Analysis reveals how 40 of the largest global livestock companies are exposed to climate risks in animal feed supply chains and highlights emerging solutions to strengthen resilience

Asia is the largest supplier of soybean, maize and wheat to the world’s 40 largest protein producers; and is also one of the regions most vulnerable to climate change.

Less than half (18/40) of livestock giants disclose supplier information on animal feed, leaving investors unable to identify weaknesses in supply chains.

Only three of 18 companies report having more than five suppliers per crop, highlighting a lack of resilience across the sector.

The US$90 trillion-backed FAIRR investor network is today publishing a report which finds that livestock giants are overdependent on a limited number of geographic regions and suppliers for animal feed - particularly for soybeans, maize and wheat. Relying on animal feed crops from a few geographic areas heightens the systemic risk of climate shocks - such as drought or flooding - to yields, in turn increasing food prices for consumers and exposing investors to volatility.

The report, Grains, Gains and Growing Climate Risks: Building Resilience in Soft Commodity Supply Chains, analyses the soft commodity supply chains of 40 publicly listed protein producers* - including Tyson Foods, JBS and Marfrig - assessed by the Coller FAIRR Climate Risk Tool, the Coller FAIRR Protein Producer Index and Bloomberg data**.

Companies such as Almarai and JBS have the least geographically diversified animal feed supply chains. Livestock producers such as Muyuan and Wens have built a more geographically diversified supplier base, providing a stronger buffer against climate-related disruptions.

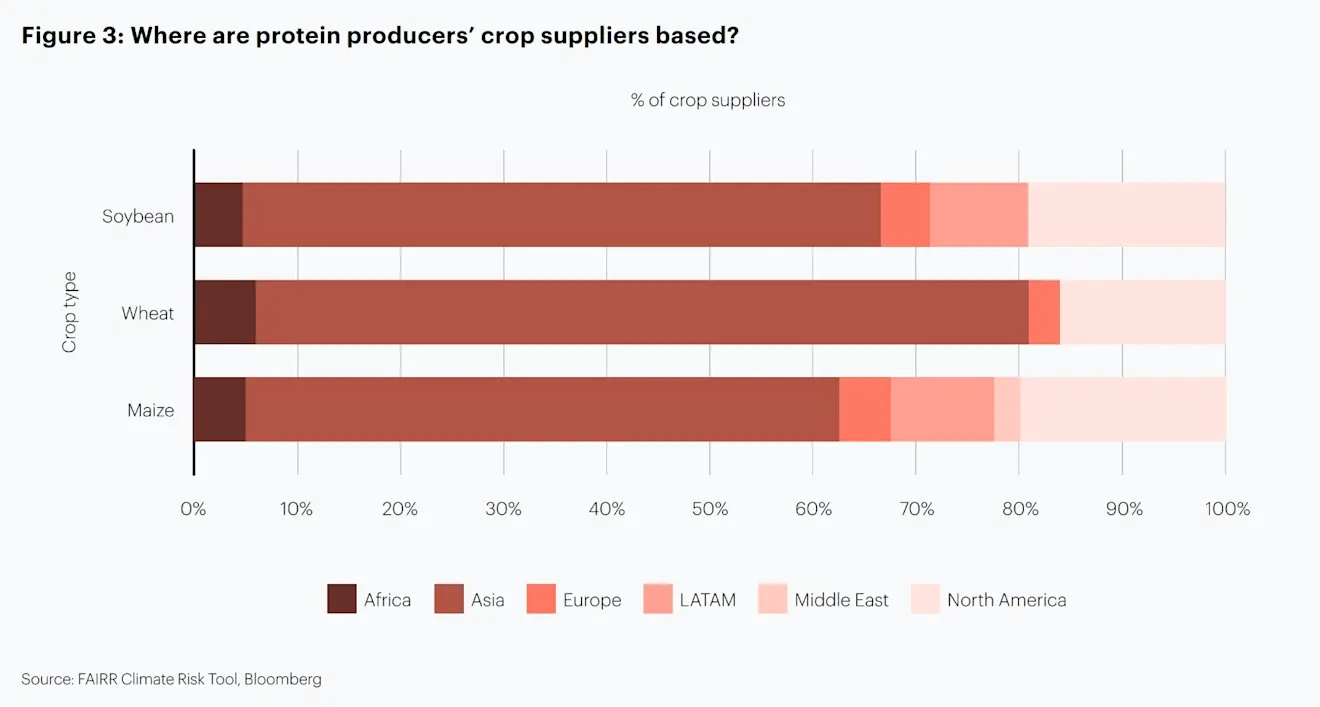

FAIRR finds that Asia accounts for roughly 60% of the supplier base for soybean, wheat and maize, while North America accounts for 20% (see Fig.3). Concentration in Asia is particularly concerning as the region is seeing warming rates nearly double the global average – with more frequent and intense heatwaves, floods, and storms – making disruptions to production and logistics more likely.

Not only are suppliers clustered in just a few regions, but 11 out of the 18 companies that have disclosed their supplier information rely on a very limited number of feed crop suppliers. More than half (10) of these companies rely on just one or two suppliers for maize, rising to over 60% for wheat and soybeans. Only three companies report having more than five suppliers per crop. The overlay of supplier and geographic concentration typically reinforce each other. A single supplier often means higher upstream dependency and a narrower regional sourcing footprint.

For each additional 1°C-rise in global temperatures, average yields are projected to decline by around 6% for wheat, 7.4% for maize, and 3.1% for soybeans, increasing their cost. In response to these pressures, the number of companies acknowledging climate-related risks to feed availability and pricing in their disclosures has risen from 60% in 2022 to 87% in 2024. Yet, as of 2024, only 10 companies have quantified the financial impact of the climate risks they face, and even fewer have calculated feed-related costs.

Weiming Pu, Senior Analyst, Climate & Nature at FAIRR, said:

"Climate shocks are rapidly turning into feed shocks. Feed crops are highly vulnerable to changing weather conditions and make up 70% of total livestock production costs. What once felt like an environmental issue is now a clear supply chain and financial risk for livestock companies. It is crucial for companies to build resilience through sourcing diversification and investment in climate solutions."

Solutions are emerging across the value chain, and encouragingly, more companies said last year that they are committing capital to build resilience in their feed sourcing compared to 2022. Pilot initiatives show that diversified feed ingredients such as microbial proteins can reduce soybean meal dependence by 5% to 8%, while maintaining performance and cutting formulation costs. Technological innovations like precision irrigation are helping stabilise yields and water use, particularly in regions facing escalating heat and water stress.

Notes to editor

*Companies in the analysis:

Almarai Co JSC, Astral Foods Ltd, Australian Agricultural Co Ltd, Beijing Sanyuan Foods Co Ltd, Bell Food Group AG, BRF SA, Cal-Maine Foods Inc, Charoen Pokphand Foods PCL, Cherkizovo Group PJSC, China Mengniu Dairy Co Ltd, China Modern Dairy Holdings Ltd, COFCO Joycome Foods Ltd, Cranswick PLC, Emmi AG, Fonterra Co-operative Group Ltd, Fujian Sunner Development Co Ltd, GFPT PCL, Grupo Bafar SAB de CV, Hormel Foods Corp, Industrias Bachoco SAB de CV, Inghams Group Ltd, Inner Mongolia Yili Industrial Group Co Ltd, Japfa Ltd, JBS S.A, LDC SA, Maple Leaf Foods Inc, Marfrig Global Foods SA, MHP SE, Minerva SA, Muyuan Foodstuff Co Ltd, NH Foods Ltd, Prima Meat Packers Ltd, Sanderson Farms Inc, Scandi Standard AB, Thaifoods Group PCL, Tyson Foods Inc, Vinamilk, Vital Farms, Wens Foodstuff Group Co., Ltd, WH Group Ltd.

**Methodology

This report highlights findings derived from an analysis of company disclosures and data from the Coller FAIRR Climate Risk Tool (CRT 2023), the Coller FAIRR Protein Producer Index (PPI 2024) and Bloomberg (June 2025).

Media contact

For more information, including interviews and further comment, please contact:

Ino Rousselet, ESG Communications (Part of the Flag Group)

Contact number: +44 77 8614 8010 | e: ino.rousselet@flag.co.uk

About FAIRR

The FAIRR Initiative is a global investor network, founded by Jeremy Coller, with a membership representing US$90 trillion in assets under management. FAIRR works with institutional investors to define the material risks and opportunities linked to intensive animal agriculture and provides investor members with the research, tools and engagements necessary to integrate this information into their asset stewardship and investment decisions. This includes the Coller FAIRR Protein Producer Index, the world’s only comprehensive assessment of the largest global animal protein companies. Visit www.fairr.org.