This week’s London Climate Action Week has Driving Green, Fair and Resilient Climate Transitions as a key theme and reminds us why financial institutions need to play a role in driving the climate transition.

In order to actively engage with companies and support them in their strategic transition plans, investors need access to transparent data. Clear and accurate data will help to illustrate how their investments are likely to perform during their transition. As climate-related risks facing the animal agriculture sector continue to grow, so too does the need for better data.

One recent example of the increasing risks can be found in Kansas (US), where at least (0.5% of the state’s cattle population) was lost in a matter of days last month due to high temperatures and humidity. This represents a loss of at least US$4 million. Plus, according to the US Environmental Protection Agency (EPA), heatwaves in the US are steadily increasing in frequency, duration and intensity. This suggests the risks from heatwaves will continue to grow, and investors must be aware of the potential financial impacts.

Additionally, earlier in June, farming leaders in New Zealand sent the government their recommendation for introducing a price on agricultural greenhouse gas (GHG) emissions. The finer details of the plan, including clarity on the implications for investors, remain unclear.

The Coller FAIRR Climate Risk Tool aims to help investors by addressing the lack of data in a sector that suffers from chronic under-reporting on the impacts of climate-related risks. It shows how meat producers’ profitability will be impacted by 2050, given five material climate-related cost increases. These cost parameters are currently being refined in line with recent scientific and policy developments.

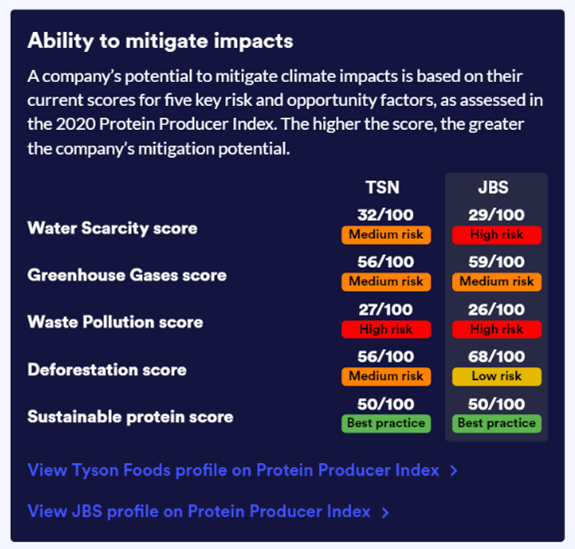

The Tool then draws on current company performance across one opportunity factor and four risk factors to calculate the extent to which companies can mitigate their climate-related costs:

Opportunities: Sustainable Proteins<br />Risks: GHG Emissions, Waste, Water Use, Deforestation & Biodiversity

How can investors use the Tool to mitigate climate risk?

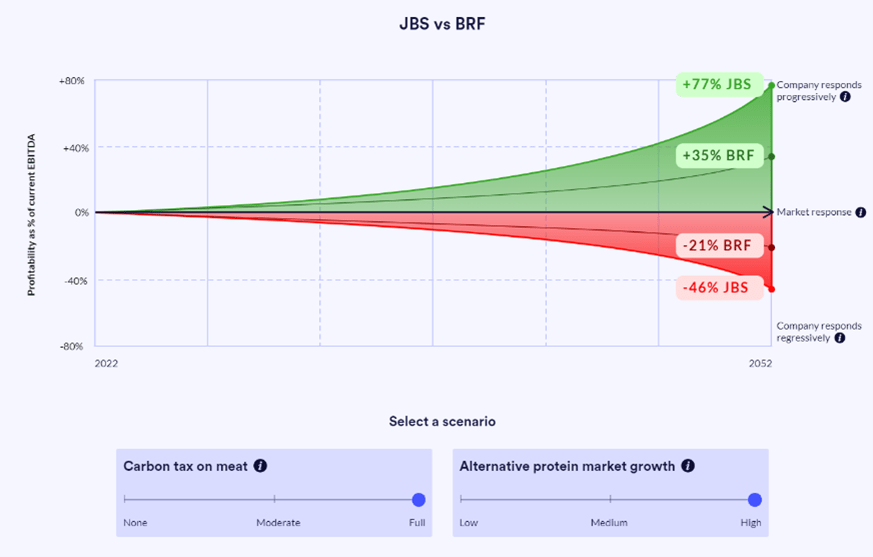

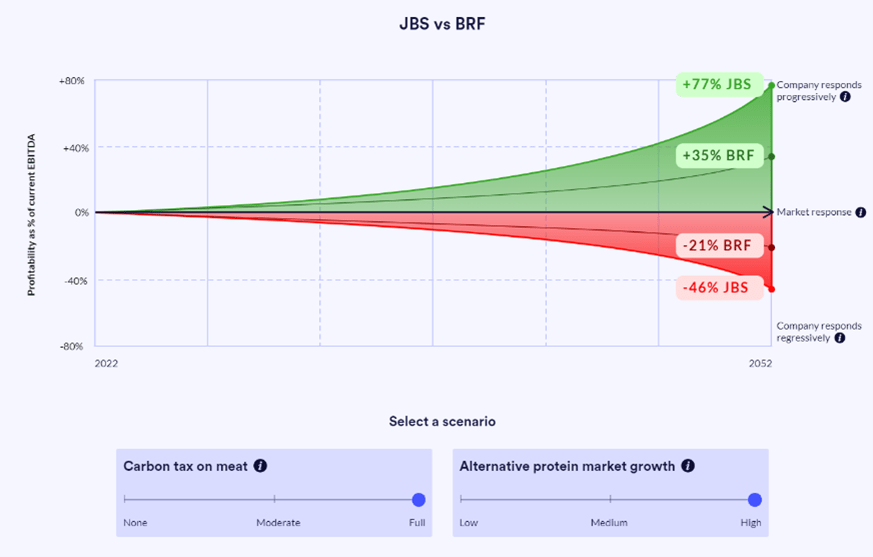

To assess and compare the future profitability of protein producers. The Tool provides levers which can be adjusted to see the profitability impact on companies under different ranges of carbon taxes and alternative protein market growth scenarios. The levers can be adjusted based on investor preferences. This can help investors assess which of the companies is better prepared for future climate risks. The graph below includes an example comparing the two Brazilian protein producers, JBS and BRF. The green section indicates how the companies will perform in a progressive scenario. Here, companies with better climate disclosure, lower exposure to emissions-intensive proteins such as beef, and higher exposure to alternative proteins can mitigate climate-related costs to a greater extent and therefore be more profitable. While the red section shows performance in a regressive scenario. Here, companies do not capture any alternative protein market growth and are less profitable.

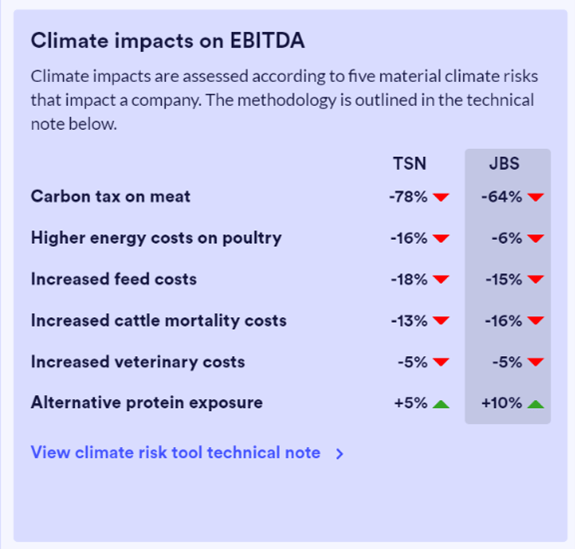

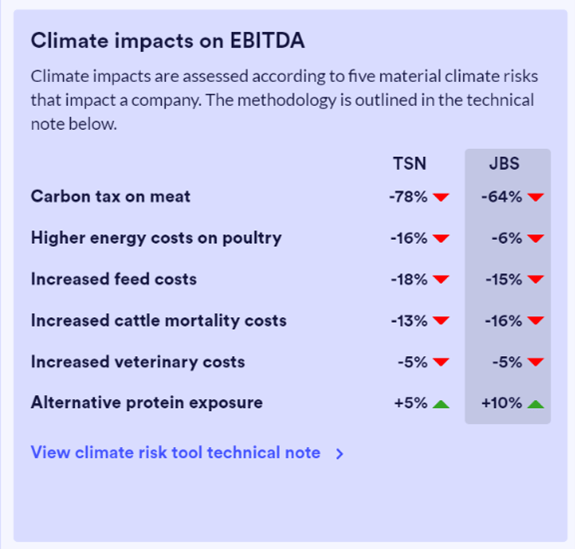

To analyse the increase in climate cost across key categories of physical and transition risk. Users can assess how companies’ geographic and protein exposure will affect their climate-related costs. For example, companies with higher beef exposure will face higher carbon taxes and cattle mortality costs. While companies with more exposure to developed countries will also see higher carbon taxes and energy costs.

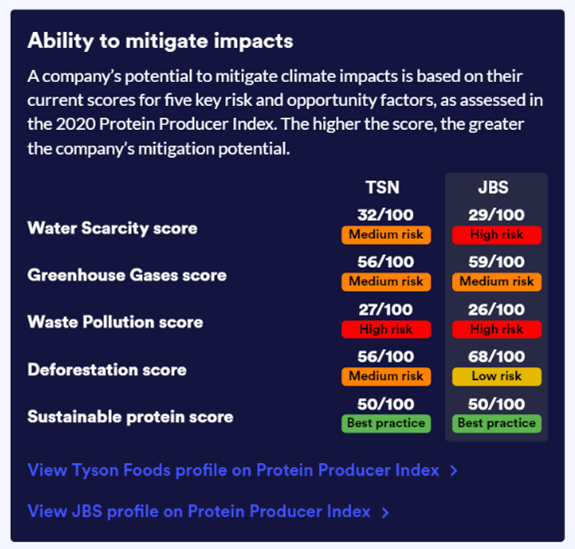

To examine a company’s potential to mitigate climate risks. Company performance and disclosure on four climate-related risks and one opportunity factor is used as a proxy for their mitigation potential.

To analyse supply chain risks facing downstream companies. Animal protein products are a significant amount of the production costs for consumer-facing companies like McDonald’s, Walmart and Sysco pay a significant portion of their costs to protein producers. Over 28% of McDonald’s costs are attributed to Tyson Foods, and these expect to be met with some cost pass-through, eroding their profit margins.1

To engage proactively with companies on climate-related risks and opportunities. Investors can use the Tool to build the case for better climate risk management and alternative protein diversification, by illustrating how doing so could reduce their climate risks and improve future profitability.

“As an active, sustainable & research-driven investor, DPAM believes it is crucial to assess these risks and opportunities both holistically and in an industry-specific manner, by combining knowledge and scenarios from a variety of sources. FAIRR’s updated Climate Risk Tool is undoubtedly a valuable and informative resource for conducting these vital assessments.” ~ Gerrit Dubois, Degroof Petercam

The Climate Risk team is currently developing the Coller FAIRR Climate Risk Tool 3.0. We are inviting investor members to join the Technical Advisory Committee to ensure the Tool continues to be a useful component of the climate transition arsenal. The Committee would be involved in discussions on the development of the tool, alongside other key stakeholders. If you are interested in joining the Committee or have questions about the Tool, please contact Simi Thambi.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.