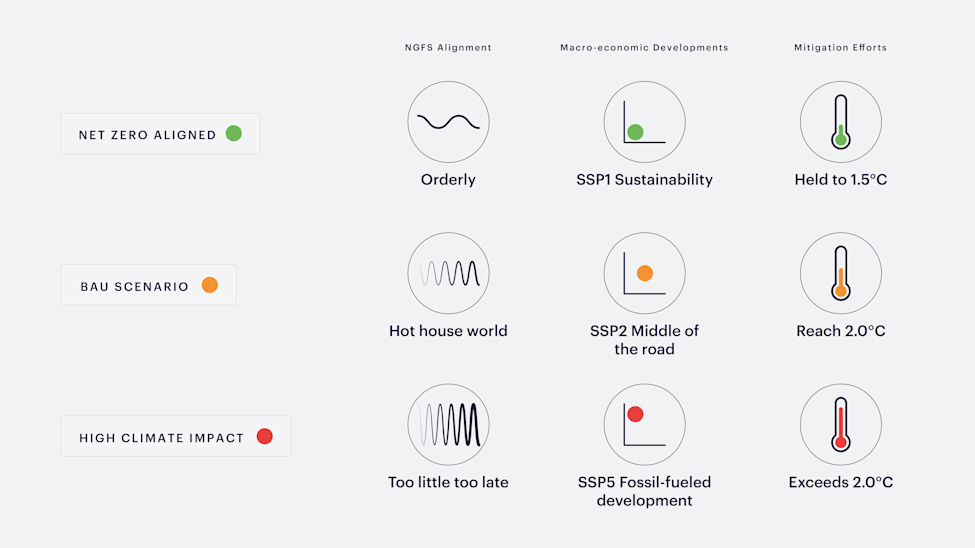

Introducing the Coller FAIRR Climate Risk Tool - the only climate risk analysis tool that quantifies the materiality of risks and opportunities of the largest livestock producers. Working with three distinct climate scenarios based on IPCC and NGFS - High Climate Impact, Business as Usual, and Net Zero Aligned – the Tool illustrates how each scenario could impact the cost and profitability of each of the 40 meat and dairy companies. The underlying model focuses on three material climate-related costs - carbon tax, feed costs and heat stress – and provides investors with a critical lens to assess how these costs may affect them in the future. By leveraging the tool, investors can make informed decisions to better identify climate-related risks and opportunities in their investment portfolios.

What makes it unique

The tool is the first ever to simulate macro-level climate risk implications for the livestock sector and quantifies the financial impact at the company level. The underlying model is set apart by the high level of expertise behind its development. It was built in partnership with International Institute for Applied Systems Analysis (IIASA), a leading institution for climate-related scenario analysis, to ensure the accuracy and reliability of scenarios projected. Built with investors in mind, rounds of consultation with a technical advisory committee consisting of investors and academics were held during the development phase. Feedback and insights are taken into account to ensure the tool meets the needs of the investment community.