A new research briefing from the FAIRR Initiative on water-related risks finds that water scarcity is fast becoming an urgent - and overlooked - threat to global food systems and financial markets.

Nearly two-thirds of the 60 companies in the Coller FAIRR Protein Producer Index are failing to manage water-related risks effectively – the largest drivers of risk being partial supply chain coverage of water dependencies and insufficient data to compare water withdrawals to financial benchmarks.

Approximately 60% of global GDP, equivalent to US$58 trillion, is highly vulnerable to water availability – but there are insufficient water sector targets to reduce demand for a limited supply of water.

Across all sectors, the cost of proactively addressing water risks is estimated to be five times lower than the financial impact of inaction - but as physical, transition and tipping point risks increase, more ambitious targets by companies are needed.

(London, 26/08/25) As World Water Week kicks off in Stockholm, the FAIRR Initiative, representing $80trn in assets under management, has released a timely research briefing that alerts investors to water insecurity in the agri-food supply chain. The briefing’s publication follows a summer of acute droughts in North America and European countries such as Spain, the UK and Italy.

The briefing outlines the mounting financial risks water scarcity poses to global food production, its direct link to investment performance and the urgent need for both companies and investors to take action to mitigate water-related threats, now and into the future.

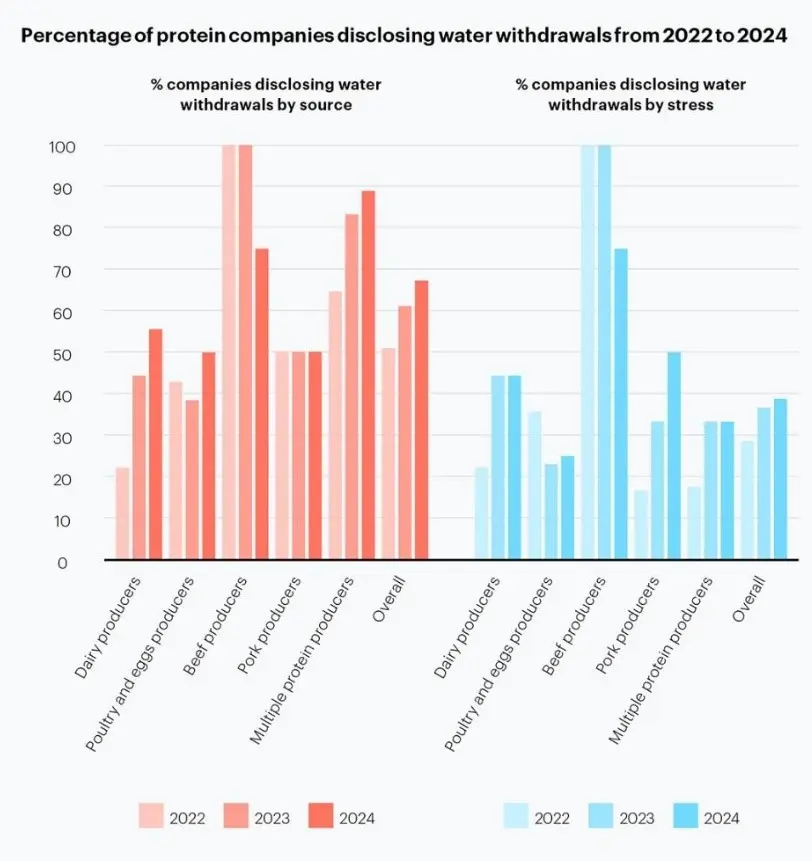

FAIRR’s analysis finds that despite growing risks, water-related disclosure among agri-food companies remains alarmingly poor, which inhibits companies and investor’s capacity to make progress. According to the Coller FAIRR Protein Producer Index, which assesses the performance of 60 of the world’s largest protein producers across 10 critical material sustainability factors, reporting on water withdrawals and scarcity indicators continues to rank among the lowest of all metrics.

Just 10 livestock companies in the Coller FAIRR Protein Producer Index have set targets to reduce water withdrawals - most of those focus narrowly on improving efficiency rather than cutting total water withdrawals across supply chains.

For disclosure among livestock producers, the situation is even starker. Of the companies assessed in FAIRR’s 2024 Index, only one - Vital Farms, a US-based producer of egg and dairy products - disclosed all its feed sources from water-stressed areas. Seven other companies reported partial data, while the remaining 44 provided none at all.

In the most recent assessments, the number of livestock companies rated as high risk for water use and scarcity fell slightly by 10.5%, from 38 to 34. Still, nearly two-thirds (62%) remain in the high-risk category, indicating widespread failure to manage water-related risks effectively.

Freshwater demand is set to exceed supply by 40% within just five years, according to the Global Commission on the Economics of Water. With agriculture responsible for 70% of the world’s freshwater withdrawals, the growing appetite for water-intensive agricultural products is accelerating a global crisis, threatening not only ecosystems and communities, but also the long-term stability of agri-food markets and investor returns.

The cost of inaction is staggering: water scarcity is projected to cost companies across all sectors between US$200 billion and US$300 billion – which is around five times the estimated cost of proactively managing water-related risks.

In the agri-food sector, the consequences are already playing out. Water insecurity is driving down crop yields, inflating operational costs and destabilising supply chains. Water-related risk also varies significantly by both product and geography, with high water-use products like dairy, lamb, pork and beef posing greater exposure, particularly in water-stressed regions such as northern China, India and the U.S. Virtual water, hidden water embedded in traded goods, compounds this risk, with nearly 20% of all water used for global food production traded internationally, primarily through livestock, wheat, maize and soy.

To protect long-term value, investors must act now. The briefing outlines three key actions to mitigate water risks:

Demand better disclosure – Push companies to improve transparency on water use, withdrawals and risk exposure across their operations and supply chains.

Standardise material metrics – Advocate for consistent, comparable reporting frameworks to evaluate water-related performance and the financial materiality of water risk across the agri-food sector.

Set ambitious and resilient targets – Encourage companies to adopt clear, time-bound goals for reducing water risk and building long-term water resilience.

Henry Throp, Research Manager at FAIRR, said:

“With the World Water Forum approaching in Saudi Arabia in 2027, there’s still time for governments and companies to make ambitious commitments and to take significant steps. But action must start now.

“Just as big tech – and especially artificial intelligence - faces scrutiny over their water use, a handful of highly dependent agri-food companies hold outsized influence in building water resilience. It is critical that we understand the financial implications of water insecurity – and the value that can be generated in building resilience. This report is crucial - it quantifies water risk with clarity and gives investors the tools to act before the crisis deepens.”

Sudip Hazra, Director of the First Sentier MUFG Sustainable Investment Institute, said:

“Water risk is no longer a distant environmental concern, it’s a material financial issue that will shape markets over the next decade. Investing in water resilience isn’t just about mitigating downside risk; it’s a strategic imperative for safeguarding long-term value across the agri-food sector.”

Notes to editor

Media contact

For more information, including interviews and further comment, please contact:

Ino Rousselet, ESG Communications

Contact number: +44 77 8614 8010 | e: ino.rousselet@flag.uk

About FAIRR

The FAIRR Initiative is a global investor network, founded by Jeremy Coller, with a membership representing US$80 trillion in assets under management. FAIRR works with institutional investors to define the material risks and opportunities linked to intensive animal agriculture and provides investor members with the research, tools and engagements necessary to integrate this information into their asset stewardship and investment decisions. This includes the Coller FAIRR Protein Producer Index, the world’s only comprehensive assessment of the largest global animal protein companies. Visit www.fairr.org.