This year, a new acronym on sustainable finance regulation entered the discourse. Sustainable Finance Disclosure Regulation (SFDR) imposes mandatory ESG disclosure obligations for asset managers and other financial markets. This blog aims to summarise SFDR through an investor lens, including what it means for investors and how it relates to FAIRR’s research.

What Is SFDR Regulation?

SFDR was introduced by the European Commission alongside the Taxonomy Regulation, forming part of a package of legislative measures arising from the European Commission’s Action Plan on Sustainable Finance. With the interest in ESG products continuing to grow, SFDR seeks greater transparency from investment firms based in the EU with products that have a sustainable investment objective.

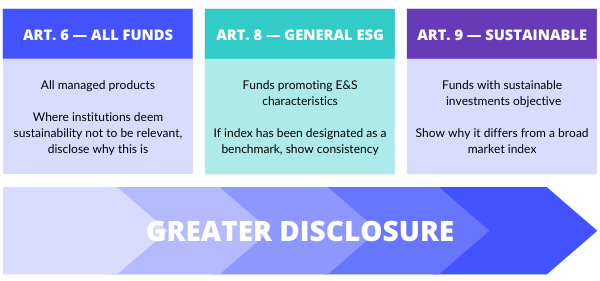

From 10 March 2021, financial sector participants have been required to disclose the sustainability of their funds. Each fund had to be self-classified by the institution into one of three categories: Article 6, 8 or 9. In Article 6, all managed products are included, irrespective of ESG credentials. Under Articles 8 and 9, funds undergo greater disclosure, with Article 9 undergoing the most disclosure. For example, some asset managers categorise products as Article 8, from which investments that do not reach sustainability objectives are excluded.

Source: SFDR regulation

Based on preliminary data from Morningstar, up to 25% of European fund managers have been classified as Article 8 or 9, with the market in Europe amounting to as much as Є2.4 trillion. However, it seems that fund managers have interpreted the regulation differently — and some have been taking a more conservative approach due to the worry of having to downgrade a fund later.

Under Article 8 (also known as the ‘light green’ classification), some financial sector participants may classify funds that focus on aligning with net-zero over time, or that have a lower carbon intensity compared to a specific threshold. It remains to be seen, however, whether the SFDR regulation will reduce the issue of ‘greenwashing’.

How Does This Relate to Agriculture**?**

There is not a specific focus on agricultural investments in the regulation. However, from 1 January 2022, all asset managers will need to disclose how they are incorporating the principle adverse impacts (PAIs) into their decision-making. In addition, products that are classified under Article 8 or 9 must periodically report on how these products are aligned with the EU taxonomy objectives outlined below. As shown in the table, some EU taxonomy objectives have links to the risk and opportunity factors in the Coller FAIRR Protein Producer Index.

EU Taxonomy objective | Risk & Opportunity Factors |

|---|---|

Climate Change Mitigation | |

Climate Change Adaption | |

Sustainable Use and Protection of Water and Marine Resources | |

Transition to a Circular Economy | N/A |

Pollution Prevention and Control | |

Protection and Restoration of Biodiversity and Ecosystems |

Animal agriculture investments, in particular, may impact several of the factors listed above. For example, the livestock sector is responsible for 14.5% of all global anthropogenic greenhouse gas (GHG) emissions and accounts for the use of 30% of all freshwater resources. Moreover, agriculture threatens 86% of the species at risk of biodiversity loss, according to a recent report by Chatham House. The Coller FAIRR Protein Producer Index discloses information on how companies are performing against some of these objectives.

Currently, it can be challenging to put companies and funds into these categories due to a lack of data. In this sense, ESG data providers, such as the FAIRR Initiative, can help support investors in their implementation of the SFDR and other financial reporting requirements.

Another challenge of which investors need to be aware is that the UK is developing its own regulation, which will likely be similar to the SFDR. There was some surprise when the UK government decided not to implement the SFDR into UK domestic law; nevertheless, it remains relevant for UK firms operating in the EU.

Some commentators have argued that there needs to be coordination between different initiatives, arguing for more global solutions rather than regional or national approaches. For example, investing in fossil fuels may accelerate global warming, which, in turn, will affect agricultural yields and any investments in that sector.

How Does This Relate to Other Financial Regulations?

There is a link to the EU taxonomy because investors are required to report against both the SFDR and the EU taxonomy. As noted above, products classified under Articles 8 or 9 must periodically report on how these products are aligned with the EU taxonomy.

However, the EU taxonomy has also fallen under criticism. Recent reports suggest that the criteria have been watered down, thus weakening its credibility. An example of this is waste, where wording around the use of less sustainable recycling processes of plastic have changed from ‘mechanical recycling is not possible’ to [mechanical recycling] is ‘not technically feasible or economically viable.’ This leads to greater room for interpretation.

Moreover, there are some similarities with the Task Force on Climate-related Financial Disclosures (TCFD) disclosures. Both the SFDR and the TCFD require investment managers to make both entity-level and product-level disclosures. The UK is set to become the first country in the world to make TCFD disclosures mandatory by 2025. There are also moves by the G7 towards mandatory TCFD disclosure. However, the key difference is that the SFDR is broader than the TCFD given that it covers all ESG risks as opposed to just climate change.

Overall, there appears to be a need for greater coherence between different regions and approaches in the future. Research by SP Global suggests that more than $3 trillion worth of parent firms based outside the EU will be considering how to disclose against the SFDR. We are likely to see more calls for alignment between different frameworks, as well as calls for better data on ESG risks, as investors navigate the new sustainable finance landscape.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.

Written by