Last week, the new EU Framework for vaccination came into effect in an attempt to control and align the EU response to the worst avian flu epidemic in EU history. This move by the EU comes as avian flu continues to spread amongst farmed and wild poultry, hitting record numbers with 50 million birds culled in the EU alone from October 2021 to September 2022. It also comes in response to the rising concern that the avian flu epidemic could spillover to humans, and mutate causing human-to-human transmission.

Preventing Future Pandemics

Despite this being the case, pandemic fatigue is impacting society’s willingness to address the prevention of a future pandemic. The current outbreak of avian flu is spiraling and has already infected a range of mammals including foxes and otters in the UK, sea lions in Peru, and mink in Spain. If this virus continues to mutate, it would not be the first avian flu that has mutated enough to enable human-to-human transmission – the Center for Disease Control and Prevention (CDC) recognizes that the Spanish influenza of 1918-1919 had “genes of avian origin”.

Pandemic prevention instruments like the International Instrument for pandemic prevention, preparedness and response being drafted by the World Health Organization (WHO) are a critical step towards safer and more resilient societies. However, Zero Draft, recently published by the WHO, did not highlight the role that intensive animal farming plays in disease spread which was noted by several NGOs. Additionally, the negotiations arguably did not include the private sector as much as they could have.

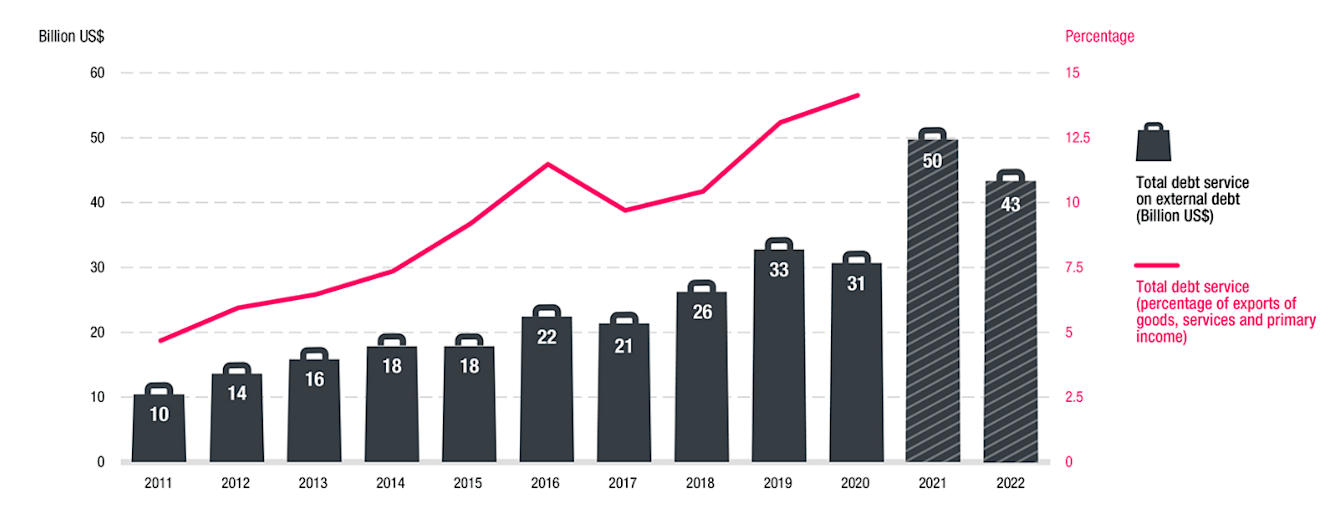

Others have noted the need for additional financial support for low-income countries to adequately prevent future pandemics. The International Monetary Fund predicts low-income countries will need around $200bn by 2025 to step up their pandemic response. Yet as the below graph shows, debt in low-income countries increased substantially during the COVID-19 pandemic, limiting already constrained resources to address this challenge. As FAIRR’s previous work on this topic highlighted, it will be cheaper to prevent pandemics than to respond to them.

Source: UNCTAD

The risks associated with the mass over-production of homogenous livestock in stressful environments is something that FAIRR has highlighted in the past through two previous policy papers that responded to the COVID-19 pandemic – An Industry Infected and Industry Reinfected. The launch of the World Bank’s Pandemic Fund is highly relevant and necessary to help build back resilient economies and societies and alleviate financial pressures which COVID-19 accentuated. These kinds of instruments and funds need to be as robust as possible and need to focus on the prevention of future pandemics, rather than just providing funding for a response.

FAIRR Emerging Disease Risk Ranking 2022

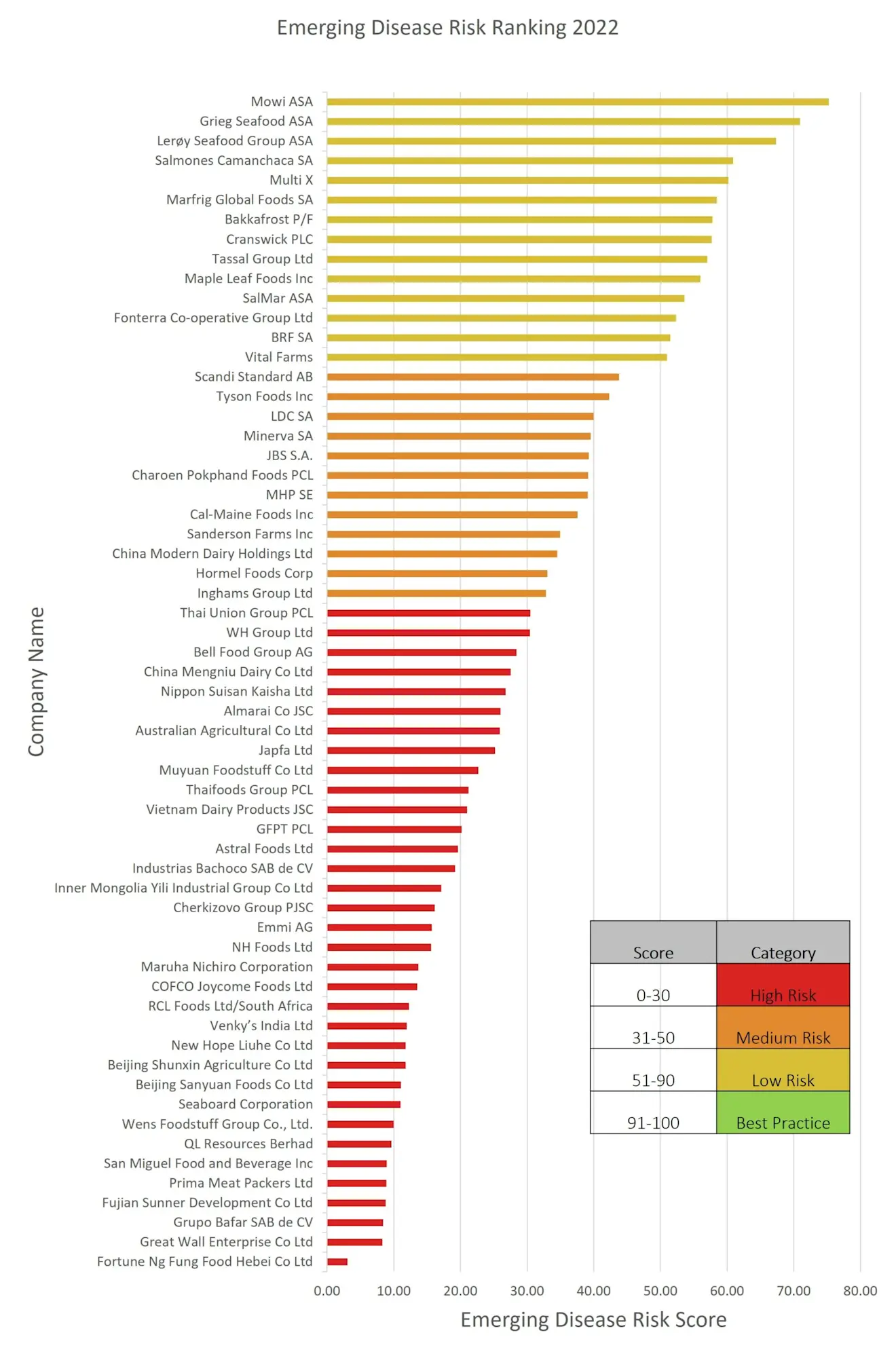

This year’s update on the Emerging Disease Risk Ranking1 again suggests that the industry has yet to adapt sufficiently to the emerging disease risks posed by industrial practices. As per previous methodologies, FAIRR has adapted the data used in the FAIRR Protein Producer Index to create an Emerging Disease Risk Ranking illustrated in Figure 1. The Emerging Disease Risk Ranking has been determined by evaluating the 60 companies in the Index on six risk indicators: deforestation & biodiversity loss, antibiotics, waste and pollution, working conditions, food safety and animal welfare.

The results show that 34 of the 60 companies continue to operate at high risk, with a further 12 being categorized as medium risk and 14 at low risk. While this is an improvement from last year’s ranking, which highlighted 38 of the 60 companies as high risk, 19 at medium risk and only 3 at low risk, additional progress still needs to be made to ensure that this sector continues to adapt to the risk of emerging diseases.

Figure 1: FAIRR Emerging Diseases Risk Ranking 2022

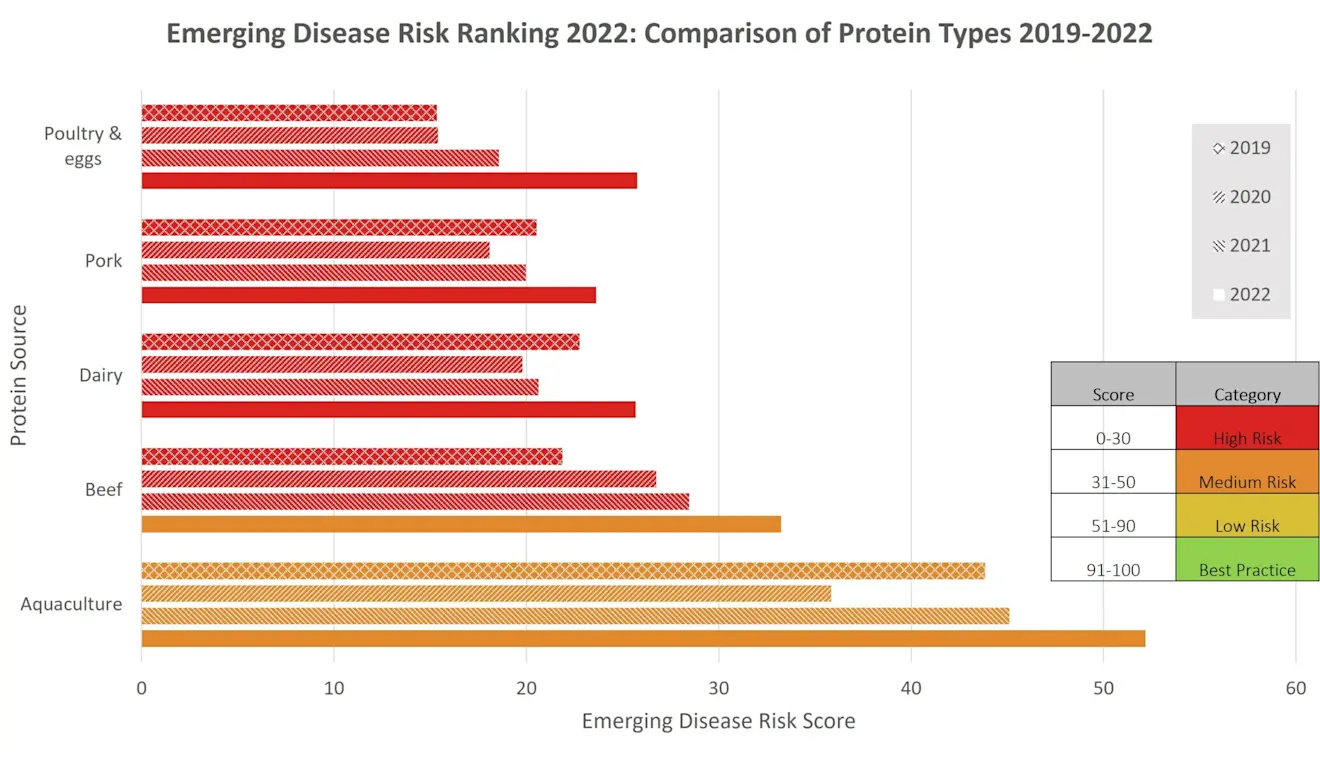

Figure 2: Emerging Disease Risk Ranking 2022: Comparison of Protein Types 2019-2022

Of particular relevance to the current state of affairs is the performance of companies that primarily produce Poultry & Eggs products3. Although the poultry sector has seen steady improvements in its emerging disease risk score since 2019 as illustrated in Figure 2**,** this sector is still categorised as high risk and the avian flu epidemic has only made this protein source more vulnerable.

Moreover, among different protein sectors, poultry has been the worst average performer over the last four years. Where the poultry sector particularly lags behind other industries is under the FAIRR Waste and Pollution risk factor – an issue which is already making headlines in the UK because of serious biodiversity concerns. Given the poultry sectors’ poor performance in the emerging disease risk ranking, there is a potential risk that relying on a shift from beef to chicken production as part of climate plans, for example, could pose additional risks for emerging diseases. This is also the case for the antibiotics risk factor, where only 1 out of the 19 Poultry & Egg companies in the Index is performing as “best practice”. The overuse of antimicrobials contributes to antimicrobial resistance (AMR) which has been described as a ‘silent pandemic’ by the G7.

Financial Implications of Bird Flu

The US alone has reported 58,386,983 avian flu cases since January 2022. As the virus continues to spread its presence on farms is causing severe impacts on the economy and is raising animal welfare concerns. The US Department of Agriculture reported a total cost of $570m for the culling of poultry in 2022, the British Poultry Council reported a loss of 40% of all free-range turkeys throughout winter, and Gressingham one of the UK’s largest duck and specialist poultry producers lost its entire flock across three farms throughout 2022.

These impacts are not only felt by farmers but are felt at multiple levels across the supply chain. Trade embargoes can restrict exports, share prices of downstream protein-producing companies have decreased, and governments are forced to compensate farmers for their losses. In January 2023 Cal-Maine Foods Inc reported a 15% decline in share price from late December 2022 with analysts attributing this fall directly to the avian flu spread throughout the US. Astral Foods reported the cost of the 2017 avian flu outbreak to amount to $3.8m, and the EU Commission approved nearly $160m aimed at compensating businesses affected by avian flu in France alone. These trends align with Rabobank’s projections that the spread of avian flu will have severe economic impacts to the global poultry supply chain.

The 2004 avian flu outbreak caused US exports of poultry to contract by 20% and the 2015-2017 outbreak cost $332m. The consequences of the current epidemic warrant interest from global financial markets to prevent this epidemic from escalating further and turning it into a systematic risk that cannot be diversified by asset managers or companies.

In an upcoming policy paper, FAIRR will explore the role of vaccines as a potential solution to avian flu disease control, especially in light of policy movements to address the avian flu spread which move in this direction.

Avoiding Future Crises

As the avian flu epidemic continues to evolve and escalate significant strides must be taken to ensure that poultry farming practices do not allow the virus to mutate further. The poultry sector must be able to address public health and animal welfare concerns but also safeguard the industry and its stakeholders from the huge financial losses caused by mass culling.

Public concern around zoonotic spillover is putting intensive poultry farms under increasing pressure to control the spread of the virus while also advocating for good animal welfare practices and workers’ protection. Vaccines may offer one possible solution to controlling the spread of this virus however this should not be considered a silver bullet solution. The EU’s attempt to promote vaccine use is viewed positively as a risk mitigation strategy, with access to vaccines also mentioned by the WHO Pandemic Prevention Treaty. These movements to improve vaccine implementation should be supported by additional control and mitigation measure if the spread of the virus is to be holistically addressed.

This is why FAIRR will take an avian-flu-specific approach to its next rendition of its pandemic work. Highlighting and prioritising the tragedy of the virus, the risk, and the material and financial losses of avian flu, which are also in line with those identified by the World Organisation for Animal Health (WOAH).

This article includes inputs from Helena Wright, FAIRR, Rajel Khambhaita, FAIRR, Ekaterina Zabolonskaya, FAIRR, and Harry White, FAIRR.

Footnotes

1 In previous years, the Emerging Disease Risk Ranking utilized seven indicators from the FAIRR Protein Producer Index that we consider most relevant for Emerging Disease Risk, with the aim to initiate a discussion around the links between protein production and risk factors for emerging diseases (including alternative proteins in the average score). This year, the Emerging Disease Risk Ranking does not include alternative proteins in the average score in line with the Coller FAIRR Protein Producer Index methodology. FAIRR acknowledges the shortcomings of this methodology in its current form, noting that more research needs to be done on other drivers of emerging disease risk; including biosecurity risk, wildlife exploitation, and geographically specific deforestation risks, and we hope to be able to incorporate additional factors in future as new data emerges.

2 This comparative data reflects the updated methodology for the year 2022 which no longer includes the alternative protein opportunity score in the average.

3 The Coller FAIRR Protein Producer Index does not have an equal representation of companies from each animal protein. These figures do not take into consideration the Index weighting of companies that primarily produce poultry & eggs, nor does it include those companies which produce multiple proteins.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.

Written by

Policy Officer