Three-year US$16.6 trillion investor engagement calling for better management of manure and effluents at major meat and fertiliser companies drives improved risk assessment but reveals lack of concrete strategies to manage manure and pollution – threatening biodiversity, human health and investor returns.

Just nine pork and poultry companies in the analysis create as much faeces every year as one third of the world’s human population, FAIRR estimates.

10/12 companies in the analysis now assess water-quality risks (up from 7/12 in 2022), but only BRF, JBS and Tyson Foods disclose high-risk geographic regions.

7/10 pork and poultry producers include livestock supply chains in their risk assessment (up from 1/10 in 2022), yet only 4/10 cover all suppliers, leaving major gaps in risk visibility.

(London, 25/09/25) The US$80tn-backed FAIRR investor network has today released new analysis following a three-year engagement with 10 of the world’s largest listed pork and poultry producers and two fertiliser companies*. The report, The Cost of Contamination: Addressing Water Pollution Risks in Intensive Animal Agriculture, highlights the urgent need for pork, poultry and fertiliser producers to take action on water pollution.

The findings mark the close of the first three-year cycle of FAIRR’s Waste and Pollution Engagement, supported by 71 investors representing US$16.6 trillion in combined assets. Results reveal that 10/12 companies have now assessed the water-quality risks of their own operations, up from 7/12 in 2022. However, there remains a lack of transparency about the results. Only three companies – BRF, JBS and Tyson Foods – clearly disclose the geographic regions exposed to high water-quality risks from their operations.

Furthermore, 7/10 pork and poultry producers now include livestock supply chains in their risk assessments to some extent, showing significant progress from the 1/10 that did so in 2022. However, just 4/10 of companies include all their suppliers, meaning that most producers do not have full visibility of their risk exposure.

Only 1/10 livestock company – Tyson Foods – has disclosed targets to mitigate pollution at high-risk sites. This suggests that the overall rise in risk assessments has not translated into companies implementing mitigation strategies.

Meanwhile, fertiliser producers have not made progress in evaluating the risks associated with their products. Neither company has set or implemented tangible strategies, despite being in a position to enable a circular economy for organic fertilisers.

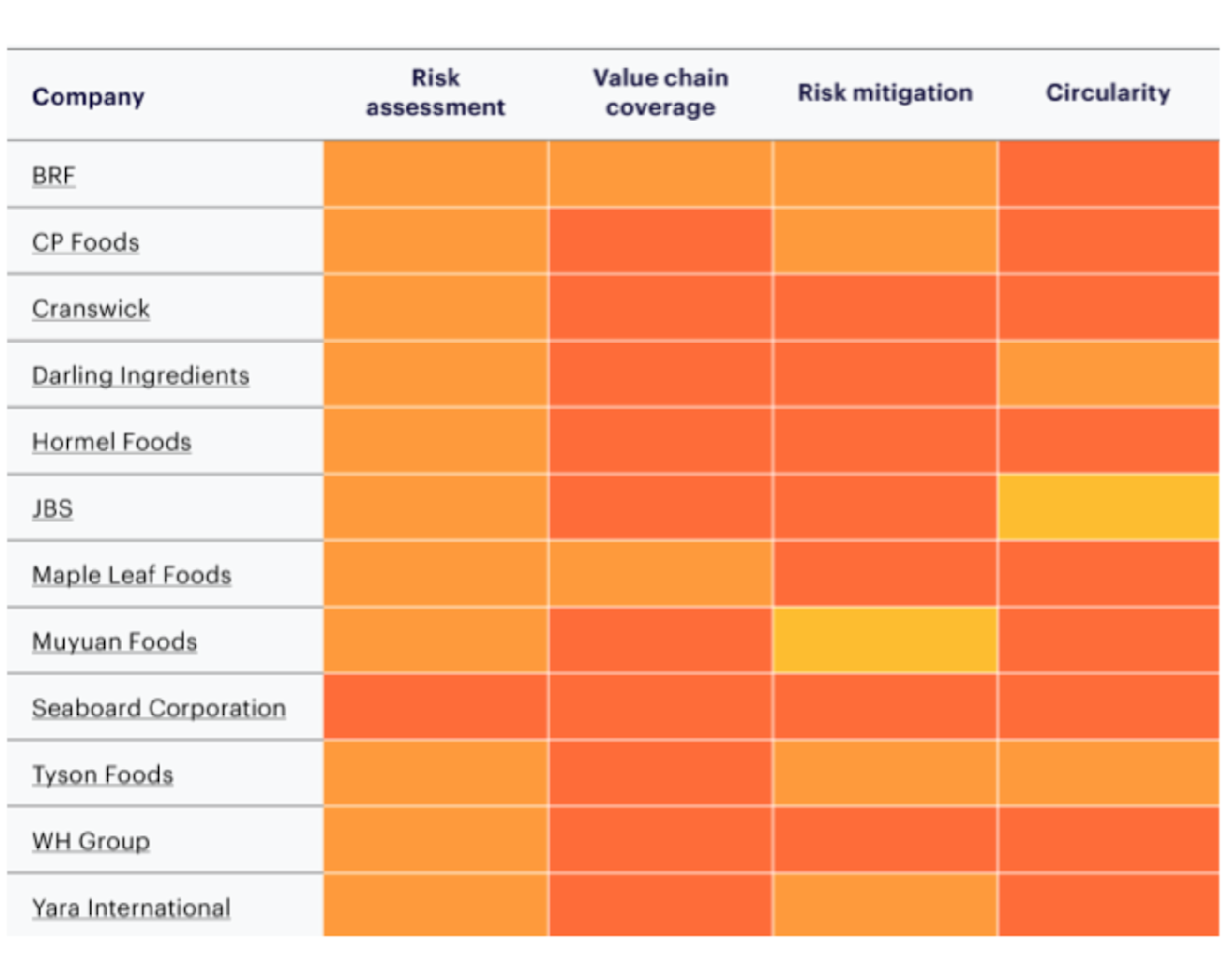

Table 1**: Overview of pork and poultry producers and fertiliser companies' performance

FAIRR estimates that animal manure produced by the pork and poultry companies (excluding Hormel) is equivalent to the human faecal waste of 2.5 billion people***. JBS is the biggest poo producer, creating as much faeces per year as 1.2 billion people – nearly the population of China. The next highest poo producers, Tyson Foods and BRF, produce manure comparable to the human populations of the USA and Brazil, respectively.

Although manure can be a good source of fertiliser, improper and excessive use leads to significant nutrient loss from the soil through leaching or volatilisation. Nutrient runoff threatens aquatic life as a result of eutrophication and negatively affects soil biodiversity. Manure from intensive farms often contains traces of antibiotics, which both accelerate the spread of antimicrobial resistance in soils and waterways and further harm biodiversity. These risks are amplified in regions with weak enforcement of pollution regulations, which are largely where the companies in the analysis operate.

Circularity to create a high-quality end product from manure and other animal waste remains an untapped opportunity for the sector, hampered by a lack of financial incentives and limited policymaker support. However, some companies have begun to explore solutions to turn organic waste into products that are easy to transport and to apply by farmers, and that have a higher nutrient absorption by plants compared to raw manure. For instance, JBS’s Campo Forte initiative sells organic fertilisers made from nutrients recovered from its operations.

FAIRR finds that 7/10 of meat companies involved in the engagement mentioned supporting projects in their feed supply chains that promote crop rotation and no or low tillage. While these can have a positive impact on improving pollution risks, they remain small-scale projects and pilot schemes rather than industry-wide initiatives.

Maria Montosa Ródenas, Technical Specialist in Nature Research & Engagements at FAIRR, said:

"The production of protein in intensive livestock farming comes with a cost. Alongside fertiliser producers, pork and poultry companies should embrace nutrient circularity to turn waste into wealth. Circularity that creates a high-end quality product will enable these businesses to leverage waste streams and ultimately create economic value – a material financial gain for both companies and investors, while providing better outcomes for the planet."

The report calls on investors to:

Demand full disclosure of water-quality risks, including geographic exposure and supply chain coverage.

Push companies to set formal mitigation targets for high-risk areas.

Encourage pollution-reducing interventions that support sustainable farming.

Advocate for fertiliser producers to invest in low-impact products and collaborate across the agri-food supply chain to reduce pollution risks.

Notes to editor

*BRF, CP Foods, Cranswick, Darling Ingredients, Hormel Foods, JBS, Maple Leaf Foods, Muyuan Foods, Seaboard Corporation, Tyson Foods, WH Group and Yara International

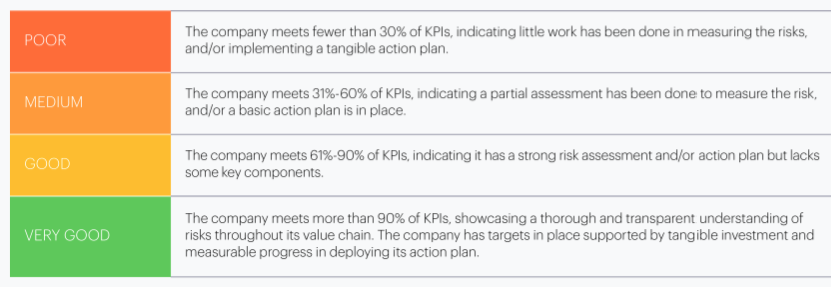

**Table 1 Key:

*** Please note that Hormel Foods was not included in this analysis of human faeces equivalent because there was no publicly available information on the number of animals processed by the company.

Media contact

For more information, including interviews and further comment, please contact:

Ino Rousselet, ESG Communications (Part of the Flag Group)

Contact number: +44 77 8614 8010 | e: ino.rousselet@flag.co.uk

About FAIRR

The FAIRR Initiative is a global investor network, founded by Jeremy Coller, with a membership representing US$80 trillion in assets under management. FAIRR works with institutional investors to define the material risks and opportunities linked to intensive animal agriculture and provides investor members with the research, tools and engagements necessary to integrate this information into their asset stewardship and investment decisions. This includes the Coller FAIRR Protein Producer Index, the world’s only comprehensive assessment of the largest global animal protein companies. Visit www.fairr.org.