Robust climate targets are crucial for investors to assess the resilience of their portfolios and the credibility of entity-level decarbonisation plans.

The Science Based Targets initiative's new Financial Institutions Net-Zero (FINZ) Standard, published in July 2025, and the Corporate Net-Zero Standard V2 draft, which will open for public consultation in November, mark a significant step in enabling investors to drive capital towards climate solutions and decarbonise their portfolios by 2050.

These standards arrive at a critical moment, when investors are under growing pressure to demonstrate credible transition plans, mobilise finance and align with emerging regulations. Understanding key elements of the FINZ Standard will be crucial for investors to maintain credibility, ensure regulatory compliance, and promote long-term portfolio resilience.

This Insight piece looks at what the FINZ Standard and the Corporate Net-Zero Standard draft include, what they aim to achieve and why they matter for investors.

Two standards, one goal

The two standards cover Scope 1–3 emissions across various sectors. The Corporate Net-Zero Standard encompasses upstream and downstream Scope 3 emissions from categories 1–14, whereas the FINZ Standard extends this framework to include financed emissions (Category 15).

Together, they aim to align company-level decarbonisation plans with portfolio-level net-zero target setting and ensure consistency across the real economy and capital markets.

The FINZ Standard applies to institutions that derive 5% or more of their revenue from lending, investing (asset owners and managers), insurance underwriting and other capital market activities.

For investors, this represents a critical shift beyond reliance on corporate disclosures to also demonstrating genuine portfolio alignment with climate goals and measurable, real-world emission reductions.

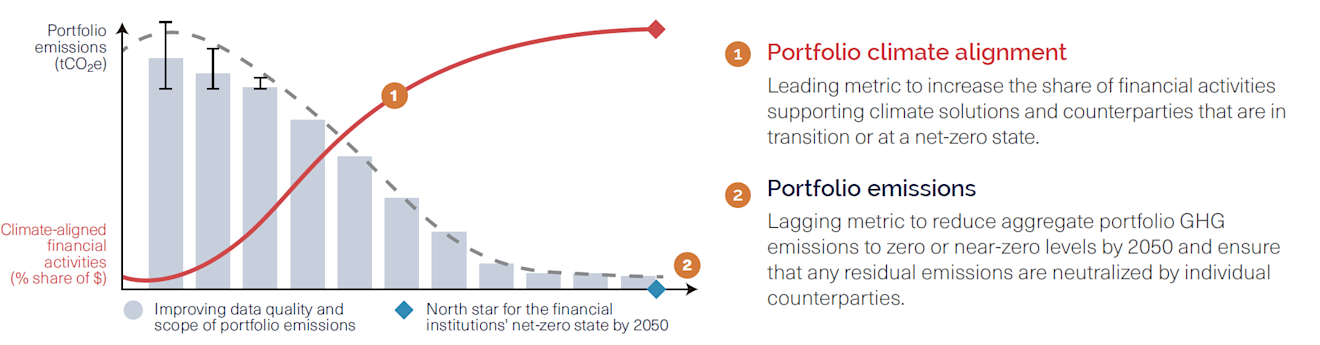

Figure 1: Financial Institutions Net-Zero Standard conceptual framework

Source: SBTi. (2025). FINZ Standard: One-page summary | Version 1.0. Copyright 2025 by SBTi. Reprinted with permission.

Segmentation of capital markets and sectors

The FINZ Standard recognises the distinct roles of various financial actors, including asset managers and owners across different asset classes, insurers, and banks, providing guidance based on the degree of influence, ownership share, and the type of capital deployed.

It also links these financial actors to specific sectors, with more stringent target milestones for emissions-intensive sectors such as agriculture, energy, and steel, while providing guidance on directing capital towards climate solutions.

For investors, this can support enhanced transparency and accountability across their portfolios, while reinforcing the need to leverage stewardship, capital allocation and investment due diligence to meet the standard’s requirements.

It also highlights the importance of moving from one-size-fits-all decarbonisation strategies to credible sector-specific climate transition plans in portfolio construction and stewardship dialogues.

Climate alignment and investment in climate solutions

The FINZ Standard introduces three climate alignment categories: in transition, climate solutions, and net-zero state. This categorisation offers investors a structured framework to assess and track progress across their portfolios, particularly against the SBTi’s mandatory long-term alignment targets.

The climate solutions category is particularly significant. To qualify, an entity, project or asset must generate at least 90% of its revenue from activities aligned with eligible regional or national taxonomies, as defined in the standard’s implementation list, such as renewable energy, nature-based solutions, or industrial retrofits.

By allowing credible climate solutions to count towards meeting the SBTi’s required portfolio-alignment targets, the standard can facilitate the much-needed scaling of investment into such solutions.

It also underscores the need for clear metrics to demonstrate portfolio alignment, while encouraging investors to leverage stewardship to help remaining companies in their net-zero transition.

Regional differentiation and milestones

Not all markets are equal when it comes to decarbonisation – in terms of the emission levels that need to be reduced, or the time required to achieve these goals – and the FINZ Standard acknowledges this.

Investments are given different timelines for long-term portfolio alignment, depending on whether they are focused on developed or developing economies. The standard supports the use of targeted transition finance, technical assistance, and blended capital mechanisms to help align developing market investments with global net-zero goals.

The regional differentiation also extends to the use of eligible country-specific taxonomies used to define climate solutions, enabling financial institutions to unlock investments in key markets.

The standard also embeds interim, near-term targets, validated every five years, alongside immediate policy requirements for selected high-emitting sectors, to encourage meaningful, immediate and near-term actions.

What is missing to drive agri-food system transformation

While the new SBTi standards represent a step forward in integrating financial institutions into the net-zero transition, gaps remain, particularly for the agri-food sector, which sits at the centre of climate and nature risks.

This gap is particularly significant, given that the global food system is now the largest driver of breaches across five planetary boundaries, according to the EAT–Lancet Commission.

FAIRR’s Climate Risk Tool highlights the financial materiality of these risks for the animal protein sector, with potential losses of over US$24 billion by 2030 if left unaddressed.

The FINZ Standard complements the SBTi’s Forest, Land, and Agriculture (FLAG) guidance, identifying relevant supply- and demand-side activities and asking investors to assess their deforestation exposure and publish an engagement strategy if exposure is significant.

However, the requirement for financial institutions to eliminate deforestation exposure by 2030 falls short of emerging global expectations. Frameworks such as the Accountability Framework Initiative have called for an earlier, enforceable deadline of 2025.

The standard also does not clarify metrics and pathways needed to finance the transition, especially in hard-to-abate sectors such as the agri-food sector. The EAT–Lancet Commission estimates that realigning global diets and production systems within planetary boundaries will require an annual investment of US$200 billion – US$500 billion. Yet recent financial flows into sustainable food systems remains a fraction of that.

Investors need clearer signals on what constitutes a credible and just transition, guidance on how to assess synergies and trade-offs between climate and nature risks, as well as metrics and frameworks to mobilise capital towards holistic solutions and engage with high-emitting companies.

Finally, although the SBTi standards use five-year validation cycles which strengthen accountability, the disclosure requirements remain largely focused on corporates.

More explicit expectations for asset-level transparency, Scope 3 data (disaggregated for land-use and value-chain emissions), and links to nature-related frameworks, such as the Taskforce on Nature-related Financial Disclosures and Science-Based Targets for Nature, would further support investors to make informed decisions.

From targets to transformation

The new FINZ Standard marks an evolution in how investors can measure, manage, and mobilise capital to transition to a net-zero and nature-positive economy.

Alongside the updated corporate standard, it shifts the focus from individual corporate pledges to portfolio-level accountability, moving the emphasis from target setting to real-world impact.

For investors, the message is clear: integrating transition risk into investment decisions, recognising companies that are advancing climate and nature-based solutions and focusing stewardship efforts on tangible outcomes are crucial for credible net-zero alignment.

At the same time, the agri-food sector continues to lag other industries in setting credible, science-based targets, with clearer metrics and incentives for transition finance, stronger deforestation commitments, and better integration of climate-nature considerations needed.

As the SBTi opens its revised Corporate Net-Zero Standard for a second public consultation in November, investors have a unique opportunity to shape this important initiative so that it continues to support global climate and nature goals.

FAIRR encourages its members and investors more broadly to engage with this process, ensuring the standard remains ambitious and practical to drive a just, credible, and investable transition.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.

Written by

Sajeev Mohankumar PhD

Senior Technical Specialist, Climate and Nature

Sajeev joined FAIRR in 2023 as the Senior Technical Specialist across the Climate and Biodiversity workstreams. He supports investor members and agri-business to assess financial risks and opportunities for net-zero and nature-positive transitions.