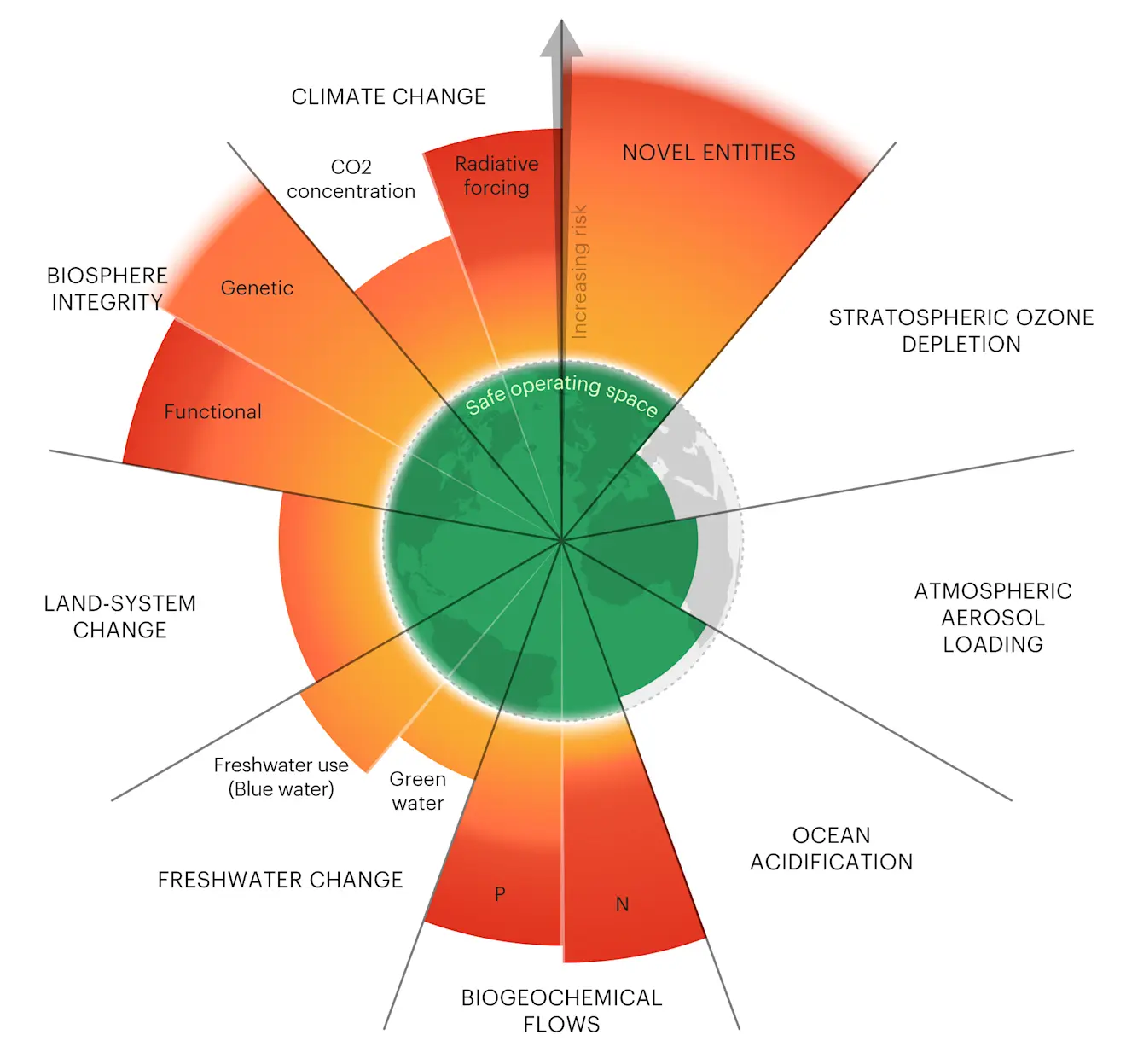

In September 2023, the Stockholm Resilience Centre updated its planetary boundaries framework, which tracks the level of anthropogenic activities impacting the processes that regulate the resilience and stability of the Earth’s system. Findings showed that six of the nine boundaries have now crossed a safe operating space (Figure 1). If no action is taken, this could lead to irreversible damage to our planet.

Figure 1: Safe operating space crossed for six out of the nine planetary boundaries

Source: Planetary Boundaries (2023)

Intensive livestock production is pushing the planetary limits

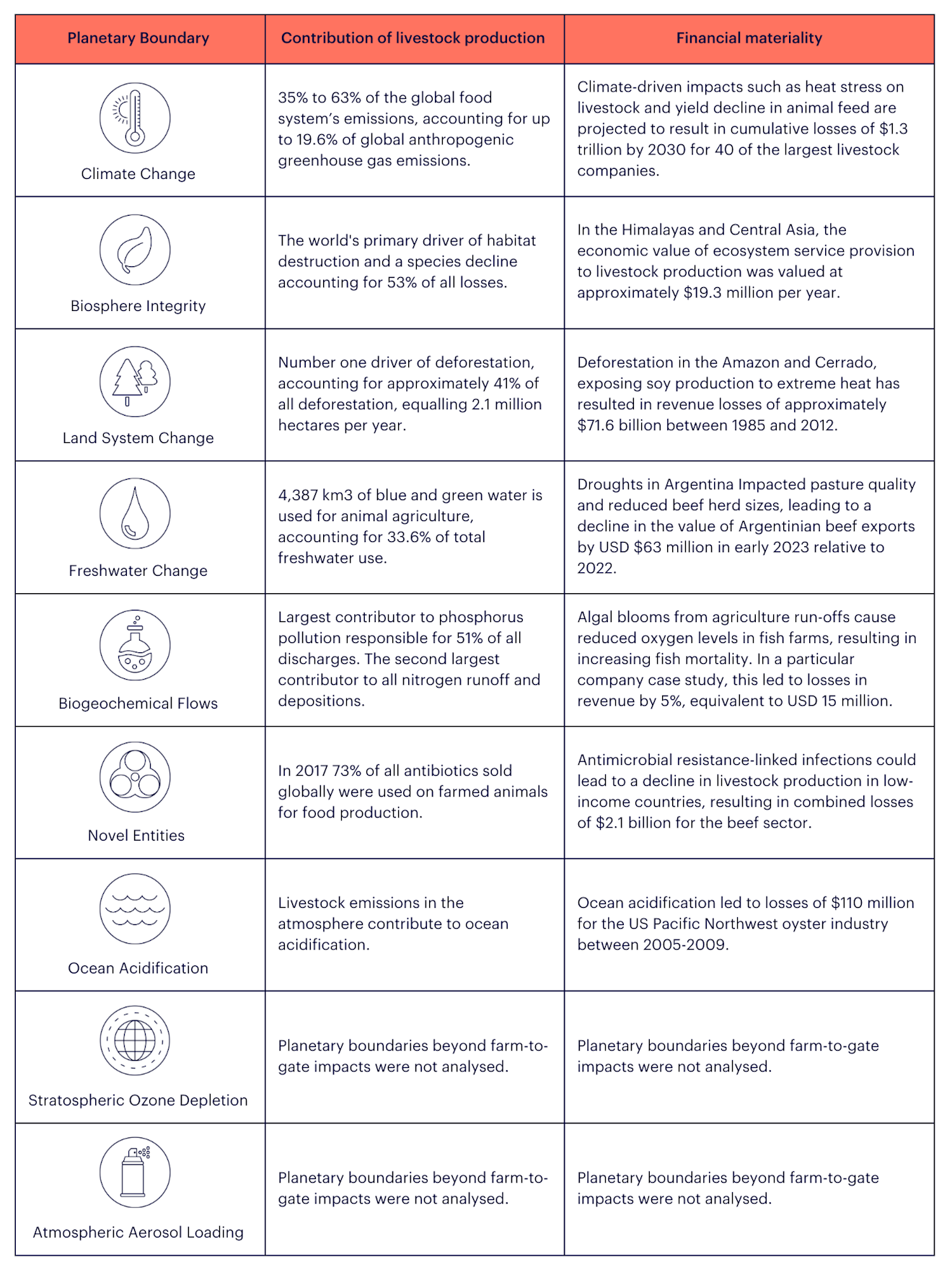

Livestock production significantly contributes to breaching the safe operating space of the planetary boundaries (Table 1). Most of these impacts occur upstream in the production process until the farm gate, driven by the rearing and management of animals, animal feed production, and agrochemical inputs. Climate change is primarily driven by methane emissions from enteric fermentation from cattle ruminants. However, nitrous oxide and carbon dioxide from animal feed production, manure management and land use change are also key contributors. For nature, land-use change from pasture expansion and animal feed production drive deforestation and impact biodiversity. Moreover, nutrient run-off from fertiliser application in animal feed production leads to algal blooms in water bodies, disrupting surrounding ecosystems. Finally, the use of harmful pesticides and medically important antibiotics during livestock production leach into soils and plants, deteriorating natural habitats.

Table 1: Livestock production contributes to the planetary boundaries and impacts financial materiality

Source: Full set of references and additional details, available in the FAIRR Climate Nature Nexus report (2024)

Livestock industry in a race to stay within bounds

International frameworks and commitments are pushing companies, governments, and investors to transform their operations to bring the planetary boundaries back within a safe operating space. Commitments like the Paris Agreement and the Science-based Target Initiative (SBTi) Forest, Land and Agriculture (FLAG) guidance include targets to reduce emissions by no later than 2050. For nature, commitments to reduce impacts are much sooner, with the Global Biodiversity Framework (GBF) and the Science-based Target for Nature (SBTN) having timeframes ranging from 2025 to 2030.

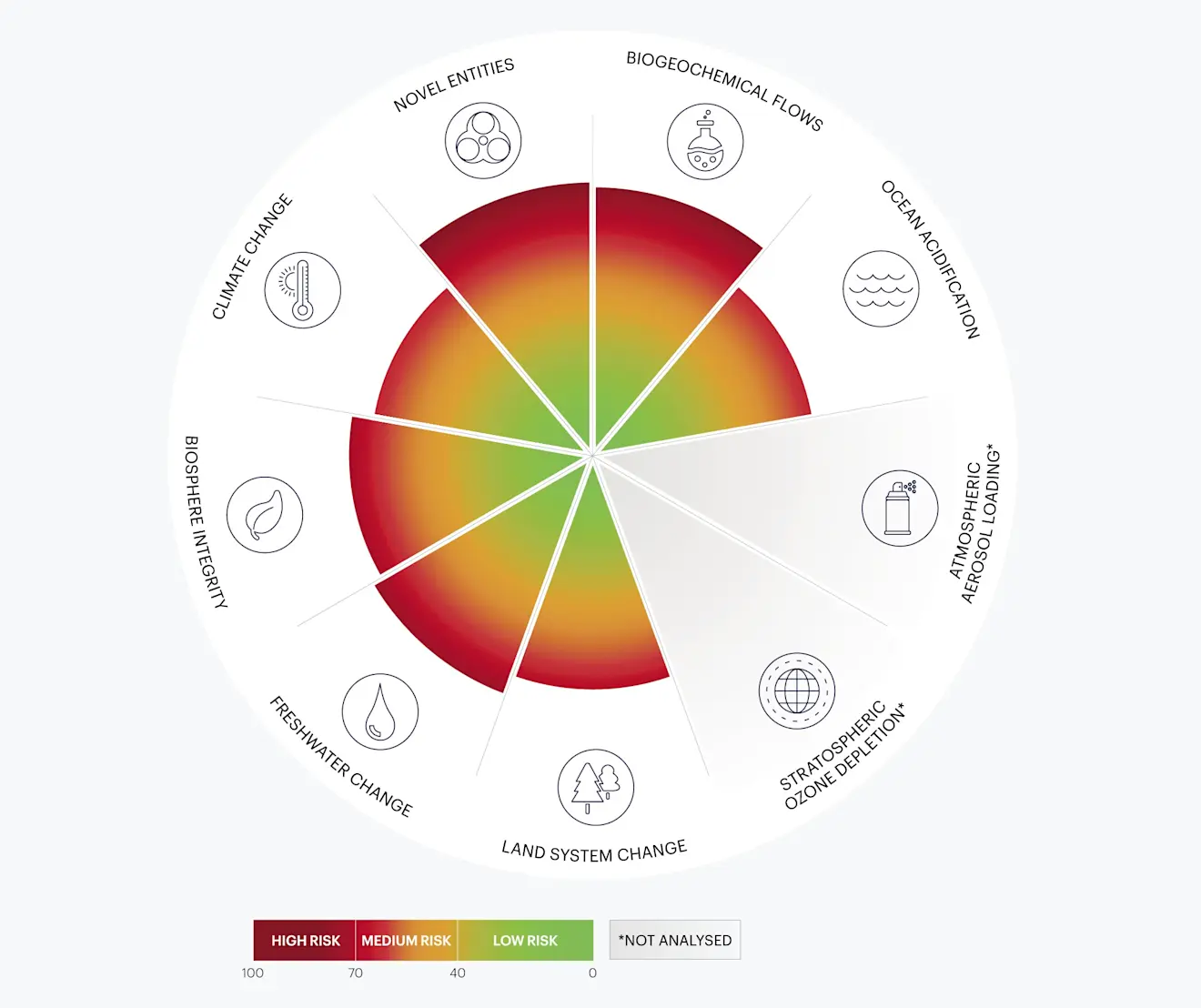

Despite these looming targets, animal protein producers remain at high risk in reducing their nature-related impacts and at medium risk in addressing climate (Figure 2). With the livestock sector vulnerable to the negative feedback loops of exceeding the planetary boundaries, inaction to bring the boundaries back within a safe operating space is a financial risk for the companies and investors who produce animal protein (Table 1).

Figure 2: Mapping sustainability risks of livestock companies against the planetary boundaries

Source: Coller FAIRR Protein Producer Index (2023) and Planetary Boundaries (2023)

Note: The performance of livestock companies was estimated by mapping the relevant risk factors from the Coller FAIRR Protein Producer Index against corresponding planetary boundaries. The FAIRR Climate Nature Nexus report (2024) provides additional details on the mapping.

Solutions can pave the way towards a net-zero and nature-positive future

Implementing solutions that sequester and reduce emissions is essential for the agriculture sector to reach net zero. Moreover, with the urgent need to meet nature-related targets, investors with exposure to livestock companies will need to include nature in their sustainability plans. Therefore, climate and nature-based solutions will be an integral part of net-zero and nature-positive transition roadmaps. With the majority of the livestock sectors' climate and nature impacts occurring at the farm level, implementing solutions on-farm can mitigate risks and support meeting international commitments and targets.

Prioritising and selecting solutions to invest in requires a clear understanding of the climate mitigation potential, benefits for nature, impact on farmer livelihoods, costs, and feasibility of each solution. To create a basis for comparability, FAIRR, in its recently published “Tackling the Climate-Nature Nexus” report, has developed a framework that illustrates the benefits and trade-offs of different climate and nature-based solutions.

The findings from this framework illustrate that nature-based solutions that leverage the earth’s natural capital have the most potential to address both climate and nature impacts. Moreover, nature-based solutions can sequester carbon, unlike non-nature-based solutions. Given the interconnection between climate and nature impacts, nature-based solutions represent a massive opportunity for the livestock sector to reduce its contribution to exceeding the planetary boundaries. Despite this, investment in nature-based solutions remains low, with nature-negative activities receiving 3-7 times more funding. The United Nations Environment Programme (UNEP) has stated that annual investment in nature-based solutions must increase by 268.5% by 2050 (2022 baseline), equaling $737 billion. 33% of these investments must be directed at solutions that will be implemented at the farm level.

Bridging the investment gap in climate and nature-based solutions

To close the investment gap for climate and nature-based solutions, public and private investors will need to mobilise capital to tackle the environmental impacts of livestock production. Institutional investors can help in the uptake of solutions through engagement and stewardship activities with their portfolio companies. On the other hand, private equity can directly fund promising solutions and/or solution providers, whereas fixed-income investors can help in the use of proceeds through green bonds or sustainability-linked loans to incentivise the adoption of climate and nature-based solutions. There are also recent developments in real asset investments that capitalise on solutions through better land management.

Reducing livestock production's contribution to exceeding planetary boundaries will require a coordinated effort from solution providers, companies, investors, policymakers, and other non-governmental stakeholders. As shareholders and debtholders, investors play a key role in helping to reform current production systems to protect and ensure long-term value creation. Figure 3 summarises a few ways investors can address climate and nature-related impacts.

Figure 3: Role of investors in addressing climate and nature-related risks

Source: FAIRR Climate Nature Nexus report (2024)

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.

Written by

Senior Analyst