The headlines of the past 18 to 24 months paint a worrying picture of sustainability sentiment among investors, companies and policymakers.

From initiative withdrawals to reduced public support for diversity, equity and inclusion programmes, reversals in climate commitments and mandate restrictions on asset managers, public appetite for sustainability has tempered significantly in some quarters.

Recent flow data also reflects that, with sustainability-focused funds experiencing their worst quarter on record over the first three months of 2025, registering US$8.6 billion in net outflows, according to Morningstar.

But assets under management in these funds have remained steady, at US$3.2 trillion as of 31 March, and crucially, investors continue to signal their consideration of financially material sustainability factors, as recent proxy voting trends show.

Proxy voting is a core shareholder duty, and early signs from this year’s proxy season show that agri-food investors are not shying away from exercising this duty, particularly around environmental and social (E&S) issues.

This Insight looks beyond the headlines to analyse this activity and some of the trends that defined the 2024 proxy season, while outlining why these matter amid broader challenges to fiduciary duty and shareholder rights.

2025 shareholder resolutions in the agri-food sector

The agri-food sector consistently sees more shareholder resolutions focused on E&S issues than other industries, highlighting growing investor awareness of the sector’s material risks, including climate change, biodiversity loss, and labour rights.

Mondelez International has faced two high-profile shareholder proposals this proxy season focusing on human rights issues.

Both resolutions asked for a human rights assessment, one focused on the company’s approach to migrant workers in its supply chains, the other on operations in conflict-affected and high-risk regions, including Russia and Ukraine.

Mondelez filed a no-action request with the SEC to exclude the latter proposal, citing the 5% economic relevance threshold, which the US regulator denied. A similar resolution regarding the company’s human rights policies in Russia and Ukraine garnered 30% shareholder support last year.

Biodiversity and nature risks are a growing theme in this year’s filings. A group of investors, led by BNP Paribas, submitted a resolution at McDonald’s Corporation, asking it to assess and disclose the risks that nature loss could pose to its key commodity supply chains. The proposal was withdrawn prior to the AGM following an agreement with the company.

Concerns about ocean biodiversity have also made it onto the ballot and are expected to gain additional traction as investor awareness of the associated portfolio risks increases.

Two shareholder resolutions were filed at Coles and Woolworths focused on the nature risks related to salmon farming, in particular on biodiversity loss, as sustainable trading platform SIX Exchange highlights. Sustainable aquaculture has been the focus of a FAIRR investor engagement since 2020.

A similar resolution in 2024 received approximately 30% support from shareholders.

As the 2025 proxy season continues, these shareholder resolutions highlight the evolving expectations of investors in the agri-food sector, which continue to place environmental and human rights issues at the forefront, bucking the broader picture painted by recent headlines.

2024 E&S issues and trends in the agri-food sector

Data from the PRI Collaboration Platform reveals that 134 shareholder resolutions were filed at agri-food companies across the supply chain in 2024, some of which are shown in Figures 1 and 2.

Notably, 87% of these focused on E&S issues – well above the 60% average observed across other sectors.

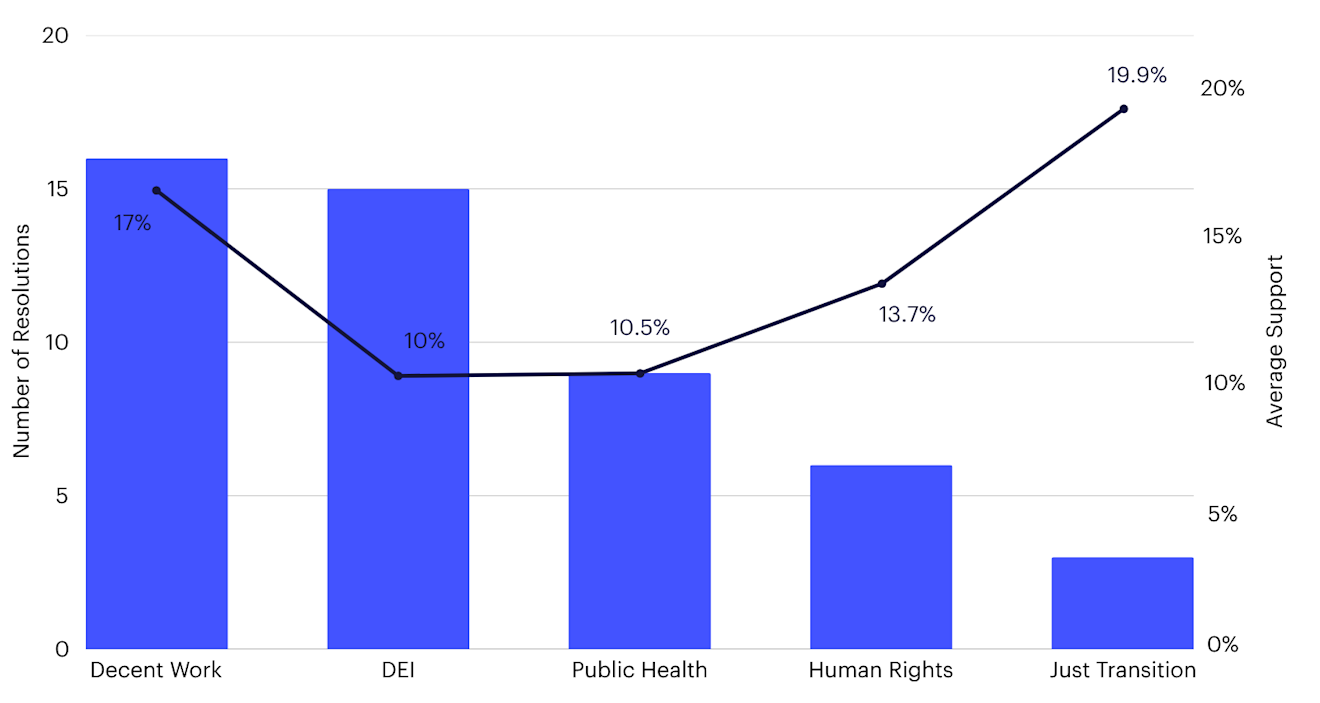

Resolutions addressing social risks gained an average of 17.4% shareholder support, outperforming the cross-sector average of 14%. Decent work was the leading theme of these proposals, followed by diversity, equity and inclusion and public health.

The highest-supported social resolution was a proposal on freedom of association at Amazon, which garnered 31.2% of shareholder votes. This follows a similarly high-profile and widely supported resolution on the same issue at Starbucks in 2023.

Three resolutions focused on the emerging theme of just transition. These received the highest average support among social issues, indicating that investors increasingly recognise social equity as a critical component of a successful climate transition.

Figure 1: Agri-Food Social Resolutions 2024

Source: PRI Collaboration Platform. Retrieved 31 March 2025, from https://collaborate.unpri.org/

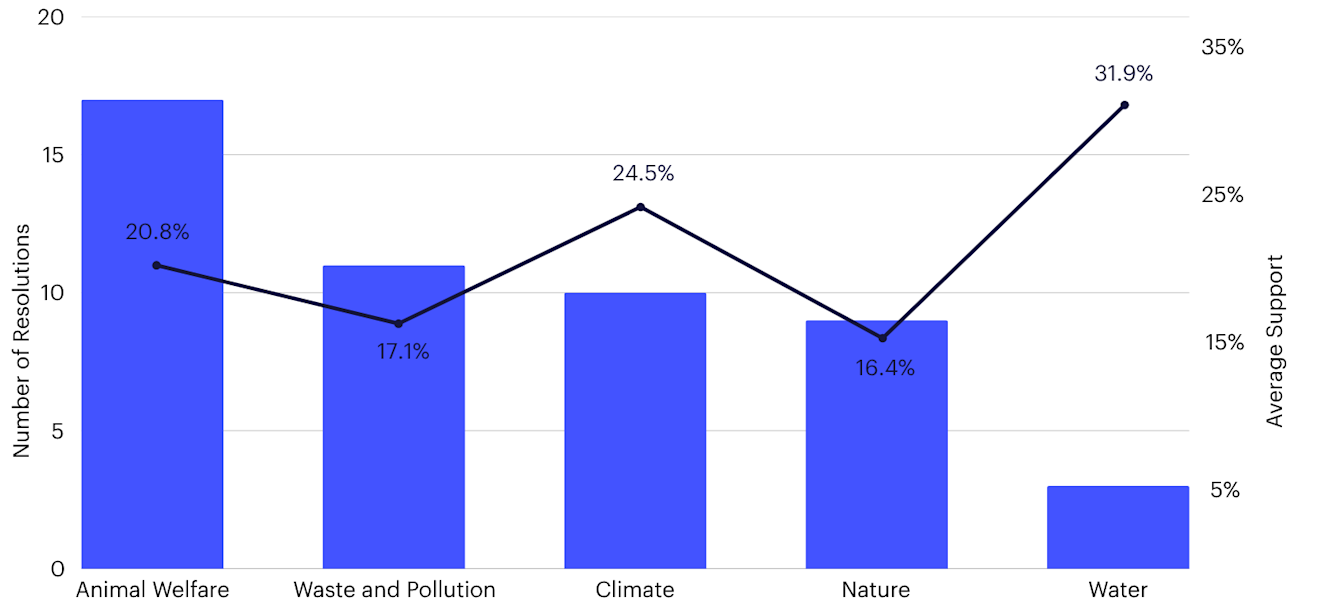

Environmental resolutions at agri-food companies also received stronger backing compared to other sectors. Water-related resolutions received the highest average support, at 30% – increasing substantially compared to 2023, when they received a 7.8% share on average.

Ongoing droughts in Europe and the US have heightened investor concern over water scarcity, which poses material risks to supply chains and operations.

Animal welfare also emerged as a prominent issue, with 17 resolutions filed. Many focused on the use of pig gestation crates, a practice facing legal restrictions in several US states.

Waste and pollution continued to draw attention, with most proposals targeting plastic packaging, while one resolution asked for greater disclosure on pesticide-related risks.

Figure 2: Agri-Food Environmental Resolutions 2024

Source: PRI Collaboration Platform. Retrieved 31 March 2025, from https://collaborate.unpri.org/

Most of the resolutions filed in 2024 asked consumer-facing companies for better supply chain disclosure and policy implementation. However, greater attention from shareholders is needed on upstream actors, such as protein producers and chemical input suppliers, to encourage a comprehensive supply chain risk management approach.

Nonetheless, the wider trend signals that investors are becoming more advanced in how they address the interconnected and complex risks in the agri-food sector, which is particularly positive in the context of mixed sustainability views more broadly.

Table 1: Shareholder resolutions filed at agri-food companies

Company | Proposal | FAIRR Topics | Voting Outcome |

|---|---|---|---|

Advisory vote on the welfare of poultry disclosures | Animal Welfare | 35.9% | |

Identify water risk exposure | Water | 28.7% | |

GHG targets and transition plan | Climate | 27.9% | |

GHG targets and transition plan | Waste & Pollution | 20.6% | |

Just climate transition report | Climate/Just Transition | 17.77% | |

Phase out routine medically important antibiotic use in supply chain | Antimicrobial Resistance | 15.2% | |

Eliminating deforestation from supply chains | Deforestation | 3.3% |

Source: PRI Collaboration Platform. Retrieved 31 March 2025, from https://collaborate.unpri.org/

Support for governance proposals on the rise

While E&S issues continue to dominate shareholder proposals in the agri-food sector, broader market trends suggest a greater focus on supporting governance-related resolutions.

The number of proposals focused on governance across sectors declined slightly between 2023 and 2024, from 252 to 234, but average support ticked up by 13%, according to Morningstar.

In contrast, the number of E&S shareholder resolutions grew from 305 to 316 over the same period, but investor support continued to decline markedly, dropping to 16% last year, compared to 33% in 2021.

The number of high-impact resolutions (those receiving at least 40% support) has also fallen by almost 50% since 2021.

The shift in sentiment regarding governance-related proposals reflects growing investor scrutiny of perceived board inaction on material risks.

These proposals increasingly target board accountability, executive compensation, and unequal voting rights, signalling a renewed emphasis on key corporate governance principles.

In 2024, for example, board members, particularly nomination committee chairs, came under greater scrutiny. For S&P 500 companies, nomination committee chairs received the lowest average support among senior board roles, at 92%, indicating increased investor frustration with board oversight.

In 2025, executive pay is already starting to dominate the proxy season. Say on Pay proposals are a focal point, with investors pushing for compensation and pay designs that align with long-term shareholder value creation and corporate strategy.

Investor concerns have also intensified over the erosion of shareholder rights and its impact on fiduciary duty. A pivotal moment came in 2024, when ExxonMobil sued shareholders over a climate resolution, ultimately restricting one filer from submitting future proposals to the company. This bold move has triggered wider alarm over the precedent it potentially sets.

Resolutions challenging dual- and multi-class share structures, particularly at Meta, Tesla, and Alphabet (Google), have continued to receive broad support, as investors advocate for equitable voting power.

In the agri-food sector, meatpacking giant JBS has drawn similar criticism. The SEC recently approved its dual-listing in the US, which would allow the Batista family to increase its voting control from 48.8% to 85%.

Despite serious concerns over JBS’ deforestation practices, human rights policies and corruption, shareholders on 23 May gave the green light for the NYSE listing.

This move will have significant implications for shareholder rights and the practices of one of the largest meat producers in the world.

Importance of proxy voting remains clear

Amid the shifting regulatory landscape and increasingly polarised political environment, proxy voting continues to provide shareholders with an important lever to demand transparency, accountability, and long-term value protection from their portfolio holdings.

While broad industry trends show support has been increasingly focused on governance – the foundation for effective company risk oversight – investors in agri-food companies continue to demonstrate a more nuanced understanding of risks in the sector, which include E&S issues.

Short-term sentiment on sustainability may continue to pivot, but the importance of proxy voting as a stewardship mechanism for long-term financially material and systemic risks remains clear.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.

Written by

Isobel Rosen

Senior Investor Outreach Analyst

Isobel is a Senior Investor Outreach Analyst at the FAIRR Initiative. She is responsible for strengthening and supporting FAIRR’s global investor network.